Question: Looking to get some help with this question. The highlighted answer is incorrect. On January 1, Year 6, REK Ltd. contributed equipment to a joint

Looking to get some help with this question. The highlighted answer is incorrect.

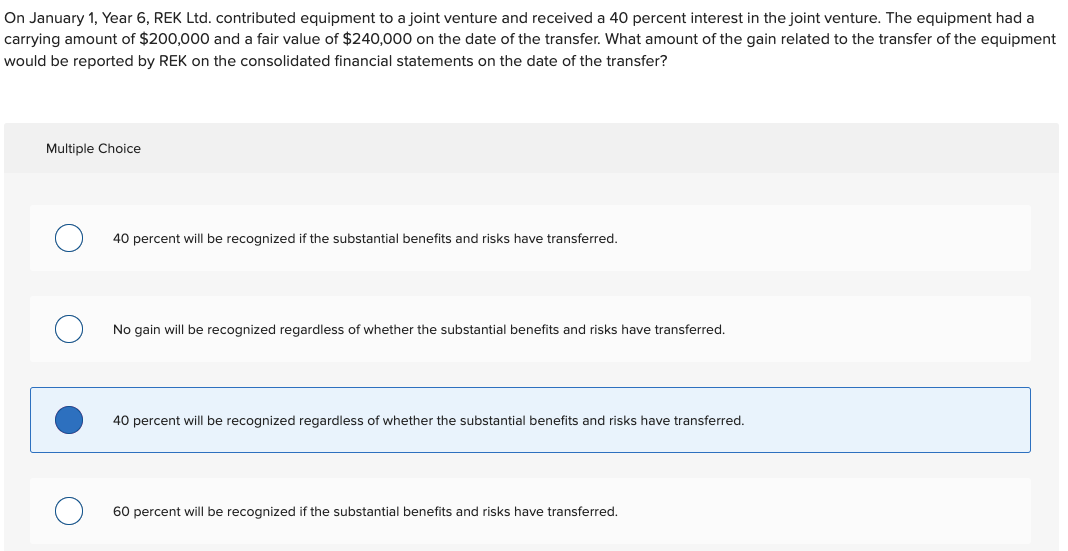

On January 1, Year 6, REK Ltd. contributed equipment to a joint venture and received a 40 percent interest in the joint venture. The equipment had a carrying amount of $200,000 and a fair value of $240,000 on the date of the transfer. What amount of the gain related to the transfer of the equipment would be reported by REK on the consolidated financial statements on the date of the transfer? Multiple Choice 40 percent will be recognized if the substantial benefits and risks have transferred. No gain will be recognized regardless of whether the substantial benefits and risks have transferred. 40 percent will be recognized regardless of whether the substantial benefits and risks have transferred. 60 percent will be recognized if the substantial benefits and risks have transferred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts