Question: Looking for help with question 5 each stock is $ 23,250 expected return of richards portfolio: 7.60% standard deviation: 13.99% SI A B C Question

Looking for help with question 5

each stock is $ 23,250

expected return of richards portfolio: 7.60%

standard deviation: 13.99%

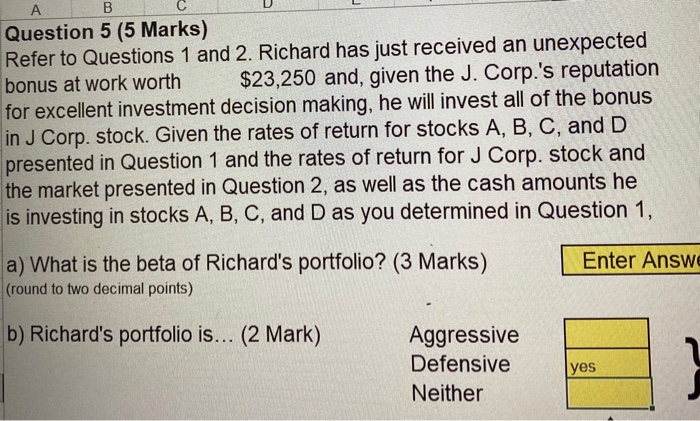

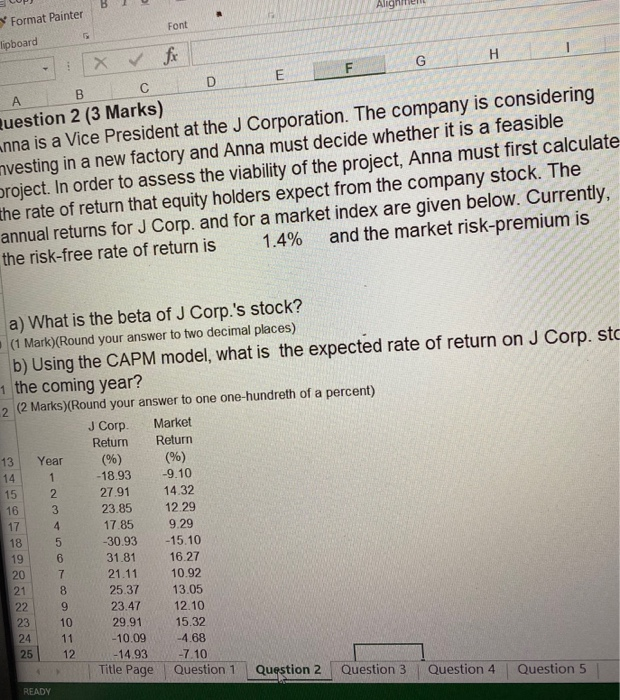

SI A B C Question 5 (5 Marks) Refer to Questions 1 and 2. Richard has just received an unexpected bonus at work worth $23,250 and, given the J. Corp.'s reputation for excellent investment decision making, he will invest all of the bonus in J Corp. stock. Given the rates of return for stocks A, B, C, and D presented in Question 1 and the rates of return for J Corp. stock and the market presented in Question 2, as well as the cash amounts he is investing in stocks A, B, C, and D as you determined in Question 1, Enter Answe a) What is the beta of Richard's portfolio? (3 Marks) (round to two decimal points) b) Richard's portfolio is... (2 Mark) Aggressive Defensive Neither yes COP 1 0 lighten Font Format Painter lipboard AB C D E F G H Question 2 (3 Marks) nna is a Vice President at the J Corporation. The company is considering mvesting in a new factory and Anna must decide whether it is a feasible project. In order to assess the viability of the project, Anna must first calculate the rate of return that equity holders expect from the company stock. The annual returns for J Corp. and for a market index are given below. Currently, the risk-free rate of return is 1.4% and the market risk-premium is (%) a) What is the beta of J Corp.'s stock? (1 Mark)(Round your answer to two decimal places) b) Using the CAPM model, what is the expected rate of return on J Corp. sto 1 the coming year? 2 (2 Marks)(Round your answer to one one-hundreth of a percent) J Corp. Market Return Return 13 Year (%) -18.93 -9.10 27.91 14.32 16 3 23.85 12.29 17.85 9.29 -30.93 -15.10 31.81 16.27 21.11 10.92 25.37 13.05 23.47 12.10 29.91 15.32 -10.09 -4.68 - 25 12 -14.93 -7.10 Title Page Question 1 Question 2 Question 3 Question 4 Question 5 READY SI A B C Question 5 (5 Marks) Refer to Questions 1 and 2. Richard has just received an unexpected bonus at work worth $23,250 and, given the J. Corp.'s reputation for excellent investment decision making, he will invest all of the bonus in J Corp. stock. Given the rates of return for stocks A, B, C, and D presented in Question 1 and the rates of return for J Corp. stock and the market presented in Question 2, as well as the cash amounts he is investing in stocks A, B, C, and D as you determined in Question 1, Enter Answe a) What is the beta of Richard's portfolio? (3 Marks) (round to two decimal points) b) Richard's portfolio is... (2 Mark) Aggressive Defensive Neither yes COP 1 0 lighten Font Format Painter lipboard AB C D E F G H Question 2 (3 Marks) nna is a Vice President at the J Corporation. The company is considering mvesting in a new factory and Anna must decide whether it is a feasible project. In order to assess the viability of the project, Anna must first calculate the rate of return that equity holders expect from the company stock. The annual returns for J Corp. and for a market index are given below. Currently, the risk-free rate of return is 1.4% and the market risk-premium is (%) a) What is the beta of J Corp.'s stock? (1 Mark)(Round your answer to two decimal places) b) Using the CAPM model, what is the expected rate of return on J Corp. sto 1 the coming year? 2 (2 Marks)(Round your answer to one one-hundreth of a percent) J Corp. Market Return Return 13 Year (%) -18.93 -9.10 27.91 14.32 16 3 23.85 12.29 17.85 9.29 -30.93 -15.10 31.81 16.27 21.11 10.92 25.37 13.05 23.47 12.10 29.91 15.32 -10.09 -4.68 - 25 12 -14.93 -7.10 Title Page Question 1 Question 2 Question 3 Question 4 Question 5 READY

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts