Question: Looking on how to do the constrisnts for part b and part c A manufacturing company must choose among a series of new investment projects.

Looking on how to do the constrisnts for part b and part c

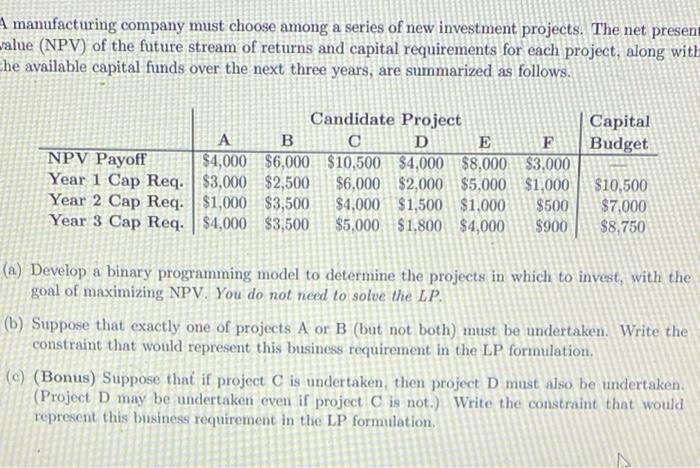

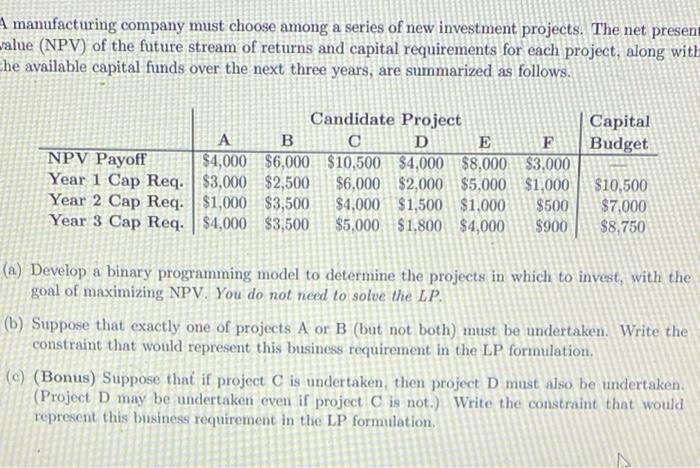

A manufacturing company must choose among a series of new investment projects. The net presen -alue (NPV) of the future stream of returns and capital requirements for each project, along with che available capital funds over the next three years, are summarized as follows. Capital Budget Candidate Project B D E F NPV Payoff $4,000 $6,000 $10,500 $4,000 $8,000 $3,000 Year 1 Cap Req. | $3,000 $2,500 $6,000 $2,000 $5,000 $1,000 Year 2 Cap Req. | $1,000 $3,500 $4,000 $1,500 $1,000 $500 Year 3 Cap Req. $4,000 $3,500 $5,000 $1,800 $4,000 $900 $10,500 $7,000 $8,750 (a) Develop a binary programming model to determine the projects in which to invest, with the goal of maximizing NPV. You do not need to solve the LP. (b) Suppose that exactly one of projects A or B (but not both) must be undertaken. Write the constraint that would represent this business requirement in the LP formulation. ( ) (Bonus) Suppose that if project C is undertaken then project D must also be undertaken. (Project D may be undertaken even if project C is not.) Write the constraint that would represent this business requirement in the LP formulation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock