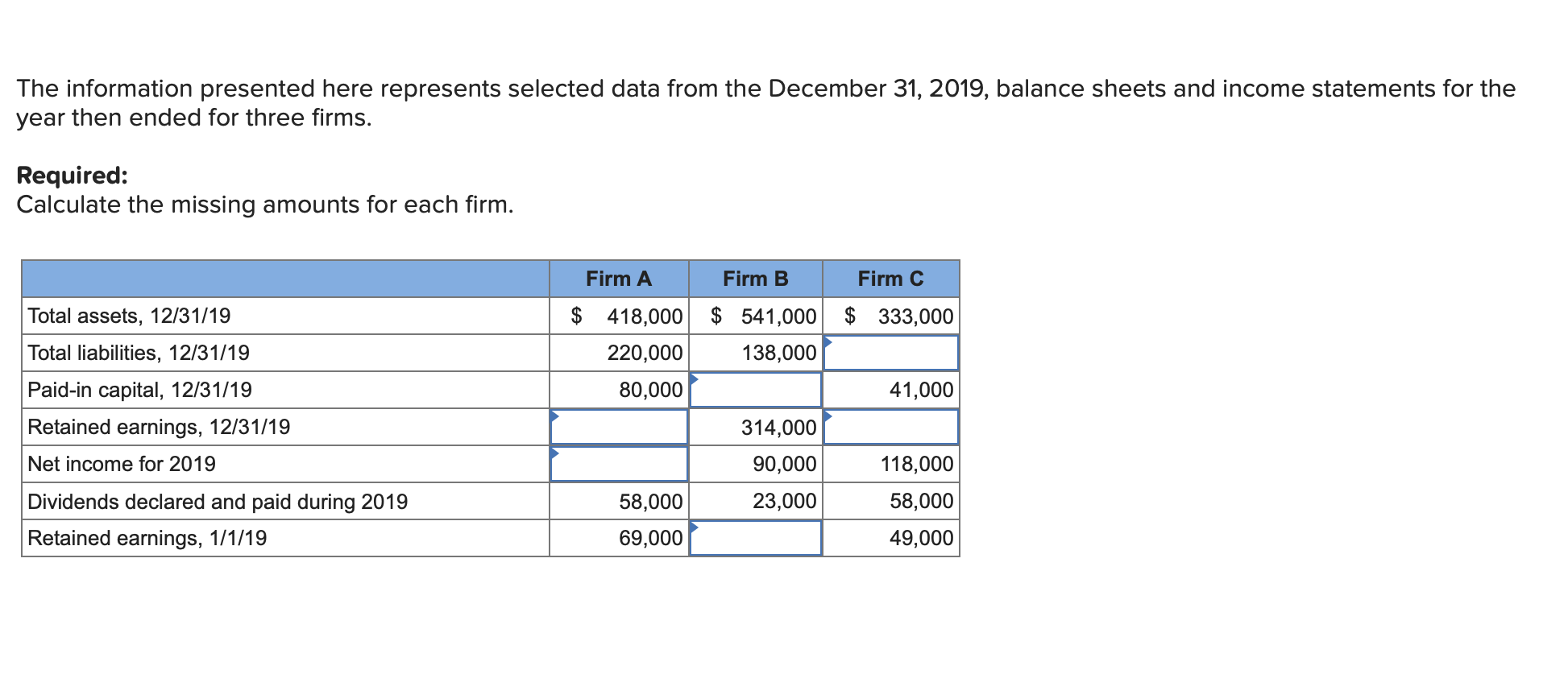

Question: The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms.

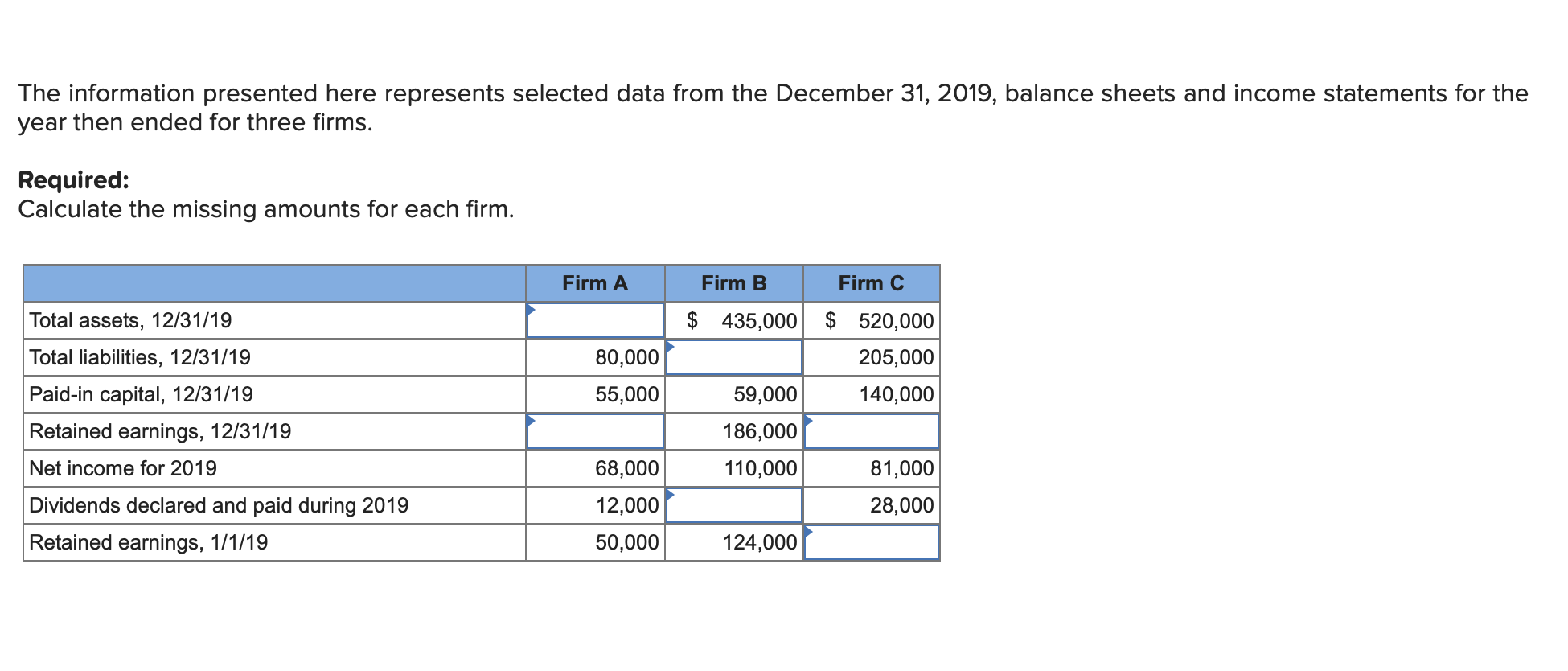

The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms. Required: Calculate the missing amounts for each firm. Firm A Firm B Firm C Total assets, 12/31/19 Total liabilities, 12/31/19 Paid-in capital, 12/31/19 Retained earnings, 12/31/19 Net income for 2019 $ 418,000 $ 541,000 $ 333,000 220,000 138,000 80,000 41,000 314,000 90,000 118,000 58,000 23,000 58,000 69,000 49,000 Dividends declared and paid during 2019 Retained earnings, 1/1/19 The information presented here represents selected data from the December 31, 2019, balance sheets and income statements for the year then ended for three firms. Required: Calculate the missing amounts for each firm. Firm A Firm B Firm C Total assets, 12/31/19 80,000 55,000 Total liabilities, 12/31/19 Paid-in capital, 12/31/19 Retained earnings, 12/31/19 Net income for 2019 Dividends declared and paid during 2019 Retained earnings, 1/1/19 $ 435,000 $ 520,000 205,000 59,000 140,000 186,000 110,000 81,000 28,000 124,000 68,000 12,000 50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts