Question: LQ 2 . ( 2 0 points ) I. During the year 2 0 2 2 , Cita Co reported sales and cost of good

LQ points

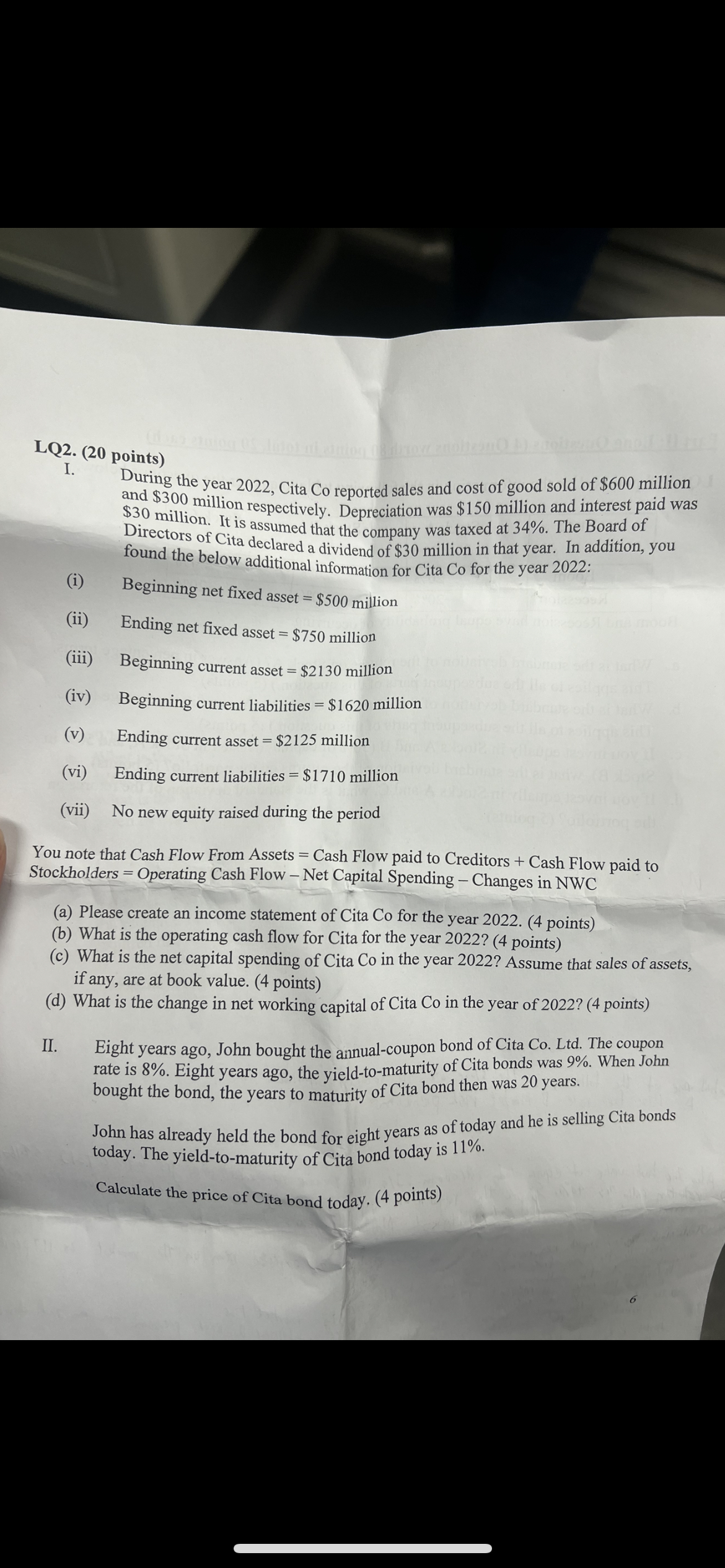

I. During the year Cita Co reported sales and cost of good sold of $ million and $ million respectively. Depreciation was $ million and interest paid was $ million. It is assumed that the company was taxed at The Board of Directors of Cita declared a dividend of $ million in that year. In addition, you found the below additional information for Cita Co for the year :

i Beginning net fixed asset $ million

ii Ending net fixed asset $ million

iii Beginning current asset $ million

iv Beginning current liabilities $ million

v Ending current asset $ million

vi Ending current liabilities $ million

vii No new equity raised during the period

You note that Cash Flow From Assets Cash Flow paid to Creditors Cash Flow paid to Stockholders Operating Cash Flow Net Capital Spending Changes in NWC

a Please create an income statement of Cita Co for the year points

b What is the operating cash flow for Cita for the year points

c What is the net capital spending of Cita Co in the year Assume that sales of assets, if any, are at book value. points

d What is the change in net working capital of Cita Co in the year of points

II Eight years ago, John bought the annualcoupon bond of Cita Co Ltd The coupon rate is Eight years ago, the yieldtomaturity of Cita bonds was When John bought the bond, the years to maturity of Cita bond then was years.

John has already held the bond for eight years as of today and he is selling Cita bonds today. The yieldtomaturity of Cita bond today is

Calculate the price of Cita bond today. points

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock