Question: Lynn is planning a savings program to put her son, Liam, through university. Liam is 10 and plans to enroll in university in 8 years,

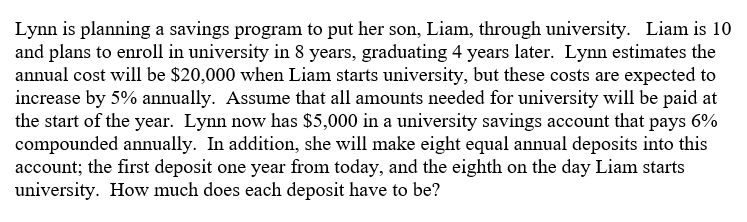

Lynn is planning a savings program to put her son, Liam, through university. Liam is 10 and plans to enroll in university in 8 years, graduating 4 years later. Lynn estimates the annual cost will be $20,000 when Liam starts university, but these costs are expected to increase by 5% annually. Assume that all amounts needed for university will be paid at the start of the year. Lynn now has $5,000 in a university savings account that pays 6% compounded annually. In addition, she will make eight equal annual deposits into this account; the first deposit one year from today, and the eighth on the day Liam starts university. How much does each deposit have to be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts