Question: Intermediate 2 Terry Part #3: Deferred Taxes To practice recognizing and reporting deferred taxes. (See Topic Guides NI&EPS 6, 7, 21). Terrys management opened a

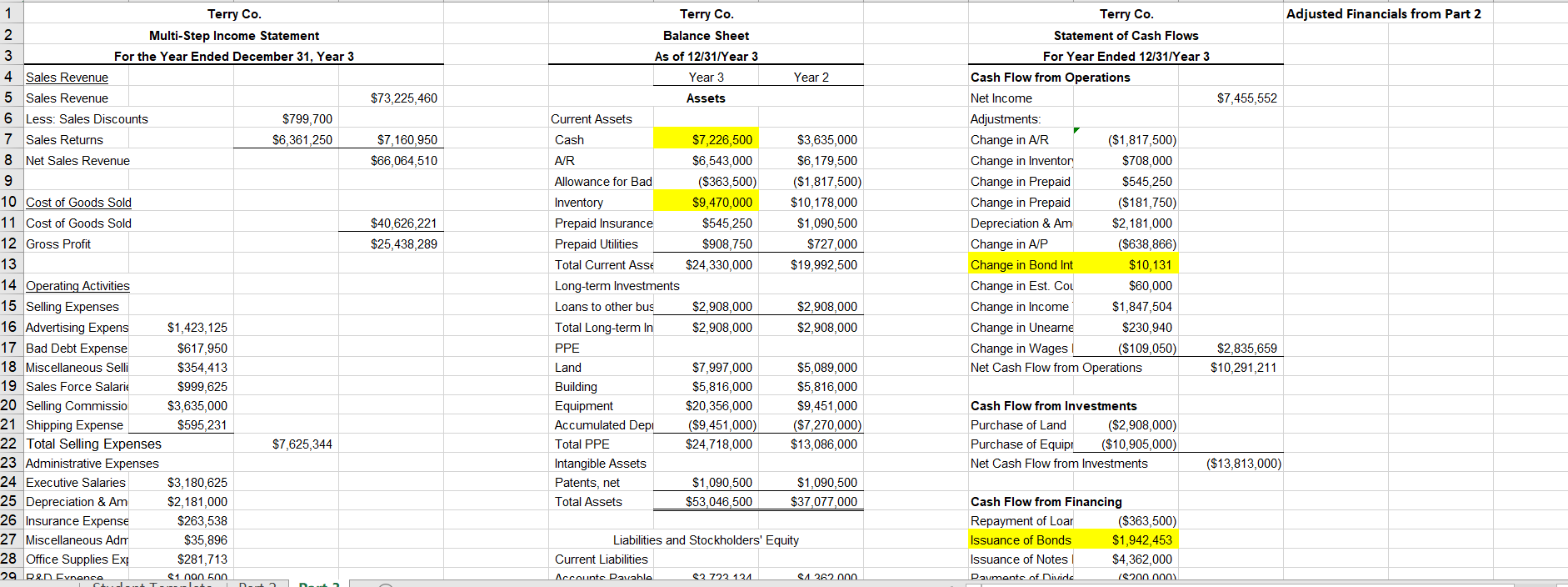

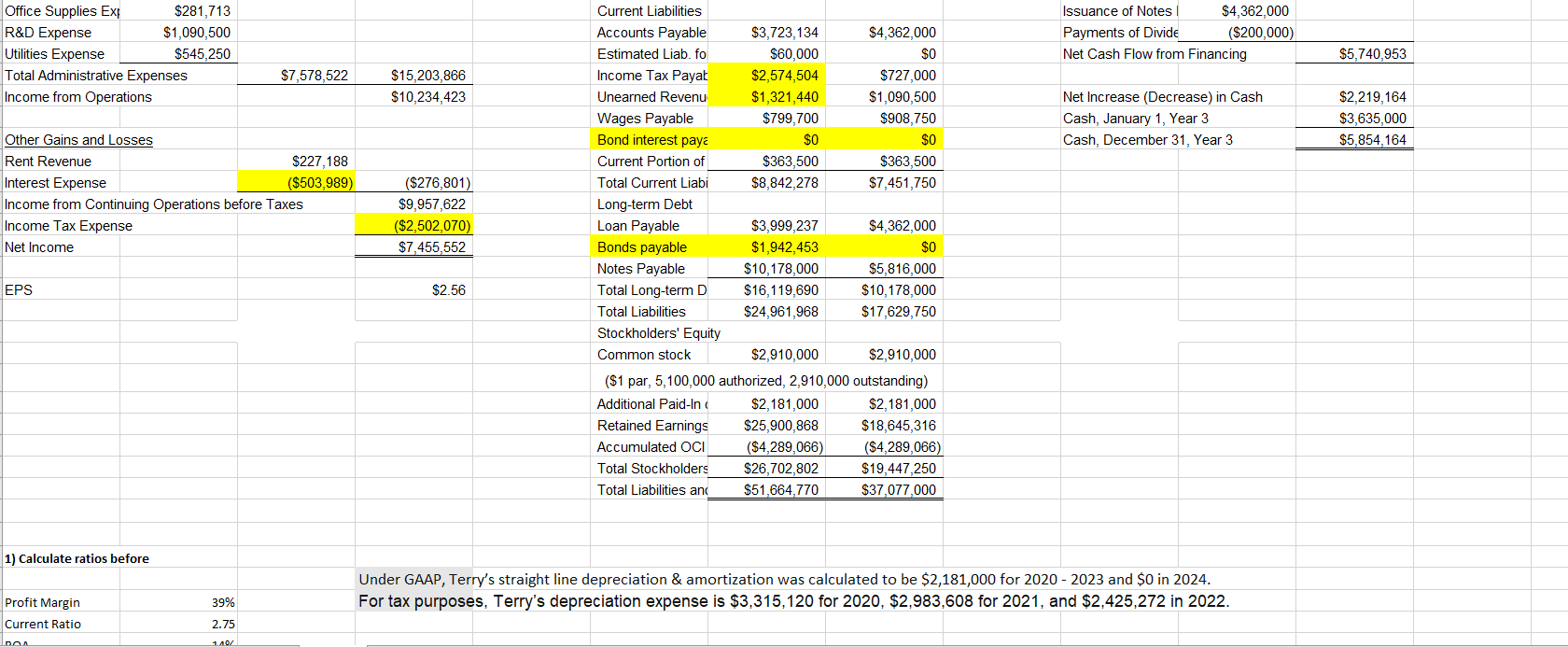

Intermediate 2 Terry Part #3: Deferred Taxes To practice recognizing and reporting deferred taxes. (See Topic Guides NI&EPS 6, 7, 21). Terrys management opened a new life insurance policy this year on the CEO. The premium for this new policy is $1,000/month. The policy cannot be prepaid. Acct 331 - Page 10 4. Critical Thinking 5. 6. Hints: 1. 2. 3. 4. The easiest way to create the correcting entry for this Terry is work through the steps we did in class through Step 6 (Making the Correct Journal Entry) for 2020. Each of the steps can be done exactly the same way we did in class. The final result will be the entry Terry should have made. Once you have the entry Terry should have made, you can then compare the numbers in that entry to the numbers Terry is currently using and make an adjusting entry. I would start by adjusting Income Tax Expense as reported in our last Terry (what Terry has recognized) to what it should be (as you just determined from Step 6 entry). Then adjust Deferred Tax (which currently has a balance of '0,'. since Terry hasnt recognized it at all). Finally, use Income Tax Payable as the plug figure. If you want to know why Income Tax Payable is the plug figure, please come and ask! The sale of the machines was recorded in an earlier Terry assignment. Youll find all of the numbers you need for the tax adjustment in that earlier problem. Make sure that you have corrected any necessary mistakes to your work on that problem before you start doing these calculations. Your ending cash balance will not change, since you haven't paid the government anything yet. However, you will need to add one (1) new line item to your Statement of Cash Flows to adjust from Net Income to Cash Flows from Operating Activities. Who might be affected by Terrys decision not to recognize deferred taxes appropriately in past years? How could this decision affect each individual or group? You should set up your tables for Step 5 just like we did in class. Calculate the three (3) ratios after you make any adjustments. What do you think investors reaction will be to the adjustment for deferred taxes (if any)? In other words, based on your changes to the financial statements and the change in the ratios, do you think investors will be happy with these changes? Why or why not?

addition:

Here are the numbers for depreciation:

Under GAAP, Terrys straight line depreciation & amortization was calculated to be $2,181,000 for 2020 - 2023 and $0 in 2024. For tax purposes, Terrys depreciation expense is $3,315,120 for 2020, $2,983,608 for 2021, and $2,425,272 in 2022.

For the record, they were publicly posted in the Announcements from the Professor and Terry 3 Discussion Boards earlier this week.

please help me to check if all the works i's correct. thank you very much

please help me to check if all the works i's correct. thank you very much

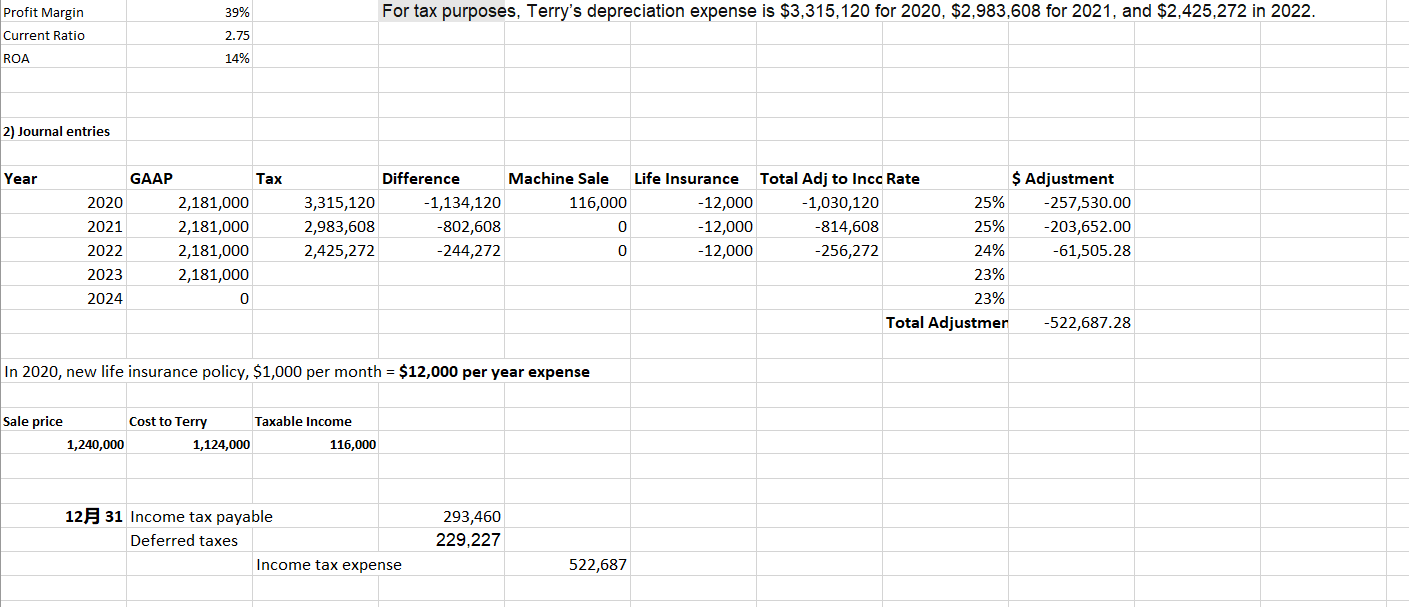

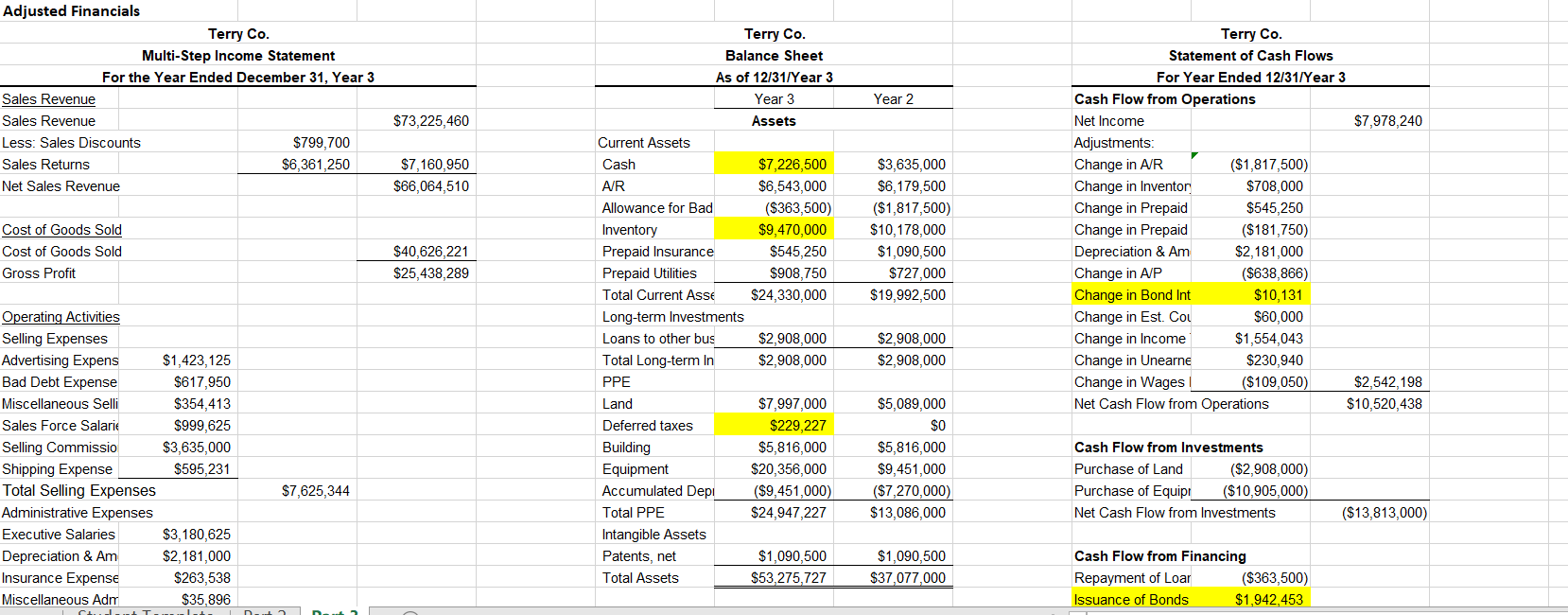

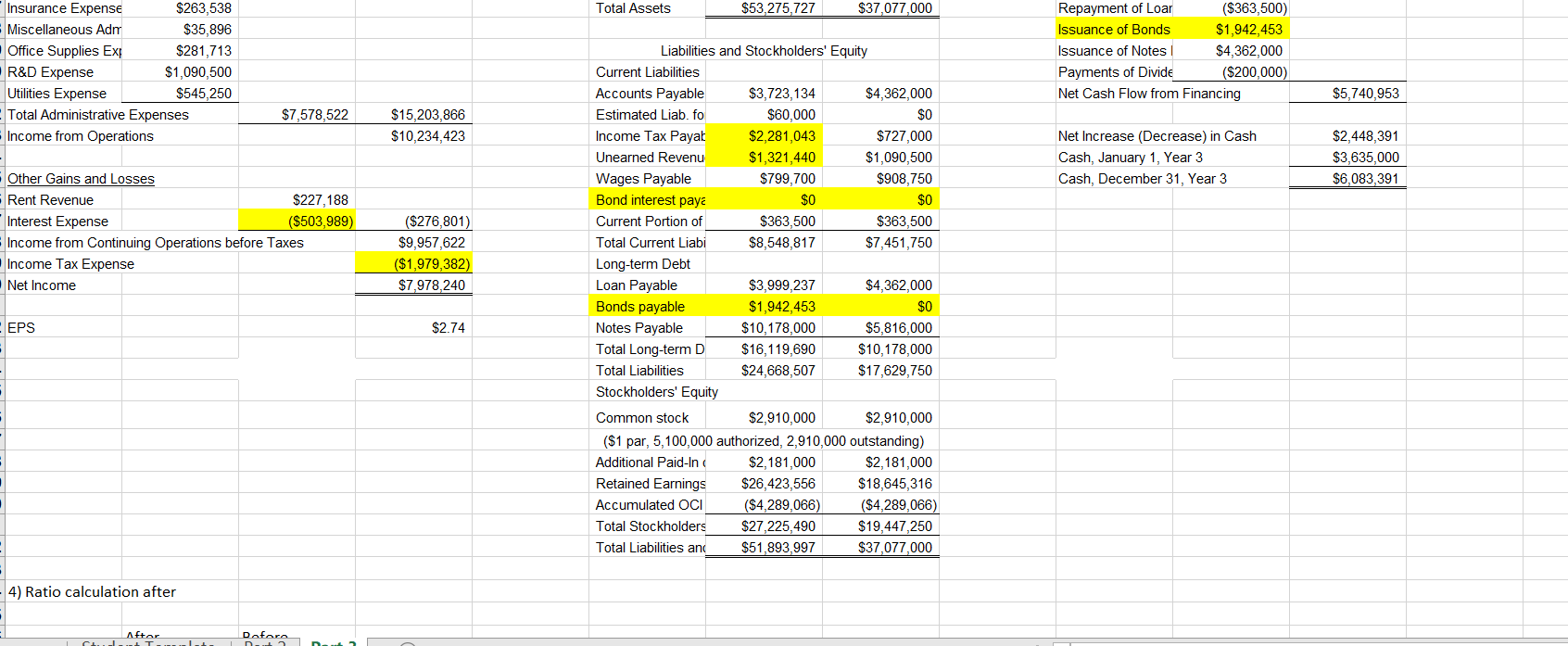

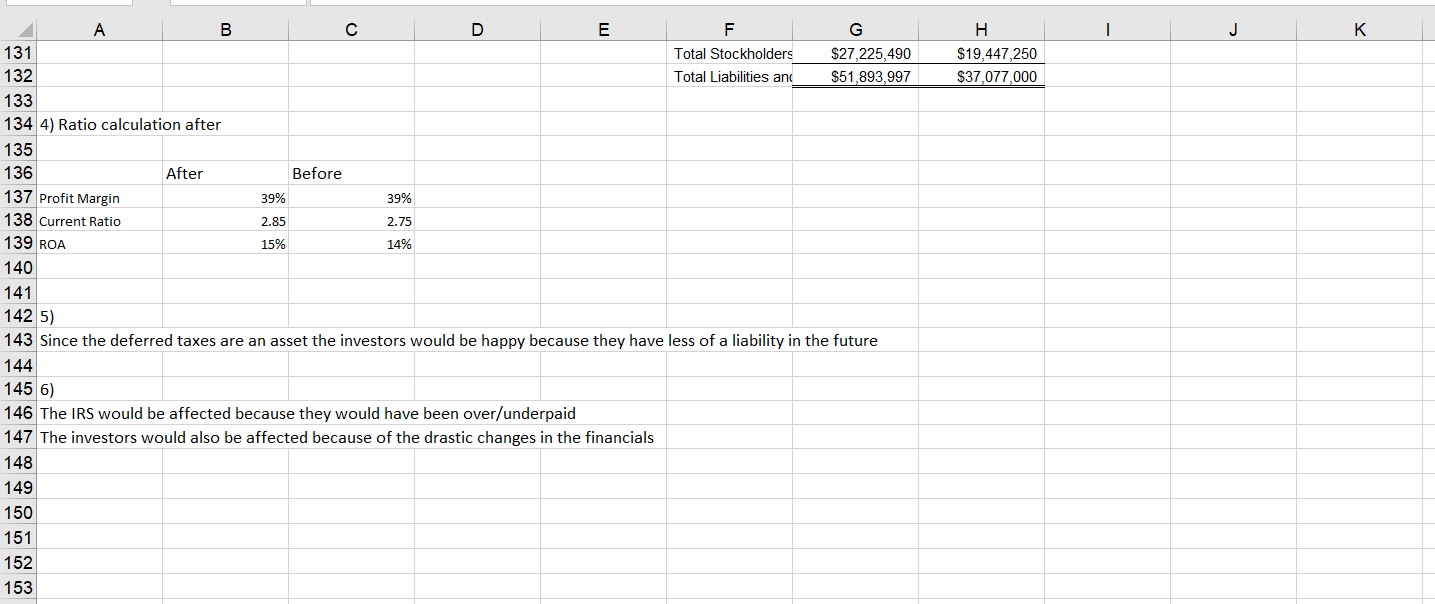

Adjusted Financials from Part 2 Terry Co. Balance Sheet As of 12/31/Year 3 Year 3 Year 2 $73,225,460 Assets Current Assets Cash $7,160,950 $66,064,510 $7,226,500 $6,543,000 ($363,500) $9,470,000 $545,250 $908,750 $24,330,000 $3,635,000 $6,179,500 ($1,817,500) $10,178,000 $1,090,500 $727,000 $19,992,500 1 Terry Co. 2 Multi-Step Income Statement 3 For the Year Ended December 31, Year 3 4 Sales Revenue 5 Sales Revenue 6 Less: Sales Discounts $799,700 7 Sales Returns $6,361,250 8 Net Sales Revenue 9 10 Cost of Goods Sold 11 Cost of Goods Sold 12 Gross Profit 13 14 Operating Activities 15 Selling Expenses 16 Advertising Expens $1,423,125 17 Bad Debt Expense $617,950 18 Miscellaneous Selli $354,413 19 Sales Force Salarie $999,625 20 Selling Commissio $3,635,000 21 Shipping Expense $595,231 22 Total Selling Expenses $7,625,344 23 Administrative Expenses 24 Executive Salaries $3,180,625 25 Depreciation & Am $2,181,000 26 Insurance Expense $263,538 27 Miscellaneous Adm $35,896 28 Office Supplies Exp $281.713 29 Ben Evnence 01 nan 500 $40,626,221 $25,438,289 Terry Co. Statement of Cash Flows For Year Ended 12/31/Year 3 Cash Flow from Operations Net Income $7,455,552 Adjustments: Change in AIR ($1,817,500) Change in Inventor $708,000 Change in Prepaid $545,250 Change in Prepaid ($181,750) Depreciation & Am $2,181,000 Change in A/P ($638,866) Change in Bond Int $10,131 Change in Est. Cou $60,000 Change in Income $1,847,504 Change in Unearne $230,940 Change in Wages ($109,050) $2,835,659 Net Cash Flow from Operations $10,291,211 A/R Allowance for Bad Inventory Prepaid Insurance Prepaid Utilities Total Current Asse Long-term Investments Loans to other bus Total Long-term In PPE Land Building Equipment Accumulated Depi Total PPE Intangible Assets Patents, net Total Assets $2,908,000 $2,908,000 $2,908,000 $2,908,000 $7,997,000 $5,816,000 $20,356,000 ($9,451,000) $24,718,000 $5,089,000 $5,816,000 $9,451,000 ($7,270,000) $13,086,000 Cash Flow from Investments Purchase of Land ($2,908,000) Purchase of Equip ($10,905,000) Net Cash Flow from Investments ($13,813,000) $1,090,500 $53,046,500 $1,090,500 $37,077,000 Liabilities and Stockholders' Equity Current Liabilities Account Pavabla 02 722 121 $4262 non Cash Flow from Financing Repayment of Loar ($363,500) Issuance of Bonds $1,942,453 Issuance of Notes $4,362,000 Pavmonte of Divide 1$200.000 Office Supplies Ex $281,713 R&D Expense $1,090,500 Utilities Expense $545,250 Total Administrative Expenses Income from Operations Issuance of Notes $4,362,000 Payments of Divide ($200,000) Net Cash Flow from Financing $5,740,953 $7,578,522 $15,203,866 $10,234,423 Net Increase (Decrease) in Cash Cash, January 1, Year 3 Cash, December 31, Year 3 $2,219,164 $3,635,000 $5.854,164 Other Gains and Losses Rent Revenue $227,188 Interest Expense ($503,989) Income from Continuing Operations before Taxes Income Tax Expense Net Income ($276,801) $9,957,622 ($2,502,070) $7,455,552 Current Liabilities Accounts Payable $3,723,134 $4,362,000 Estimated Liab. fo $60,000 $0 Income Tax Payat $2,574,504 $727,000 Unearned Revenu $1,321,440 $1,090,500 Wages Payable $799,700 $908,750 Bond interest paya $0 $0 Current Portion of $363,500 $363,500 Total Current Liabi $8,842,278 $7,451,750 Long-term Debt Loan Payable $3,999,237 $4,362,000 Bonds payable $1,942,453 $0 Notes Payable $10,178,000 $5,816,000 Total Long-term D $16,119,690 $10,178,000 Total Liabilities $24,961,968 $17,629,750 Stockholders' Equity Common stock $2,910,000 $2,910,000 ($1 par, 5,100,000 authorized, 2,910,000 outstanding) Additional Paid-In $2,181,000 $2,181,000 Retained Earnings $25,900,868 $18,645,316 Accumulated OCI ($4,289,066) ($4,289,066) Total Stockholders $26,702,802 $19,447,250 Total Liabilities and $51,664,770 $37,077,000 EPS $2.56 1) Calculate ratios before Under GAAP, Terry's straight line depreciation & amortization was calculated to be $2,181,000 for 2020-2023 and $0 in 2024. For tax purposes, Terry's depreciation expense is $3,315,120 for 2020, $2,983,608 for 2021, and $2,425,272 in 2022. Profit Margin Current Ratio 39% 2.75 140/ DON 39% For tax purposes, Terry's depreciation expense is $3,315,120 for 2020, $2,983,608 for 2021, and $2,425,272 in 2022. Profit Margin Current Ratio ROA 2.75 14% 2) Journal entries Year GAAP Tax 2020 2,181,000 2021 2,181,000 2022 2,181,000 2023 2,181,000 2024 0 Difference Machine Sale Life Insurance Total Adj to Incc Rate $ Adjustment 3,315,120 -1,134,120 116,000 -12,000 -1,030,120 25% -257,530.00 2,983,608 -802,608 0 -12,000 -814,608 25% -203,652.00 2,425,272 -244,272 0 -12,000 -256,272 24% -61,505.28 23% 23% Total Adjustmer -522,687.28 In 2020, new life insurance policy, $1,000 per month = $12,000 per year expense Sale price Cost to Terry Taxable income 1,240,000 1,124,000 116,000 12.31 Income tax payable Deferred taxes Income tax expense 293,460 229,227 522,687 Adjusted Financials Terry Co. Multi-Step Income Statement For the Year Ended December 31, Year 3 Sales Revenue Sales Revenue Less: Sales Discounts $799,700 Sales Returns $6,361,250 Net Sales Revenue Year 2 $73,225,460 $7,160,950 $66,064,510 $3,635,000 $6,179,500 ($1,817,500) $10,178,000 $1,090,500 $727,000 $19,992,500 Cost of Goods Sold Cost of Goods Sold Gross Profit Terry Co. Statement of Cash Flows For Year Ended 12/31/Year 3 Cash Flow from Operations Net Income $7,978,240 Adjustments: Change in A/R ($1,817,500) Change in Inventor $708,000 Change in Prepaid $545,250 Change in Prepaid ($181,750) Depreciation & Am $2,181,000 Change in A/P ($638,866) Change in Bond Int $10,131 Change in Est. Cou $60,000 Change in Income $1,554,043 Change in Unearne $230,940 Change in Wages ($109,050) $2,542,198 Net Cash Flow from Operations $10,520,438 $40,626,221 $25,438,289 Terry Co. Balance Sheet As of 12/31/Year 3 Year 3 Assets Current Assets Cash $7,226,500 A/R $6,543,000 Allowance for Bad ($363,500) Inventory $9,470,000 Prepaid Insurance $545,250 Prepaid Utilities $908,750 Total Current Asse $24,330,000 Long-term Investments Loans to other bus $2,908,000 Total Long-term In $2,908,000 PPE Land $7,997,000 Deferred taxes $229,227 Building $5,816,000 Equipment $20,356,000 Accumulated Depi ($9,451,000) Total PPE $24,947,227 Intangible Assets Patents, net $1,090,500 Total Assets $53,275,727 Operating Activities Selling Expenses Advertising Expens $1,423,125 Bad Debt Expense $617,950 Miscellaneous Selli $354,413 Sales Force Salarie $999,625 Selling Commissio $3,635,000 Shipping Expense $595,231 Total Selling Expenses Administrative Expenses Executive Salaries $3,180,625 Depreciation & Am $2,181,000 Insurance Expense $263,538 Miscellaneous Ador $35,896 $2,908,000 $2,908,000 $5,089,000 $0 $5,816,000 $9,451,000 ($7,270,000) $13,086,000 Cash Flow from Investments Purchase of Land ($2,908,000) Purchase of Equip ($10,905,000) Net Cash Flow from Investments $7,625,344 ($13,813,000) $1,090,500 $37,077,000 Cash Flow from Financing Repayment of Loar ($363,500) Issuance of Bonds $1,942,453 Total Assets $53,275,727 $37,077,000 Insurance Expense $263,538 Miscellaneous Ador $35,896 Office Supplies Ex! $281,713 R&D Expense $1,090,500 Utilities Expense $545,250 Total Administrative Expenses Income from Operations Repayment of Loar ($363,500) Issuance of Bonds $1,942,453 Issuance of Notes $4,362,000 Payments of Divide ($200,000) Net Cash Flow from Financing $5,740,953 $7,578,522 $15,203.866 $10,234,423 Net Increase (Decrease) in Cash Cash, January 1, Year 3 Cash, December 31, Year 3 $2,448,391 $3,635,000 $6,083,391 Other Gains and Losses Rent Revenue $227,188 Interest Expense ($503,989) Income from Continuing Operations before Taxes Income Tax Expense Net Income ($276,801) $9,957.622 ($1,979,382) $7,978,240 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable $3,723,134 $4,362,000 Estimated Liab, fo $60,000 SO Income Tax Payat $2,281,043 $727,000 Unearned Revenu $1,321,440 $1,090,500 Wages Payable $799,700 $908,750 Bond interest paya $0 $0 Current Portion of $363,500 $363,500 Total Current Liabi $8,548,817 $7,451,750 Long-term Debt Loan Payable $3,999,237 $4,362,000 Bonds payable $1,942,453 $0 Notes Payable $10,178,000 $5,816,000 Total Long-term D $16,119,690 $10,178,000 Total Liabilities $24,668,507 $17,629,750 Stockholders' Equity Common stock $2.910,000 $2,910,000 ($1 par, 5,100,000 authorized, 2,910,000 outstanding) Additional Paid-In $2,181,000 $2,181,000 Retained Earnings $26,423,556 $18,645,316 Accumulated OCI ($4,289,066) ($4,289,066) Total Stockholders $27,225,490 $19,447,250 Total Liabilities and $51,893,997 $37,077,000 EPS $2.74 4) Ratio calculation after Aftar Doforo | J K H $19,447,250 $37,077,000 B E F. G 131 Total Stockholders $27,225,490 132 Total Liabilities and $51,893,997 133 134 4) Ratio calculation after 135 136 After Before 137 Profit Margin 39% 39% 138 Current Ratio 2.85 2.75 139 ROA 15% 14% 140 141 1425) 143 Since the deferred taxes are an asset the investors would be happy because they have less of a liability in the future 144 145 6) 146 The IRS would be affected because they would have been over/underpaid 147 The investors would also be affected because of the drastic changes in the financials 148 149 150 151 152 153 Adjusted Financials from Part 2 Terry Co. Balance Sheet As of 12/31/Year 3 Year 3 Year 2 $73,225,460 Assets Current Assets Cash $7,160,950 $66,064,510 $7,226,500 $6,543,000 ($363,500) $9,470,000 $545,250 $908,750 $24,330,000 $3,635,000 $6,179,500 ($1,817,500) $10,178,000 $1,090,500 $727,000 $19,992,500 1 Terry Co. 2 Multi-Step Income Statement 3 For the Year Ended December 31, Year 3 4 Sales Revenue 5 Sales Revenue 6 Less: Sales Discounts $799,700 7 Sales Returns $6,361,250 8 Net Sales Revenue 9 10 Cost of Goods Sold 11 Cost of Goods Sold 12 Gross Profit 13 14 Operating Activities 15 Selling Expenses 16 Advertising Expens $1,423,125 17 Bad Debt Expense $617,950 18 Miscellaneous Selli $354,413 19 Sales Force Salarie $999,625 20 Selling Commissio $3,635,000 21 Shipping Expense $595,231 22 Total Selling Expenses $7,625,344 23 Administrative Expenses 24 Executive Salaries $3,180,625 25 Depreciation & Am $2,181,000 26 Insurance Expense $263,538 27 Miscellaneous Adm $35,896 28 Office Supplies Exp $281.713 29 Ben Evnence 01 nan 500 $40,626,221 $25,438,289 Terry Co. Statement of Cash Flows For Year Ended 12/31/Year 3 Cash Flow from Operations Net Income $7,455,552 Adjustments: Change in AIR ($1,817,500) Change in Inventor $708,000 Change in Prepaid $545,250 Change in Prepaid ($181,750) Depreciation & Am $2,181,000 Change in A/P ($638,866) Change in Bond Int $10,131 Change in Est. Cou $60,000 Change in Income $1,847,504 Change in Unearne $230,940 Change in Wages ($109,050) $2,835,659 Net Cash Flow from Operations $10,291,211 A/R Allowance for Bad Inventory Prepaid Insurance Prepaid Utilities Total Current Asse Long-term Investments Loans to other bus Total Long-term In PPE Land Building Equipment Accumulated Depi Total PPE Intangible Assets Patents, net Total Assets $2,908,000 $2,908,000 $2,908,000 $2,908,000 $7,997,000 $5,816,000 $20,356,000 ($9,451,000) $24,718,000 $5,089,000 $5,816,000 $9,451,000 ($7,270,000) $13,086,000 Cash Flow from Investments Purchase of Land ($2,908,000) Purchase of Equip ($10,905,000) Net Cash Flow from Investments ($13,813,000) $1,090,500 $53,046,500 $1,090,500 $37,077,000 Liabilities and Stockholders' Equity Current Liabilities Account Pavabla 02 722 121 $4262 non Cash Flow from Financing Repayment of Loar ($363,500) Issuance of Bonds $1,942,453 Issuance of Notes $4,362,000 Pavmonte of Divide 1$200.000 Office Supplies Ex $281,713 R&D Expense $1,090,500 Utilities Expense $545,250 Total Administrative Expenses Income from Operations Issuance of Notes $4,362,000 Payments of Divide ($200,000) Net Cash Flow from Financing $5,740,953 $7,578,522 $15,203,866 $10,234,423 Net Increase (Decrease) in Cash Cash, January 1, Year 3 Cash, December 31, Year 3 $2,219,164 $3,635,000 $5.854,164 Other Gains and Losses Rent Revenue $227,188 Interest Expense ($503,989) Income from Continuing Operations before Taxes Income Tax Expense Net Income ($276,801) $9,957,622 ($2,502,070) $7,455,552 Current Liabilities Accounts Payable $3,723,134 $4,362,000 Estimated Liab. fo $60,000 $0 Income Tax Payat $2,574,504 $727,000 Unearned Revenu $1,321,440 $1,090,500 Wages Payable $799,700 $908,750 Bond interest paya $0 $0 Current Portion of $363,500 $363,500 Total Current Liabi $8,842,278 $7,451,750 Long-term Debt Loan Payable $3,999,237 $4,362,000 Bonds payable $1,942,453 $0 Notes Payable $10,178,000 $5,816,000 Total Long-term D $16,119,690 $10,178,000 Total Liabilities $24,961,968 $17,629,750 Stockholders' Equity Common stock $2,910,000 $2,910,000 ($1 par, 5,100,000 authorized, 2,910,000 outstanding) Additional Paid-In $2,181,000 $2,181,000 Retained Earnings $25,900,868 $18,645,316 Accumulated OCI ($4,289,066) ($4,289,066) Total Stockholders $26,702,802 $19,447,250 Total Liabilities and $51,664,770 $37,077,000 EPS $2.56 1) Calculate ratios before Under GAAP, Terry's straight line depreciation & amortization was calculated to be $2,181,000 for 2020-2023 and $0 in 2024. For tax purposes, Terry's depreciation expense is $3,315,120 for 2020, $2,983,608 for 2021, and $2,425,272 in 2022. Profit Margin Current Ratio 39% 2.75 140/ DON 39% For tax purposes, Terry's depreciation expense is $3,315,120 for 2020, $2,983,608 for 2021, and $2,425,272 in 2022. Profit Margin Current Ratio ROA 2.75 14% 2) Journal entries Year GAAP Tax 2020 2,181,000 2021 2,181,000 2022 2,181,000 2023 2,181,000 2024 0 Difference Machine Sale Life Insurance Total Adj to Incc Rate $ Adjustment 3,315,120 -1,134,120 116,000 -12,000 -1,030,120 25% -257,530.00 2,983,608 -802,608 0 -12,000 -814,608 25% -203,652.00 2,425,272 -244,272 0 -12,000 -256,272 24% -61,505.28 23% 23% Total Adjustmer -522,687.28 In 2020, new life insurance policy, $1,000 per month = $12,000 per year expense Sale price Cost to Terry Taxable income 1,240,000 1,124,000 116,000 12.31 Income tax payable Deferred taxes Income tax expense 293,460 229,227 522,687 Adjusted Financials Terry Co. Multi-Step Income Statement For the Year Ended December 31, Year 3 Sales Revenue Sales Revenue Less: Sales Discounts $799,700 Sales Returns $6,361,250 Net Sales Revenue Year 2 $73,225,460 $7,160,950 $66,064,510 $3,635,000 $6,179,500 ($1,817,500) $10,178,000 $1,090,500 $727,000 $19,992,500 Cost of Goods Sold Cost of Goods Sold Gross Profit Terry Co. Statement of Cash Flows For Year Ended 12/31/Year 3 Cash Flow from Operations Net Income $7,978,240 Adjustments: Change in A/R ($1,817,500) Change in Inventor $708,000 Change in Prepaid $545,250 Change in Prepaid ($181,750) Depreciation & Am $2,181,000 Change in A/P ($638,866) Change in Bond Int $10,131 Change in Est. Cou $60,000 Change in Income $1,554,043 Change in Unearne $230,940 Change in Wages ($109,050) $2,542,198 Net Cash Flow from Operations $10,520,438 $40,626,221 $25,438,289 Terry Co. Balance Sheet As of 12/31/Year 3 Year 3 Assets Current Assets Cash $7,226,500 A/R $6,543,000 Allowance for Bad ($363,500) Inventory $9,470,000 Prepaid Insurance $545,250 Prepaid Utilities $908,750 Total Current Asse $24,330,000 Long-term Investments Loans to other bus $2,908,000 Total Long-term In $2,908,000 PPE Land $7,997,000 Deferred taxes $229,227 Building $5,816,000 Equipment $20,356,000 Accumulated Depi ($9,451,000) Total PPE $24,947,227 Intangible Assets Patents, net $1,090,500 Total Assets $53,275,727 Operating Activities Selling Expenses Advertising Expens $1,423,125 Bad Debt Expense $617,950 Miscellaneous Selli $354,413 Sales Force Salarie $999,625 Selling Commissio $3,635,000 Shipping Expense $595,231 Total Selling Expenses Administrative Expenses Executive Salaries $3,180,625 Depreciation & Am $2,181,000 Insurance Expense $263,538 Miscellaneous Ador $35,896 $2,908,000 $2,908,000 $5,089,000 $0 $5,816,000 $9,451,000 ($7,270,000) $13,086,000 Cash Flow from Investments Purchase of Land ($2,908,000) Purchase of Equip ($10,905,000) Net Cash Flow from Investments $7,625,344 ($13,813,000) $1,090,500 $37,077,000 Cash Flow from Financing Repayment of Loar ($363,500) Issuance of Bonds $1,942,453 Total Assets $53,275,727 $37,077,000 Insurance Expense $263,538 Miscellaneous Ador $35,896 Office Supplies Ex! $281,713 R&D Expense $1,090,500 Utilities Expense $545,250 Total Administrative Expenses Income from Operations Repayment of Loar ($363,500) Issuance of Bonds $1,942,453 Issuance of Notes $4,362,000 Payments of Divide ($200,000) Net Cash Flow from Financing $5,740,953 $7,578,522 $15,203.866 $10,234,423 Net Increase (Decrease) in Cash Cash, January 1, Year 3 Cash, December 31, Year 3 $2,448,391 $3,635,000 $6,083,391 Other Gains and Losses Rent Revenue $227,188 Interest Expense ($503,989) Income from Continuing Operations before Taxes Income Tax Expense Net Income ($276,801) $9,957.622 ($1,979,382) $7,978,240 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable $3,723,134 $4,362,000 Estimated Liab, fo $60,000 SO Income Tax Payat $2,281,043 $727,000 Unearned Revenu $1,321,440 $1,090,500 Wages Payable $799,700 $908,750 Bond interest paya $0 $0 Current Portion of $363,500 $363,500 Total Current Liabi $8,548,817 $7,451,750 Long-term Debt Loan Payable $3,999,237 $4,362,000 Bonds payable $1,942,453 $0 Notes Payable $10,178,000 $5,816,000 Total Long-term D $16,119,690 $10,178,000 Total Liabilities $24,668,507 $17,629,750 Stockholders' Equity Common stock $2.910,000 $2,910,000 ($1 par, 5,100,000 authorized, 2,910,000 outstanding) Additional Paid-In $2,181,000 $2,181,000 Retained Earnings $26,423,556 $18,645,316 Accumulated OCI ($4,289,066) ($4,289,066) Total Stockholders $27,225,490 $19,447,250 Total Liabilities and $51,893,997 $37,077,000 EPS $2.74 4) Ratio calculation after Aftar Doforo | J K H $19,447,250 $37,077,000 B E F. G 131 Total Stockholders $27,225,490 132 Total Liabilities and $51,893,997 133 134 4) Ratio calculation after 135 136 After Before 137 Profit Margin 39% 39% 138 Current Ratio 2.85 2.75 139 ROA 15% 14% 140 141 1425) 143 Since the deferred taxes are an asset the investors would be happy because they have less of a liability in the future 144 145 6) 146 The IRS would be affected because they would have been over/underpaid 147 The investors would also be affected because of the drastic changes in the financials 148 149 150 151 152 153

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts