Question: Looking for help with #4 and 5 Project 4 Section B. John Rozycki manages a 200 million U.S. dollar (USD) portfolio for Trailblazers. It holds

Looking for help with #4 and 5

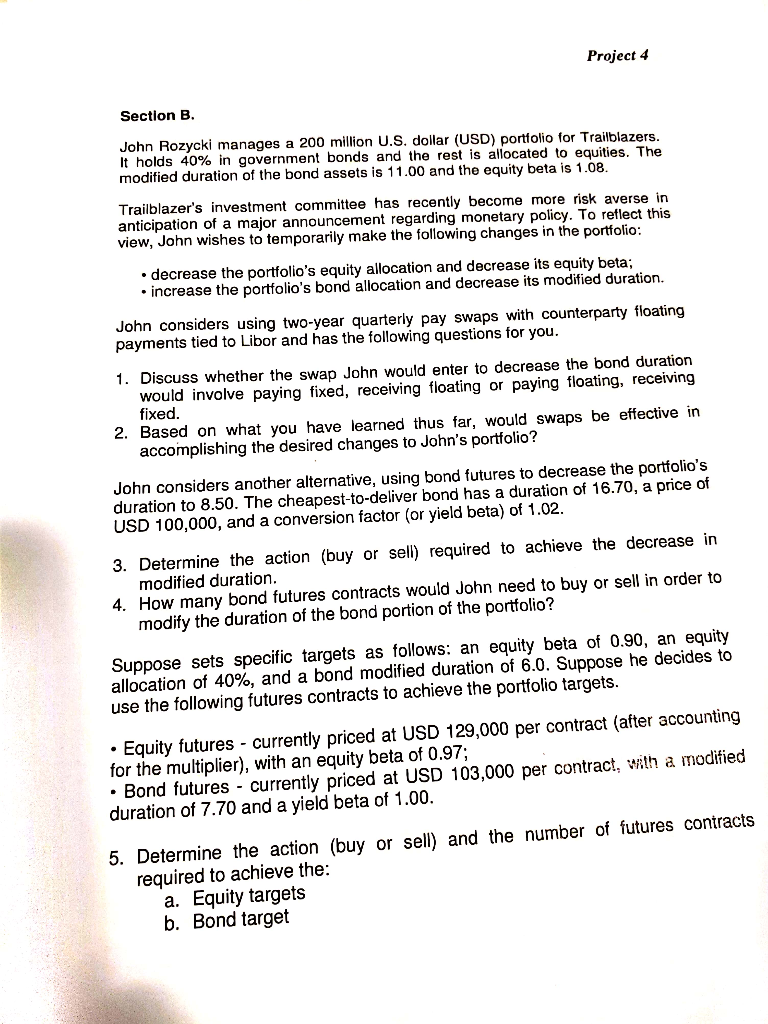

Project 4 Section B. John Rozycki manages a 200 million U.S. dollar (USD) portfolio for Trailblazers. It holds 40% in government bonds and the rest is allocated to equities. The modified duration of the bond assets is 11.00 and the equity beta is 1.08. Trailblazer's investment committee has recently become more risk averse in anticipation of a major announcement regarding monetary policy. To reflect this view, John wishes to temporarily make the following changes in the portfolio: . decrease the portfolio's equity allocation and decrease its equity beta; increase the portfolio's bond allocation and decrease its modified duration. John considers using two-year quarterly pay swaps with counterparty floating payments tied to Libor and has the following questions for you. 1. Discuss whether the swap John would enter to decrease the bond duration would involve paying fixed, receiving floating or paying floating, receiving fixed. 2. Based on what you have learned thus far, would swaps be effective in accomplishing the desired changes to John's portfolio? John considers another alternative, using bond futures to decrease the portfolio's duration to 8.50. The cheapest-to-deliver bond has a duration of 16.70, a price of USD 100,000, and a conversion factor (or yield beta) of 1.02. 3. Determine the action (buy or sell) required to achieve the decrease in modified duration. 4. How many bond futures contracts would John need to buy or sell in order to modify the duration of the bond portion of the portfolio? Suppose sets specific targets as follows: an equity beta of 0.90, an equity allocation of 40%, and a bond modified duration of 6.0. Suppose he decides to use the following futures contracts to achieve the portfolio targets. Equity futures - currently priced at USD 129,000 per contract (after accounting for the multiplier), with an equity beta of 0.97; Bond futures - currently priced at USD 103,000 per contract, with a modified duration of 7.70 and a yield beta of 1.00. 5. Determine the action (buy or sell) and the number of futures contracts required to achieve the: a. Equity targets b. Bond target Project 4 Section B. John Rozycki manages a 200 million U.S. dollar (USD) portfolio for Trailblazers. It holds 40% in government bonds and the rest is allocated to equities. The modified duration of the bond assets is 11.00 and the equity beta is 1.08. Trailblazer's investment committee has recently become more risk averse in anticipation of a major announcement regarding monetary policy. To reflect this view, John wishes to temporarily make the following changes in the portfolio: . decrease the portfolio's equity allocation and decrease its equity beta; increase the portfolio's bond allocation and decrease its modified duration. John considers using two-year quarterly pay swaps with counterparty floating payments tied to Libor and has the following questions for you. 1. Discuss whether the swap John would enter to decrease the bond duration would involve paying fixed, receiving floating or paying floating, receiving fixed. 2. Based on what you have learned thus far, would swaps be effective in accomplishing the desired changes to John's portfolio? John considers another alternative, using bond futures to decrease the portfolio's duration to 8.50. The cheapest-to-deliver bond has a duration of 16.70, a price of USD 100,000, and a conversion factor (or yield beta) of 1.02. 3. Determine the action (buy or sell) required to achieve the decrease in modified duration. 4. How many bond futures contracts would John need to buy or sell in order to modify the duration of the bond portion of the portfolio? Suppose sets specific targets as follows: an equity beta of 0.90, an equity allocation of 40%, and a bond modified duration of 6.0. Suppose he decides to use the following futures contracts to achieve the portfolio targets. Equity futures - currently priced at USD 129,000 per contract (after accounting for the multiplier), with an equity beta of 0.97; Bond futures - currently priced at USD 103,000 per contract, with a modified duration of 7.70 and a yield beta of 1.00. 5. Determine the action (buy or sell) and the number of futures contracts required to achieve the: a. Equity targets b. Bond target

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts