Question: Luul ings Review View Table DUSI! EE 31 1 Ceder AalbCode Abcd AaBbcd ABCDE AaBb No Spacing Heading 1 Heading 2 QUESTION 3 a) MumCare

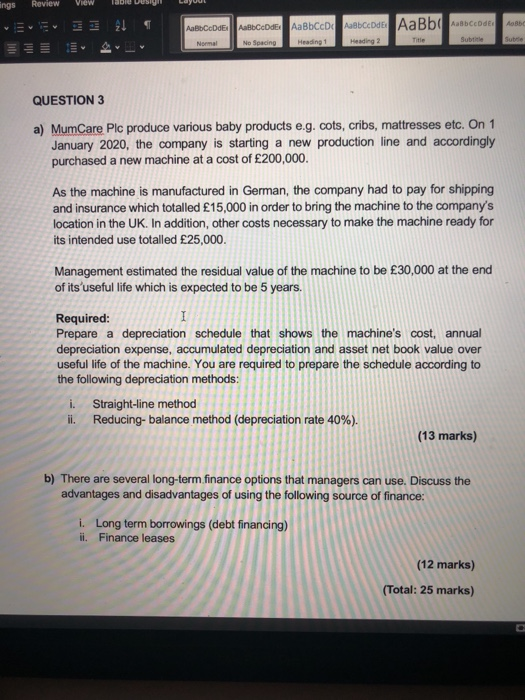

Luul ings Review View Table DUSI! EE 31 1 Ceder AalbCode Abcd AaBbcd ABCDE AaBb No Spacing Heading 1 Heading 2 QUESTION 3 a) MumCare Plc produce various baby products e.g. cots, cribs, mattresses etc. On 1 January 2020, the company is starting a new production line and accordingly purchased a new machine at a cost of 200,000 As the machine is manufactured in German, the company had to pay for shipping and insurance which totalled 15,000 in order to bring the machine to the company's location in the UK. In addition, other costs necessary to make the machine ready for its intended use totalled 25,000. Management estimated the residual value of the machine to be 30,000 at the end of its useful life which is expected to be 5 years. Required: Prepare a depreciation schedule that shows the machine's cost, annual depreciation expense, accumulated depreciation and asset net book value over useful life of the machine. You are required to prepare the schedule according to the following depreciation methods: i. Straight-line method ii. Reducing-balance method (depreciation rate 40%). (13 marks) b) There are several long-term finance options that managers can use. Discuss the advantages and disadvantages of using the following source of finance: i. Long term borrowings (debt financing) ii. Finance leases (12 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts