Question: Lummer plc has a current and target leverage ratio of 0.8 (debt/total assets), the cost of equity of 20 per cent and the long-

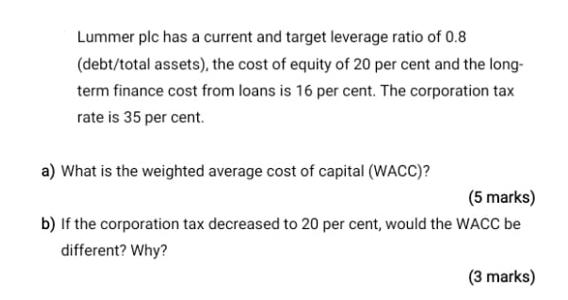

Lummer plc has a current and target leverage ratio of 0.8 (debt/total assets), the cost of equity of 20 per cent and the long- term finance cost from loans is 16 per cent. The corporation tax rate is 35 per cent. a) What is the weighted average cost of capital (WACC)? (5 marks) b) If the corporation tax decreased to 20 per cent, would the WACC be different? Why? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

I Step 1 a The Weighted Average Cost of Capital WACC is the average co... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock