Question: LVIN Saved The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for

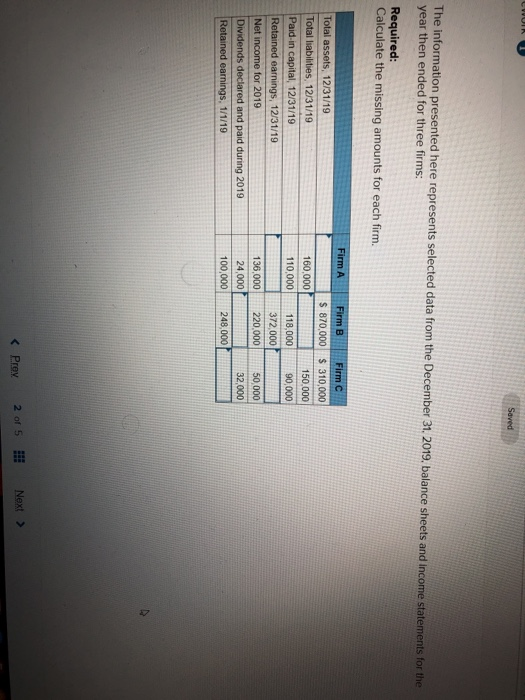

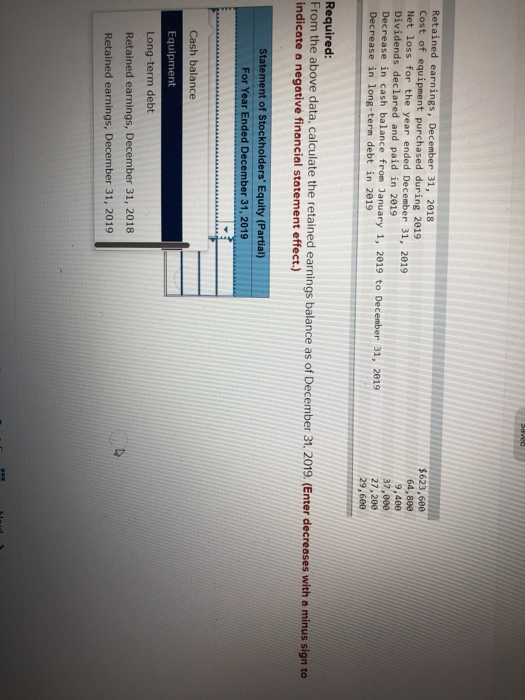

LVIN Saved The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms: Required: Calculate the missing amounts for each firm. Firm A 160,000 110,000 Total assets, 12/31/19 Total liabilities, 12/31/19 Paid in capital, 12/31/19 Retained earnings, 12/31/19 Net income for 2019 Dividends declared and paid during 2019 Retained earnings, 1/1/19 Firm B Firm $ 870,000 $ 310,000 150,000 118,000 90.000 372 000 220,000 50 000 32,000 248,000 136,000 24,000 100,000 saved Retained earnings, December 31, 2018 Cost of equipment purchased during 2019 Net loss for the year ended December 31, 2019 Dividends declared and paid in 2019 Decrease in cash balance from January 1, 2019 to December 31, 2019 Decrease in long-term debt in 2019 $623,600 64,800 9,400 37,000 27,200 29,600 Required: From the above data, calculate the retained earnings balance as of December 31, 2019. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Statement of Stockholders' Equity (Partial) For Year Ended December 31, 2019 Cash balance Equipment Long-term debt Retained earnings, December 31, 2018 Retained earnings, December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts