Question: Part I. Below is the option chain for March 2 0 2 5 ( European ) option contracts, where the underlying is the US (

Part I.

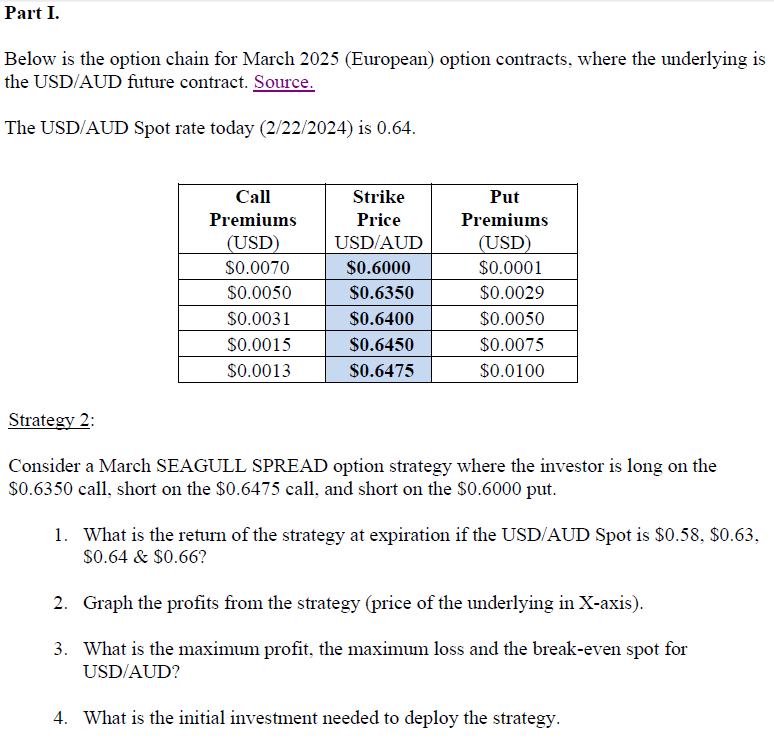

Below is the option chain for March European option contracts, where the underlying is

the USDAUD future contract. Source.

The USDAUD Spot rate today is

Strategy :

Consider a March SEAGULL SPREAD option strategy where the investor is long on the

$ call, short on the $ call, and short on the $ put.

What is the return of the strategy at expiration if the USDAUD Spot is $$

$ & $

Graph the profits from the strategy price of the underlying in Xaxis

What is the maximum profit, the maximum loss and the breakeven spot for

USDAUD

What is the initial investment needed to deploy the strategy.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock