Question: LUCENT TECHNOLOGIES AT&T spun off its research and development division (the former Bell Laboratories) in April of 1996, and the newly independent company - renamed

LUCENT TECHNOLOGIES AT&T spun off its research and development division (the former Bell Laboratories) in April of 1996, and the newly independent company - renamed Lucent Technologies - was an instant hit

LUCENT TECHNOLOGIES AT&T spun off its research and development division (the former Bell Laboratories) in April of 1996, and the newly independent company - renamed Lucent Technologies - was an instant hit  with investors. The company's stock became the most widely held in the United States, and over the following 3 years and 9 months its price increased 892%.1 This remarkable price appreciation tracked a series of steadily increasing earnings that exceeded analyst expectations. Lucent, in fact, had beaten those expectations in each of its 15 quarters of operations (Zacks, 2000). Lucent Technologies manufactures, sells and services voice and data communications systems and software. By the end of its fiscal-year 1999, Lucent generated over thirty-eight billion dollars in annual revenues, employed over 150,000 people, and had offices in more than ninety countries worldwide. On October 26, 1999, Lucent issued a press release describing record earnings for both the quarter and the fiscal year ended September 30, 1999 (Lucent, 1999a). Lucent's revenues were up 23 percent, and earnings were up 50 percent from the fourth quarter of the previous year. For the fiscal year, Lucent's revenues and earnings were up 20 and 46 percent respectively. Lucent's chairman and CEO, Richard McGinn, described the results saying: "Lucent enters the new millennium with momentum. This was the strongest quarter and the strongest year in Lucent's history." The report of these record results was accompanied by another press release. This second announcement outlined a realignment of Lucent into "four core businesses." This realignment was, in the words of McGinn, "...intended to mirror the way we are approaching customers today - with converged network solutions. We are sharpening our focus on high-growth areas - such as data networking, optical networking, wireless semiconductors, e-business and professional services - while speeding our growth in international markets. And, we will also be aligning our management structure to increase productivity and accelerate our response to customer needs" (Lucent, 1999b). Over the ensuing days and weeks, Lucent's share price soared. Climbing steadily from $59 7/8 on October 25, 1999, it traded at prices over $82 during December 1999, and closed at $72 3/8 on January 5, 2000. On January 6, however, Lucent filed a Form 8-K with the U.S. Securities and Exchange Commission. Form 8-Ks are used to report "material events," and Lucent's "event" was that first quarter earnings for the quarter ended December 31, 1999 would be significantly below expectations. Lucent reported that its revenue from Service Provider Networks was down 2%. A result, company executives said, that was caused by the domino effect of unanticipated customer shifts to new optical systems and the manufacturing deployment and capacity problems that ensued. Indeed, analysts estimated that Lucent lost up to $1 billion in sales because of production delays, delivery problems and cancelled orders during the quarter (Dow Jones, 1/20/00). Although Richard McGinn, said the company expected its problems to be resolved by the end of the second quarter, and Lucent's Chief Financial Officer, Don Peterson described the shortfall as a "bump in the road," (Burns, 1/27/00) the response of investors was harsh. The company's stock price fell from $72 3/8 to $52. The decline in stock price erased, in a single day, more than $80 billion in market capitalization and a year's worth of gains. Furthermore, a number of class action lawsuits were filed on behalf of investors who had purchased Lucent's stock between October 27, 1999 and January 6, 2000 (PRNewswire, 1/20/00). The suits claimed that Lucent violated Sections 10(b) and 20(a) of the Securities Act of 1934 by issuing a series of materially false and misleading statements that failed to disclose the weaker-than-expected performance in a timely fashion.

with investors. The company's stock became the most widely held in the United States, and over the following 3 years and 9 months its price increased 892%.1 This remarkable price appreciation tracked a series of steadily increasing earnings that exceeded analyst expectations. Lucent, in fact, had beaten those expectations in each of its 15 quarters of operations (Zacks, 2000). Lucent Technologies manufactures, sells and services voice and data communications systems and software. By the end of its fiscal-year 1999, Lucent generated over thirty-eight billion dollars in annual revenues, employed over 150,000 people, and had offices in more than ninety countries worldwide. On October 26, 1999, Lucent issued a press release describing record earnings for both the quarter and the fiscal year ended September 30, 1999 (Lucent, 1999a). Lucent's revenues were up 23 percent, and earnings were up 50 percent from the fourth quarter of the previous year. For the fiscal year, Lucent's revenues and earnings were up 20 and 46 percent respectively. Lucent's chairman and CEO, Richard McGinn, described the results saying: "Lucent enters the new millennium with momentum. This was the strongest quarter and the strongest year in Lucent's history." The report of these record results was accompanied by another press release. This second announcement outlined a realignment of Lucent into "four core businesses." This realignment was, in the words of McGinn, "...intended to mirror the way we are approaching customers today - with converged network solutions. We are sharpening our focus on high-growth areas - such as data networking, optical networking, wireless semiconductors, e-business and professional services - while speeding our growth in international markets. And, we will also be aligning our management structure to increase productivity and accelerate our response to customer needs" (Lucent, 1999b). Over the ensuing days and weeks, Lucent's share price soared. Climbing steadily from $59 7/8 on October 25, 1999, it traded at prices over $82 during December 1999, and closed at $72 3/8 on January 5, 2000. On January 6, however, Lucent filed a Form 8-K with the U.S. Securities and Exchange Commission. Form 8-Ks are used to report "material events," and Lucent's "event" was that first quarter earnings for the quarter ended December 31, 1999 would be significantly below expectations. Lucent reported that its revenue from Service Provider Networks was down 2%. A result, company executives said, that was caused by the domino effect of unanticipated customer shifts to new optical systems and the manufacturing deployment and capacity problems that ensued. Indeed, analysts estimated that Lucent lost up to $1 billion in sales because of production delays, delivery problems and cancelled orders during the quarter (Dow Jones, 1/20/00). Although Richard McGinn, said the company expected its problems to be resolved by the end of the second quarter, and Lucent's Chief Financial Officer, Don Peterson described the shortfall as a "bump in the road," (Burns, 1/27/00) the response of investors was harsh. The company's stock price fell from $72 3/8 to $52. The decline in stock price erased, in a single day, more than $80 billion in market capitalization and a year's worth of gains. Furthermore, a number of class action lawsuits were filed on behalf of investors who had purchased Lucent's stock between October 27, 1999 and January 6, 2000 (PRNewswire, 1/20/00). The suits claimed that Lucent violated Sections 10(b) and 20(a) of the Securities Act of 1934 by issuing a series of materially false and misleading statements that failed to disclose the weaker-than-expected performance in a timely fashion.

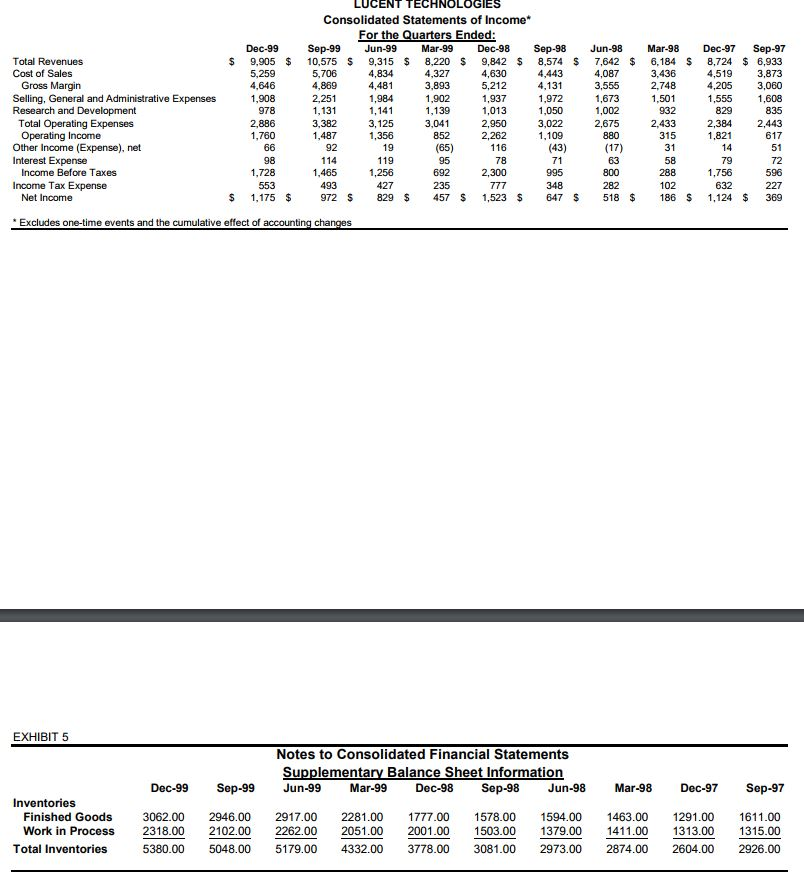

Notes to Consolidated Financial Statements Supplementary Balance Sheet Information

Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97

Inventories Finished Goods 3062.00 2946.00 2917.00 2281.00 1777.00 1578.00 1594.00 1463.00 1291.00 1611.00

Work in Process 2318.00 2102.00 2262.00 2051.00 2001.00 1503.00 1379.00 1411.00 1313.00 1315.00

Total Inventories 5380.00 5048.00 5179.00 4332.00 3778.00 3081.00 2973.00 2874.00 2604.00 2926.00

QUESTIONS

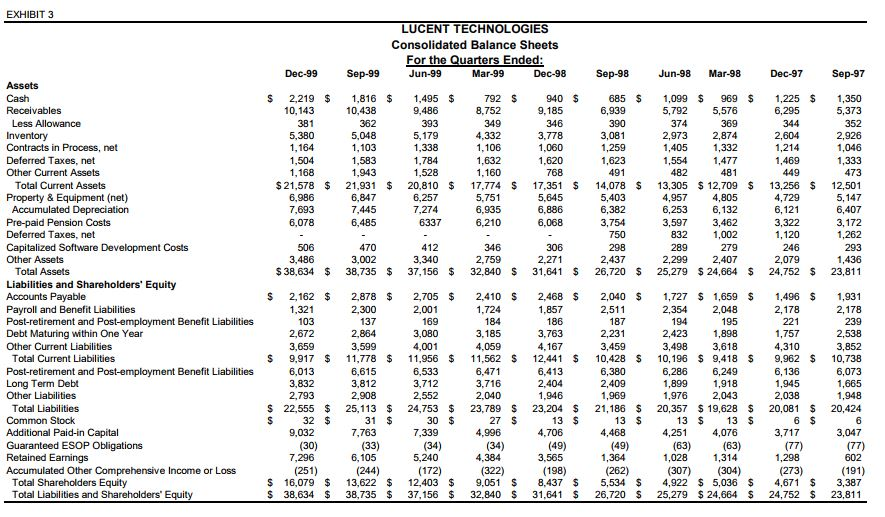

1. Conduct a DuPont decomposition of Lucent's ROE for each quarter of 1998, 1999 and 2000 (December 1999 is fiscal year 2000s first quarter). What factors contributed to the differences in Lucent's performance between those quarters?

2. Evaluate the seasonally adjusted change (i.e., quarter i in year t to quarter i in year t-1) in Lucent's: Sales, Accounts Receivable, Inventory and Gross Margin for the five quarterly periods: December 1998 through December 1999. Be sure to include an evaluation of the Footnote disclosures regarding Lucent's inventories in your examination. Does the explanation for the earnings shortfall provided by Lucent's managers make sense in light of your analysis?

3. Based on your analysis:

a) When might you have determined that Lucent would be unable to maintain its streak of record earnings?

b) Do you think the class-action lawsuits have merit?

c) Would you expect Lucent's earnings to 'recover' by the second quarter of 2000? d) What obstacles are there to Lucents recovery?

LUCENT TECHNOLOGIES Consolidated Statements of Income For the Quarters Ended Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 $ 9,905 $10,575 S 9,315 $ 8,220 9,842 8,574 7,642 $ 6,184 8,724 $6,933 4,519 3,873 4,205 3,060 1,608 Total Revenues Cost of Sales 5,706 4,869 2,251 1,131 3,382 1,487 4,443 4,131 1,972 1,050 3,022 4,834 4,481 1,984 4,327 3,893 1,902 4,630 5,212 1,937 3,436 2,748 4,087 4,646 Gross Margin Selling, General and Administrative Expenses Research and Development 1,673 1,002 Total Operating Expenses 2,886 3,041 2,433 2,384 2,443 3,125 1,356 2,950 1,821 (65) Other Income (Expense), net Interest Expense Income Before Taxes 1,728 Income Tax Expense Net Income S 1,175 $ 972 $ 829 457 1,523 $ 647 518 $ 186 S 1,124 $ 369 Excludes one-time events and the cumulative effect of accounting cha EXHIBIT 5 Notes to Consolidated Financial Statements Supplementary Balance Sheet Information Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97Sep-97 Inventories Finished Good Work in Process Total Inventories s 3062.00 2946.00 2917.00 2281.00 1777.00 1578.00 1594.00 1463.00 1291.00 1611.00 2318.00 2102.00 2262.00 2051.00 2001.00 1503.00 1379.001411.00 1313.00 1315.00 5380.00 5048.00 5179.004332.00 3778.00 3081.00 2973.00 2874.00 2604.00 2926.00 2 LUCENT TECHNOLOGIES Consolidated Statements of Income For the Quarters Ended Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97 Sep-97 $ 9,905 $10,575 S 9,315 $ 8,220 9,842 8,574 7,642 $ 6,184 8,724 $6,933 4,519 3,873 4,205 3,060 1,608 Total Revenues Cost of Sales 5,706 4,869 2,251 1,131 3,382 1,487 4,443 4,131 1,972 1,050 3,022 4,834 4,481 1,984 4,327 3,893 1,902 4,630 5,212 1,937 3,436 2,748 4,087 4,646 Gross Margin Selling, General and Administrative Expenses Research and Development 1,673 1,002 Total Operating Expenses 2,886 3,041 2,433 2,384 2,443 3,125 1,356 2,950 1,821 (65) Other Income (Expense), net Interest Expense Income Before Taxes 1,728 Income Tax Expense Net Income S 1,175 $ 972 $ 829 457 1,523 $ 647 518 $ 186 S 1,124 $ 369 Excludes one-time events and the cumulative effect of accounting cha EXHIBIT 5 Notes to Consolidated Financial Statements Supplementary Balance Sheet Information Dec-99 Sep-99 Jun-99 Mar-99 Dec-98 Sep-98 Jun-98 Mar-98 Dec-97Sep-97 Inventories Finished Good Work in Process Total Inventories s 3062.00 2946.00 2917.00 2281.00 1777.00 1578.00 1594.00 1463.00 1291.00 1611.00 2318.00 2102.00 2262.00 2051.00 2001.00 1503.00 1379.001411.00 1313.00 1315.00 5380.00 5048.00 5179.004332.00 3778.00 3081.00 2973.00 2874.00 2604.00 2926.00 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts