Question: Los Lobos Corp. uses the direct method to prepare its statement of cash flows. Los Loboss trial balances at December 31, 20 1 7 and

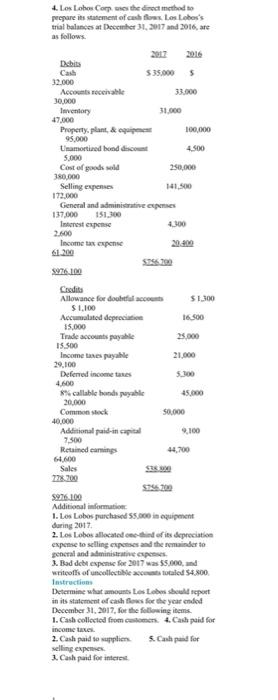

Los Lobos Corp. uses the direct method to prepare its statement of cash flows. Los Loboss trial balances at December 31, 2017 and 2016, are as follows.

2017 2016

Debits

Cash $ 35,000 $ 32,000

Accounts receivable 33,000 30,000

Inventory 31,000 47,000

Property, plant, & equipment 100,000 95,000

Unamortized bond discount 4,500 5,000

Cost of goods sold 250,000 380,000

Selling expenses 141,500 172,000

General and administrative expenses 137,000 151,300

Interest expense 4,300 2,600

Income tax expense 20,400 61,200

$756,700 $976,100

Credits

Allowance for doubtful accounts $ 1,300 $ 1,100

Accumulated depreciation 16,500 15,000

Trade accounts payable 25,000 15,500

Income taxes payable 21,000 29,100

Deferred income taxes 5,300 4,600

8% callable bonds payable 45,000 20,000

Common stock 50,000 40,000

Additional paid-in capital 9,100 7,500

Retained earnings 44,700 64,600

Sales 538,800 778,700

$756,700 $976,100

Additional information:

1. Los Lobos purchased $5,000 in equipment during 2017.

2. Los Lobos allocated one-third of its depreciation expense to selling expenses and the remainder togeneral and administrative expenses.

3. Bad debt expense for 2017 was $5,000, and writeoffs of uncollectible accounts totaled $4,800.

Instructions

Determine what amounts Los Lobos should report in its statement of cash flows for the year endedDecember 31, 2017, for the following items.

1. Cash collected from customers. 4. Cash paid for income taxes.

2. Cash paid to suppliers. 5. Cash paid for selling expenses.

3. Cash paid for interest.

4. Los Lobos Corp uses the direct method to prepare its statement of cash flows Los Lobos's trial balances at December 31, 2017 and 2016, are as follows. 2017 2016 Debits Cash $35,000 S 32,000 Accounts receivable 33,000 30,000 Inventory 31,000 47,000 Property, plant, & equipment 95,000 Unamortized bond discount 5,000 Cost of goods sold 380,000 Selling expenses 172,000 General and administrative expenses 151,300 137,000 Interest expense 4,300 2.600 Income tax expense 61.200 $756.700 $976,100 Credits Allowance for doubtful accounts $ 1,100 Accumulated depreciation 15,000 Trade accounts payable 15.500 Income taxes payable 29,100 Deferred income taxes 4,600 8% callable bonds payable 20,000 Common stock 40,000 Additional paid-in capital 7,500 Retained earnings 64,600 Sales $38.900 778.700 $756.700 $976 100 Additional information 1. Los Lobos purchased $5,000 in equipment during 2017. 2. Los Lobos allocated one-thind of its depreciation expense to selling expenses and the remainder to general and administrative expenses. 3. Bad debt expense for 2017 was $5,000, and writeoffs of uncollectible accounts totaled 54,800. Instructions Determine what amounts Los Lobos should report in its statement of cash flows for the year ended December 31, 2017, for the following items. 1.Cash collected from customers. 4. Cash paid for income taxes. 2. Cash paid to suppliers 5. Cash paid for selling expenses. 3. Cash paid for interest. 100,000 4,500 250,000 141,500 $1,300 16,500 25,000 21,000 5,300 45,000 9,100 50,000 44,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts