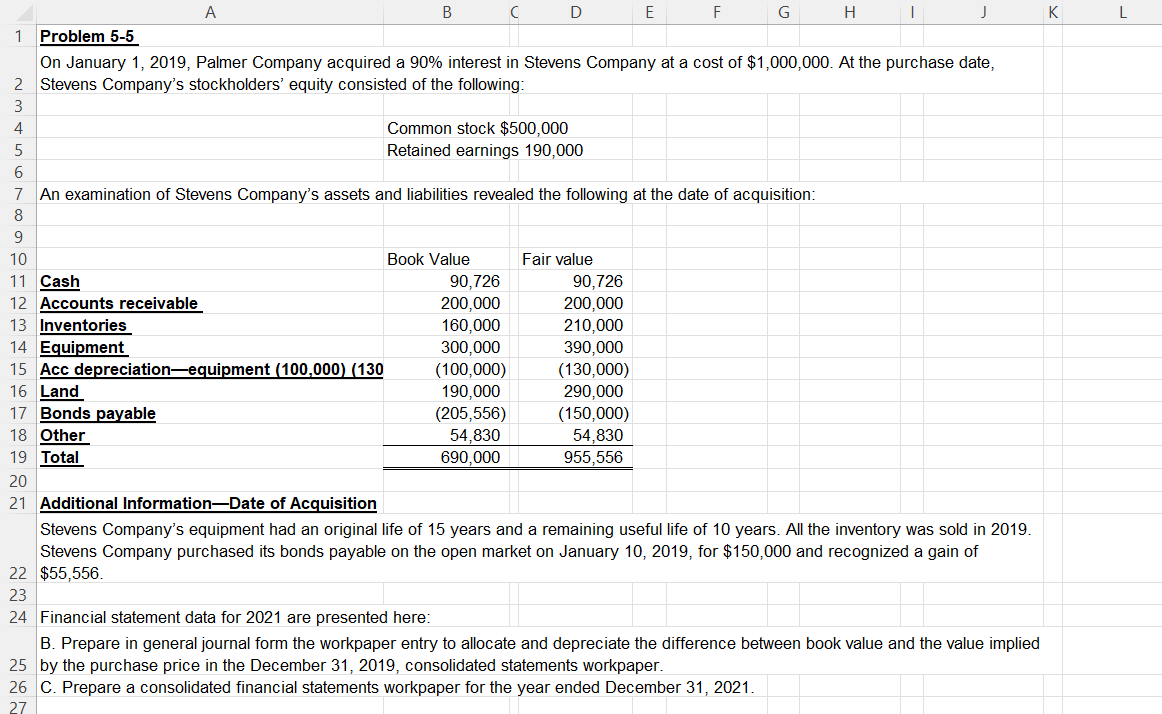

Question: Looking for explanation of how the problem was solved with calculations please 7 An examination of Stevens Company's assets and liabilities revealed the following at

Looking for explanation of how the problem was solved with calculations please

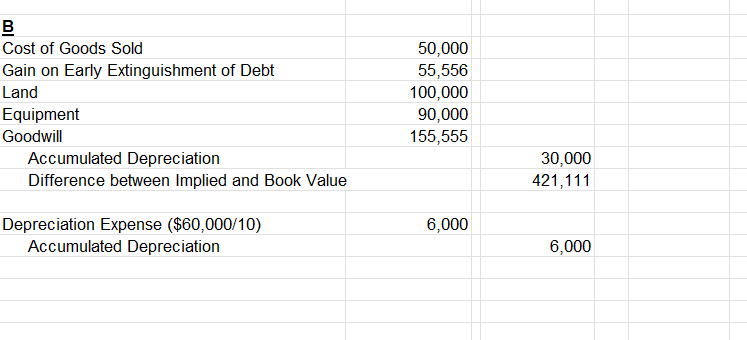

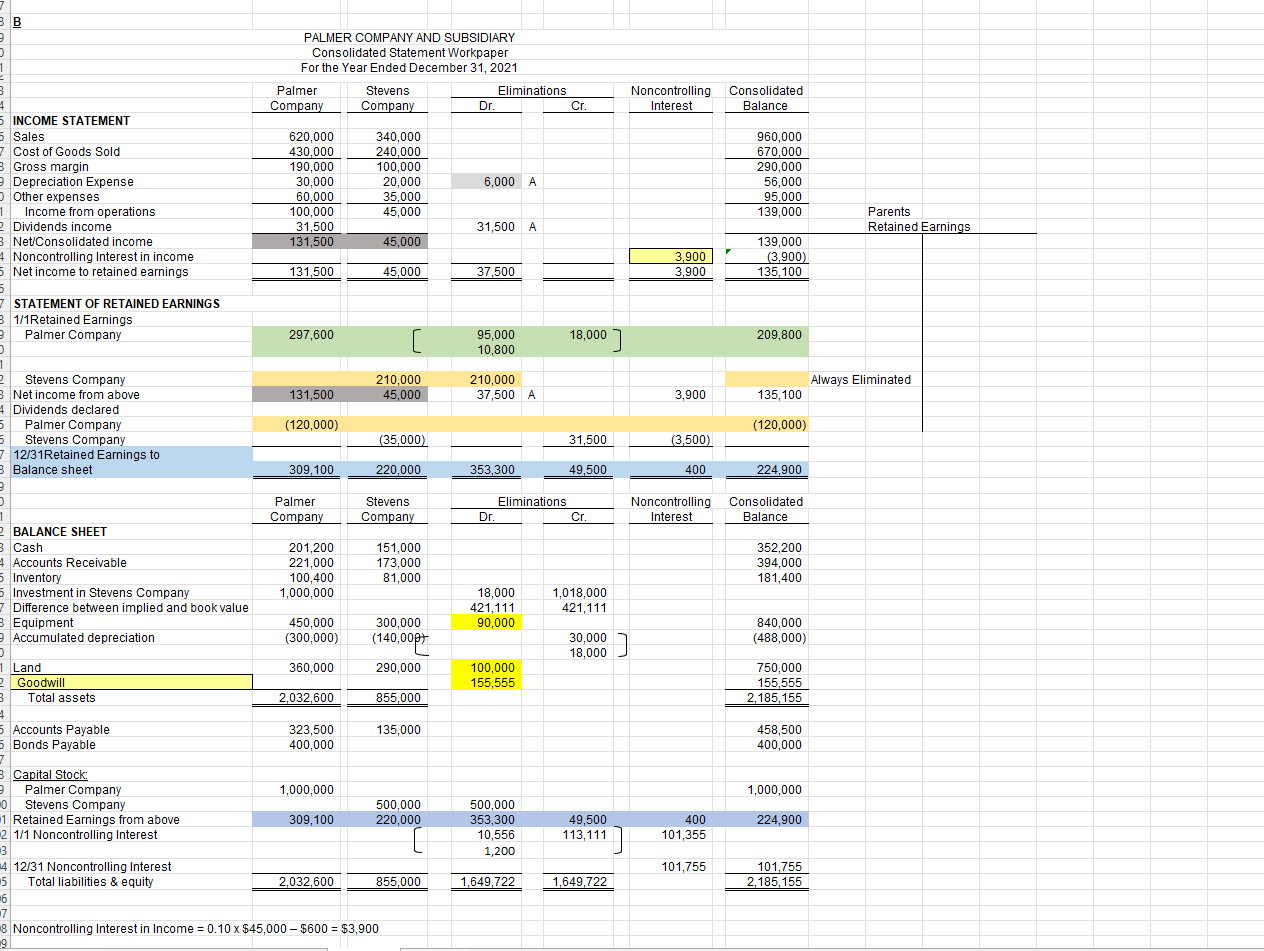

7 An examination of Stevens Company's assets and liabilities revealed the following at the date of acquisition: 8 Stevens Company's equipment had an original life of 15 years and a remaining useful life of 10 years. All the inventory was sold in 2019 . Stevens Company purchased its bonds payable on the open market on January 10,2019 , for $150,000 and recognized a gain of $55,556. Financial statement data for 2021 are presented here: B. Prepare in general journal form the workpaper entry to allocate and depreciate the difference between book value and the value implied by the purchase price in the December 31,2019 , consolidated statements workpaper. C. Prepare a consolidated financial statements workpaper for the year ended December 31, 2021. B \begin{tabular}{lr} \hline Cost of Goods Sold & 50,000 \\ \hline Gain on Early Extinguishment of Debt & 55,556 \\ Land & 100,000 \\ Equipment & 90,000 \\ Goodwill & 155,555 \end{tabular} Accumulated Depreciation Difference between Implied and Book Value Depreciation Expense ($60,000/10) 6,000 Accumulated Depreciation 6,000 PALMER COMPANY AND SUBSIDIARY Consolidated Statement Workpaper For the Year Ended December 31, 2021 Noncontrolling Interest in Income =0.10$45,000$600=$3,900

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts