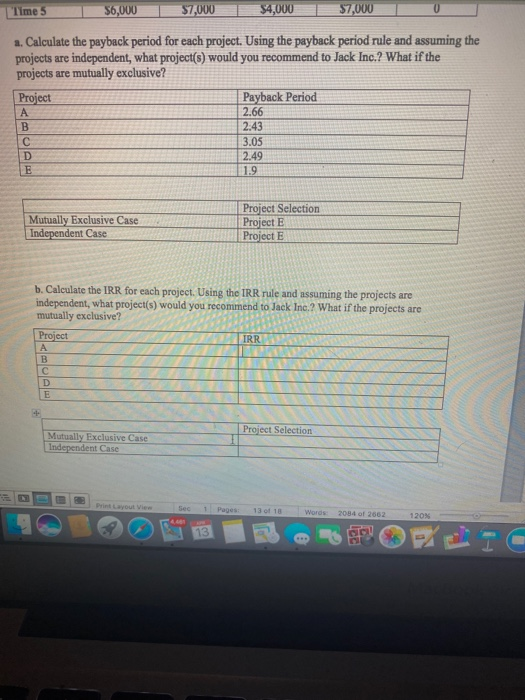

Question: looking for answers to B yes excel will do! Time 5 $6,000 $7,000 $4,000 $7,000 0 a. Calculate the payback period for each project. Using

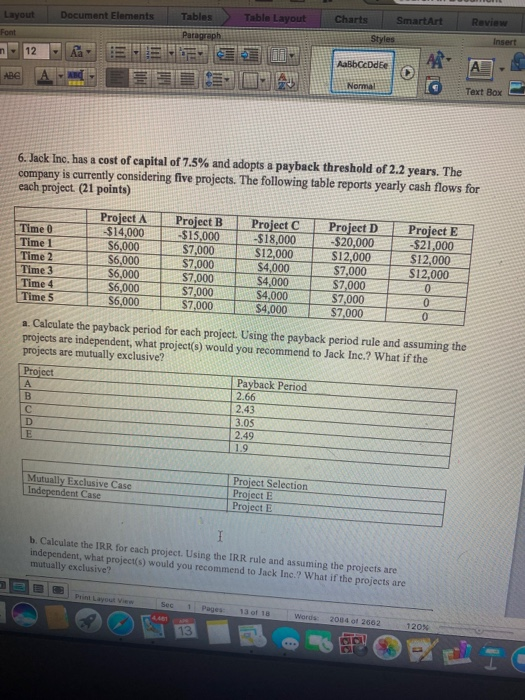

Time 5 $6,000 $7,000 $4,000 $7,000 0 a. Calculate the payback period for each project. Using the payback period rule and assuming the projects are independent, what project(s) would you recommend to Jack Inc.? What if the projects are mutually exclusive? Project Payback Period 2.66 2:43 3.05 2.49 1.9 Mutually Exclusive Case Independent Case Project Selection Project E Project E b. Calculate the IRR for each project. Using the IRR rule and assuming the projects are independent, what project(s) would you recommend to Jack Inc.? What if the projects are mutually exclusive? IRR Project A D Mutually Exclusive Case Independent Case Print Layout vion soc Pages: 13 of 10 Words 2004 of 2002 1201 Document Elements Tables Table Layout Charts SmartArt Review Insert Layout Font 12 ADE A N AaBbCcDdae EW 6. Jack Inc. has a cost of capital of 7.5% and adopts a payback threshold of 2.2 years. The company is currently considering five projects. The following table reports yearly cash flows for each project. (21 points) Time Time 1 Time 2 Time 3 Time 4 Time 5 Project A -$14,000 $6,000 $6,000 $6,000 S6,000 S6,000 Project B -$15,000 $7,000 $7,000 $7,000 $7,000 $7,000 Project C $18.000 $12,000 $4,000 $4,000 S4,000 $4,000 Project D -$20,000 $12,000 $7,000 $7,000 $7,000 $7,000 Project E -$21,000 $12,000 S12,000 0 0 0 . Calculate the payback period for each project. Using the payback period rule and assuming the projects are independent, what project(s) would you recommend to Jack Inc.? What if the projects are mutually exclusive? Project Payback Period A 2.66 B 2.43 C 3.05 D 2.49 E 11.9 Mutually Exclusive Case Independent Case Project Selection Project E Project E b. Calculate the IRR for each project. Using the IRR rule and assuming the projects are independent, what project(s) would you recommend to Jack Ine? What if the projects are mutually exclusive? Sec 1 Page 13 of 18 Words: 2004 of 2602 1 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts