Question: Ly Test 3 (Final) - Lyryx Learning Inc - Google Chrome lifa1.lyryx.com/quiz-servlets/QuizServlet?ccid=11209 Close dividends X Question 3 [15 points] Stake Technology Inc. recorded the following

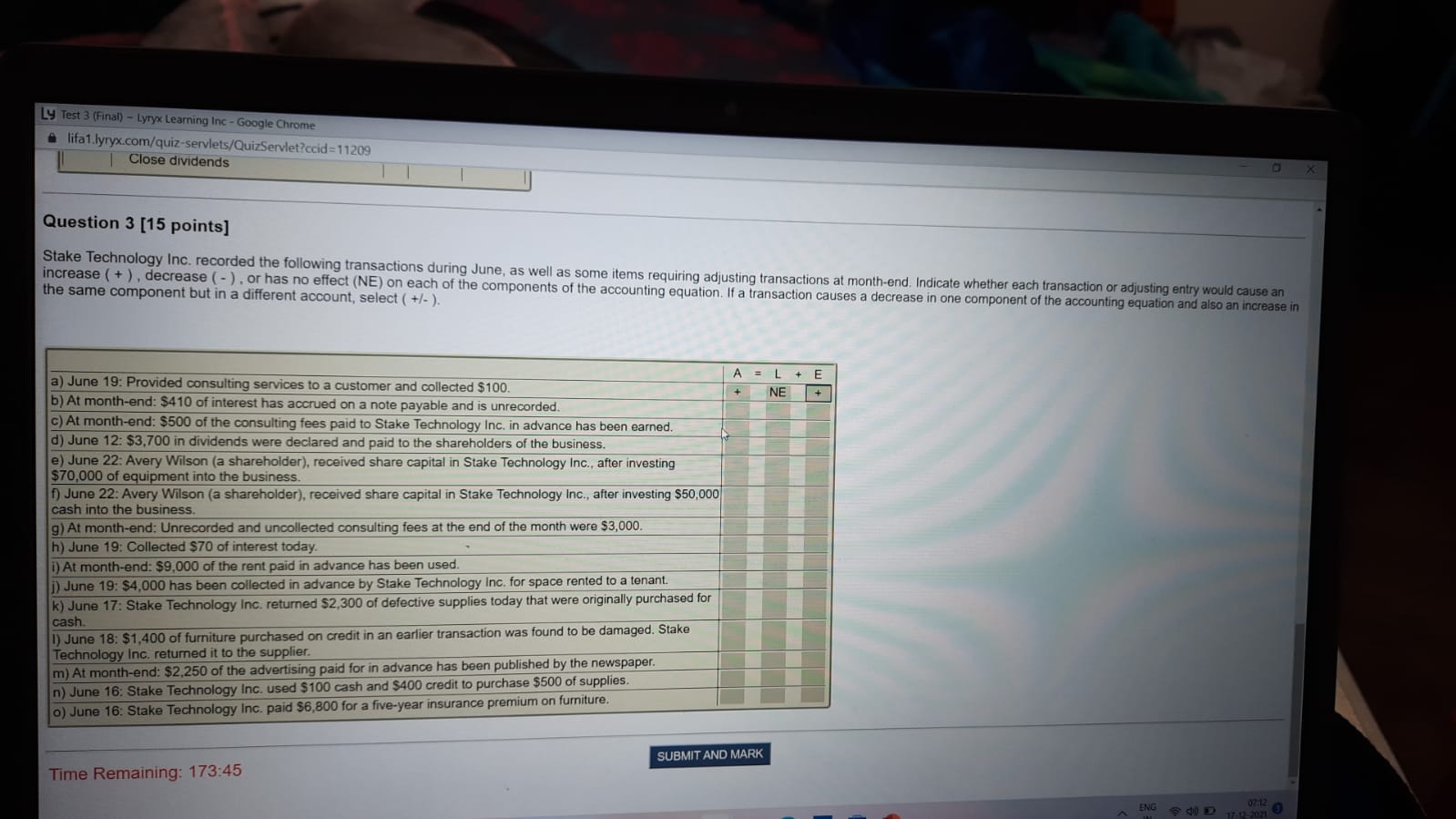

Ly Test 3 (Final) - Lyryx Learning Inc - Google Chrome lifa1.lyryx.com/quiz-servlets/QuizServlet?ccid=11209 Close dividends X Question 3 [15 points] Stake Technology Inc. recorded the following transactions during June, as well as some items requiring adjusting transactions at month-end. Indicate whether each transaction or adjusting entry would cause an increase ( + ) , decrease ( - ) , or has no effect (NE) on each of the components of the accounting equation. If a transaction causes a decrease in one component of the accounting equation and also an increase in the same component but in a different account, select ( +/- ). A = L + E a) June 19: Provided consulting services to a customer and collected $100. + NE + b) At month-end: $410 of interest has accrued on a note payable and is unrecorded. c) At month-end: $500 of the consulting fees paid to Stake Technology Inc. in advance has been earned. d) June 12: $3,700 in dividends were declared and paid to the shareholders of the business. e) June 22: Avery Wilson (a shareholder), received share capital in Stake Technology Inc., after investing $70,000 of equipment into the business. () June 22: Avery Wilson (a shareholder), received share capital in Stake Technology Inc., after investing $50,000 cash into the business. g) At month-end: Unrecorded and uncollected consulting fees at the end of the month were $3,000. h) June 19: Collected $70 of interest today. i) At month-end: $9,000 of the rent paid in advance has been used. j) June 19: $4,000 has been collected in advance by Stake Technology Inc. for space rented to a tenant. k) June 17: Stake Technology Inc. returned $2,300 of defective supplies today that were originally purchased for cash. I) June 18: $1,400 of furniture purchased on credit in an earlier transaction was found to be damaged. Stake Technology Inc. returned it to the supplier. m) At month-end: $2,250 of the advertising paid for in advance has been published by the newspaper. n) June 16: Stake Technology Inc. used $100 cash and $400 credit to purchase $500 of supplies. o) June 16: Stake Technology Inc. paid $6,800 for a five-year insurance premium on furniture. SUBMIT AND MARK Time Remaining: 173:45 ENG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts