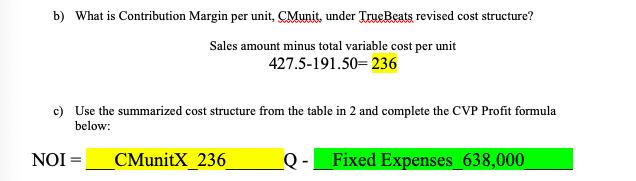

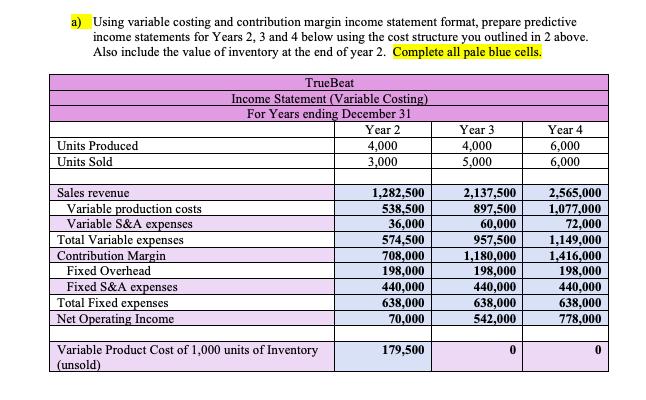

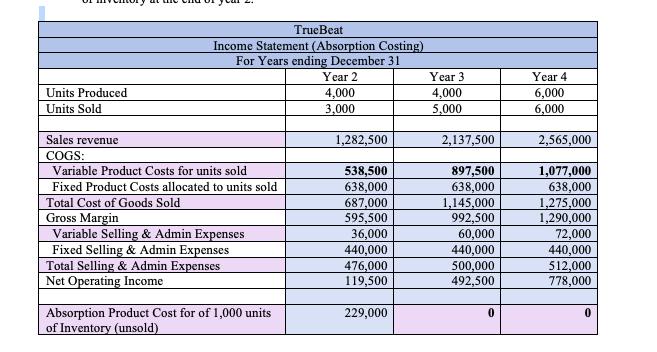

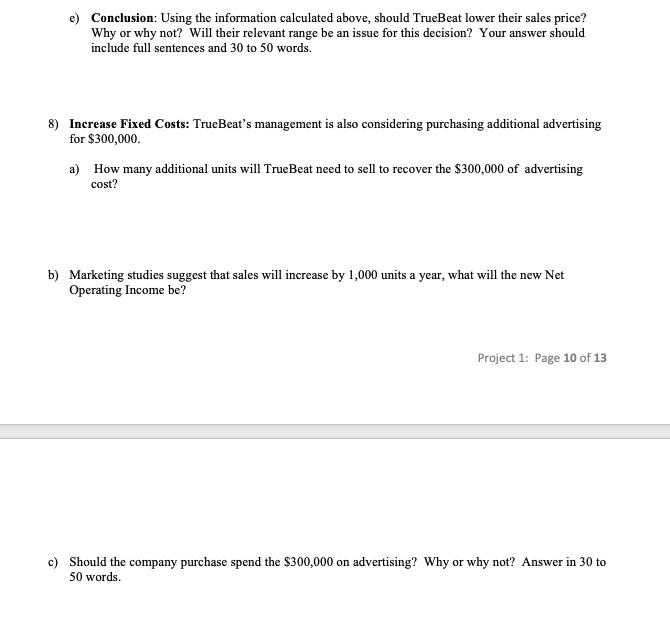

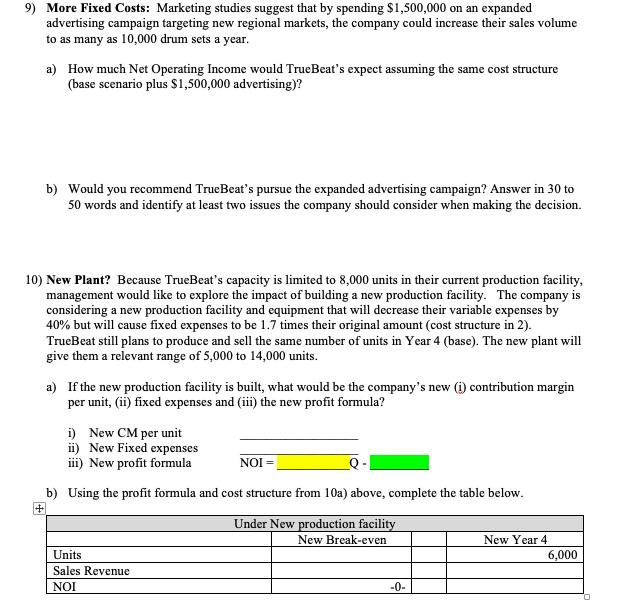

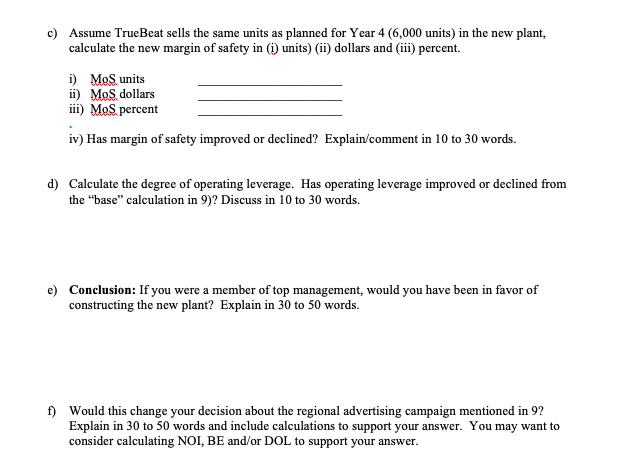

Question: looking at the revised cost structure and contribution margin from 2B(second image) and variable and absorption income statement, how do I calculate everything from Question

looking at the revised cost structure and contribution margin from 2B(second image) and variable and absorption income statement, how do I calculate everything from Question 4 to 10?

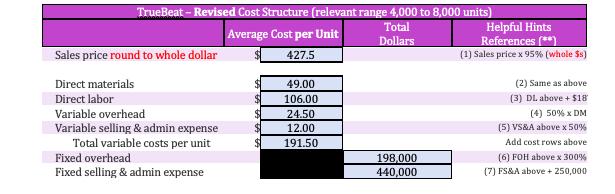

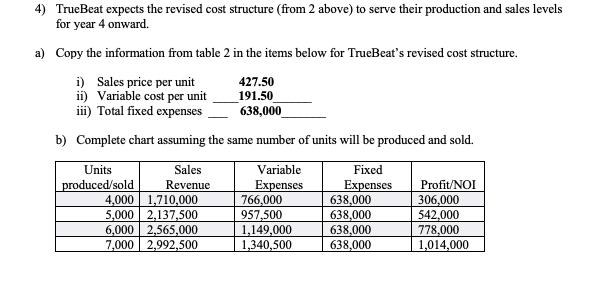

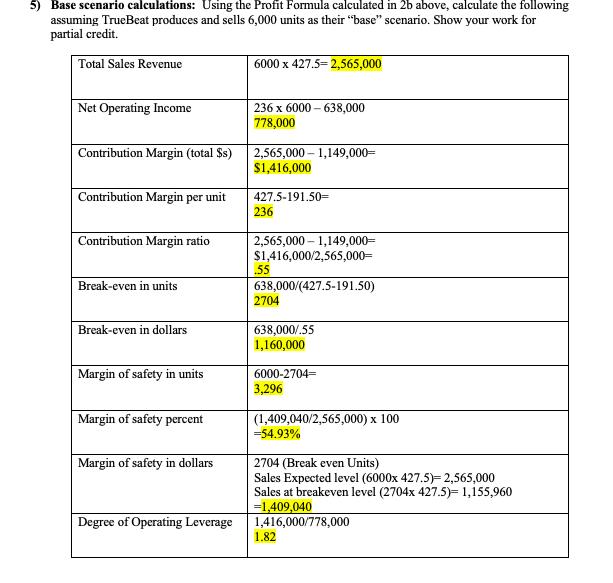

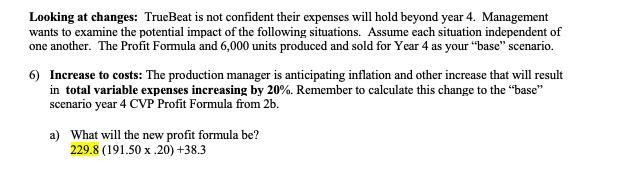

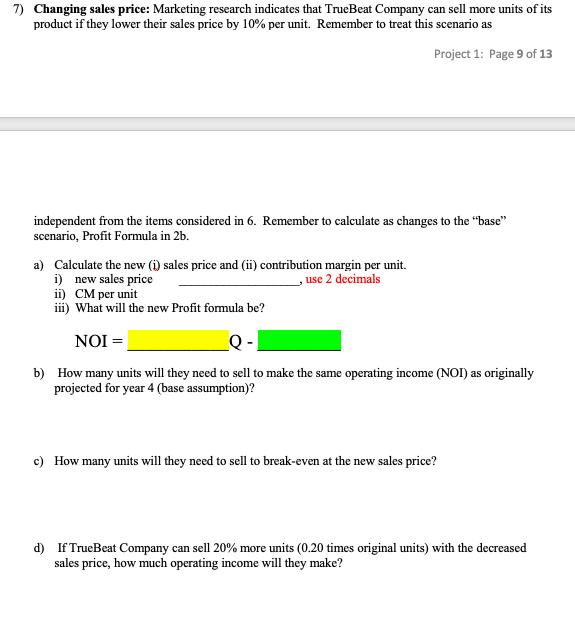

TrueBeat - Revised Cost Structure (relevant range 4,000 to 8,000 units) Helpful Hints References (**) Total Average Cost per Unit Dollars Sales price round to whole dollar 427.5 (1) Sales price x 95% (whole $s) Direct materials 49.00 (2) Same as above Direct labor 106.00 (3) DL above + $18 Variable overhead 24.50 (4) 50% x DM Variable selling & admin expense Total variable costs per unit Fixed overhead Fixed selling & admin expense 12.00 (5) VSAA above x 50% 191.50 Add cost rows above (6) FOH above x 300% 198,000 440,000 (7) FS&A above + 250,000

Step by Step Solution

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Before examining contribution margins lets review some key concepts fixed costs relevant range variable costs and contribution margin Fixed costs are those costs that will not change within a given ra... View full answer

Get step-by-step solutions from verified subject matter experts