Question: Looking for some help on the below question!! Need some help understanding the basis of this Finance/Derivatives question. Big Thumbs up to anyone who can

Looking for some help on the below question!! Need some help understanding the basis of this Finance/Derivatives question.

Big Thumbs up to anyone who can help!!

Thank you!! See below.

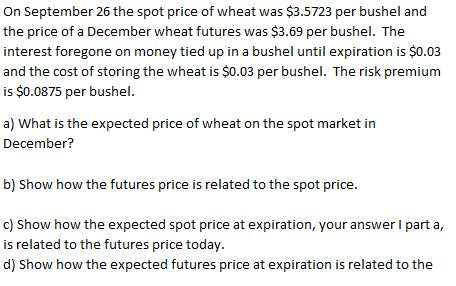

On September 26 the spot price of wheat was $3.5723 per bushel and the price of a December wheat futures was $3.69 per bushel. The interest foregone on money tied up in a bushel until expiration is $0.03 and the cost of storingthe wheat is $0.03 per bushel. The risk premium is $0.0875 per bushel a) What is the expected price of wheat on the spot market in December? b) Show how the futures price is related to the spot price c) Show how the expected spot price at expiration, your answer I part a is related to the futures price today. d) Show how the expected futures price at expiration is related to the On September 26 the spot price of wheat was $3.5723 per bushel and the price of a December wheat futures was $3.69 per bushel. The interest foregone on money tied up in a bushel until expiration is $0.03 and the cost of storingthe wheat is $0.03 per bushel. The risk premium is $0.0875 per bushel a) What is the expected price of wheat on the spot market in December? b) Show how the futures price is related to the spot price c) Show how the expected spot price at expiration, your answer I part a is related to the futures price today. d) Show how the expected futures price at expiration is related to the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts