Question: Looking for advice on how to start building a dynamic excel model that can answer the case needs. Some of the value drivers that I

Looking for advice on how to start building a dynamic excel model that can answer the case needs. Some of the value drivers that I thought of to drive the model are Stock Price, Treasury bond price, Maturity in years, Current Stock price, Dividend yield, inflation rate, inheritance goal and yearly amount to save, Living expenses, Treasury bond yield %, and trend of stock price growth

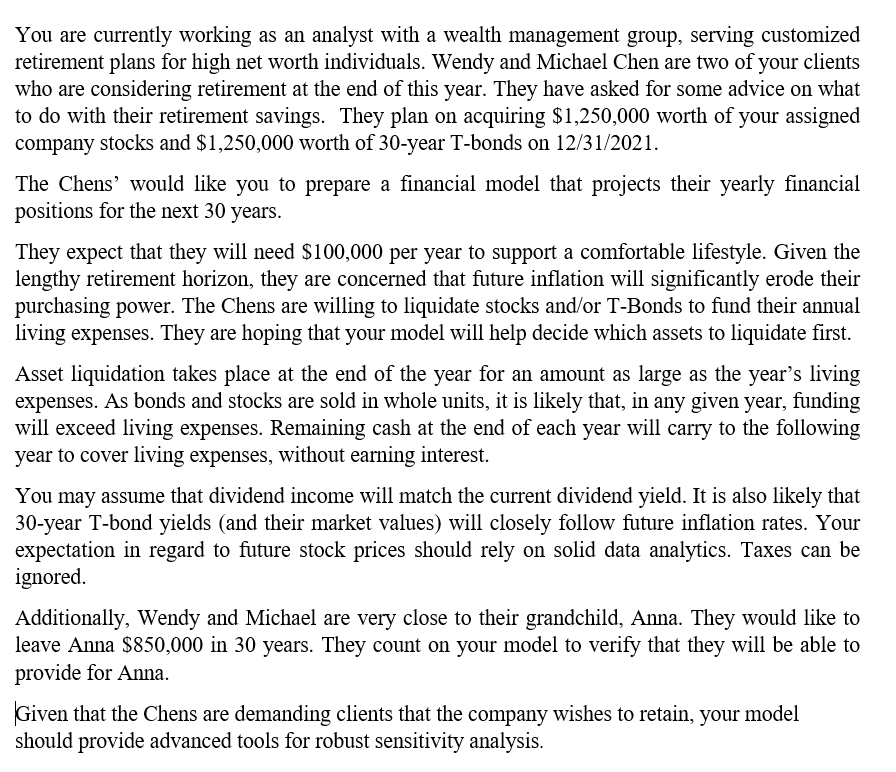

You are currently working as an analyst with a wealth management group, serving customized retirement plans for high net worth individuals. Wendy and Michael Chen are two of your clients who are considering retirement at the end of this year. They have asked for some advice on what to do with their retirement savings. They plan on acquiring $1,250,000 worth of your assigned company stocks and $1,250,000 worth of 30-year T-bonds on 12/31/2021. The Chens' would like you to prepare a financial model that projects their yearly financial positions for the next 30 years. They expect that they will need $100,000 per year to support a comfortable lifestyle. Given the lengthy retirement horizon, they are concerned that future inflation will significantly erode their purchasing power. The Chens are willing to liquidate stocks and/or T-Bonds to fund their annual living expenses. They are hoping that your model will help decide which assets to liquidate first. Asset liquidation takes place at the end of the year for an amount as large as the year's living expenses. As bonds and stocks are sold in whole units, it is likely that, in any given year, funding will exceed living expenses. Remaining cash at the end of each year will carry to the following year to cover living expenses, without earning interest. You may assume that dividend income will match the current dividend yield. It is also likely that 30-year T-bond yields (and their market values) will closely follow future inflation rates. Your expectation in regard to future stock prices should rely on solid data analytics. Taxes can be ignored. Additionally, Wendy and Michael are very close to their grandchild, Anna. They would like to leave Anna $850,000 in 30 years. They count on your model to verify that they will be able to provide for Anna. Given that the Chens are demanding clients that the company wishes to retain, your model should provide advanced tools for robust sensitivity analysis. You are currently working as an analyst with a wealth management group, serving customized retirement plans for high net worth individuals. Wendy and Michael Chen are two of your clients who are considering retirement at the end of this year. They have asked for some advice on what to do with their retirement savings. They plan on acquiring $1,250,000 worth of your assigned company stocks and $1,250,000 worth of 30-year T-bonds on 12/31/2021. The Chens' would like you to prepare a financial model that projects their yearly financial positions for the next 30 years. They expect that they will need $100,000 per year to support a comfortable lifestyle. Given the lengthy retirement horizon, they are concerned that future inflation will significantly erode their purchasing power. The Chens are willing to liquidate stocks and/or T-Bonds to fund their annual living expenses. They are hoping that your model will help decide which assets to liquidate first. Asset liquidation takes place at the end of the year for an amount as large as the year's living expenses. As bonds and stocks are sold in whole units, it is likely that, in any given year, funding will exceed living expenses. Remaining cash at the end of each year will carry to the following year to cover living expenses, without earning interest. You may assume that dividend income will match the current dividend yield. It is also likely that 30-year T-bond yields (and their market values) will closely follow future inflation rates. Your expectation in regard to future stock prices should rely on solid data analytics. Taxes can be ignored. Additionally, Wendy and Michael are very close to their grandchild, Anna. They would like to leave Anna $850,000 in 30 years. They count on your model to verify that they will be able to provide for Anna. Given that the Chens are demanding clients that the company wishes to retain, your model should provide advanced tools for robust sensitivity analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts