Question: M a. Using the information provided, construct a monthly cash budget for October through December 2017. Based on your analysis, will Noble enjoy a surplus

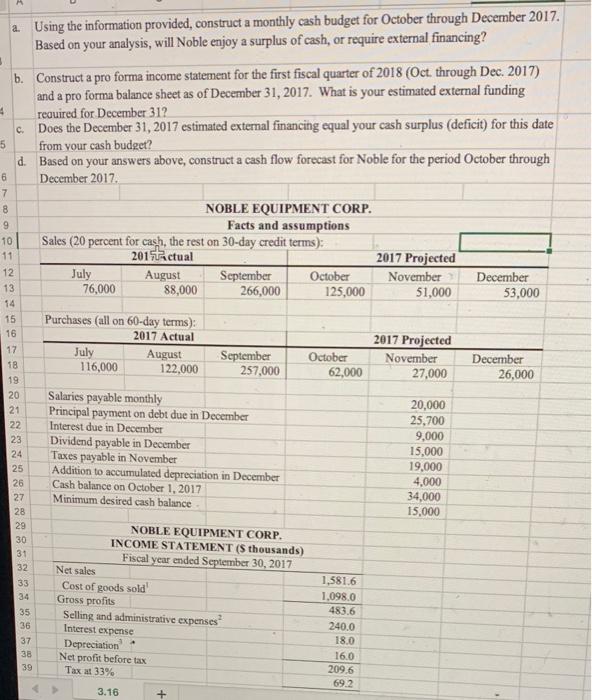

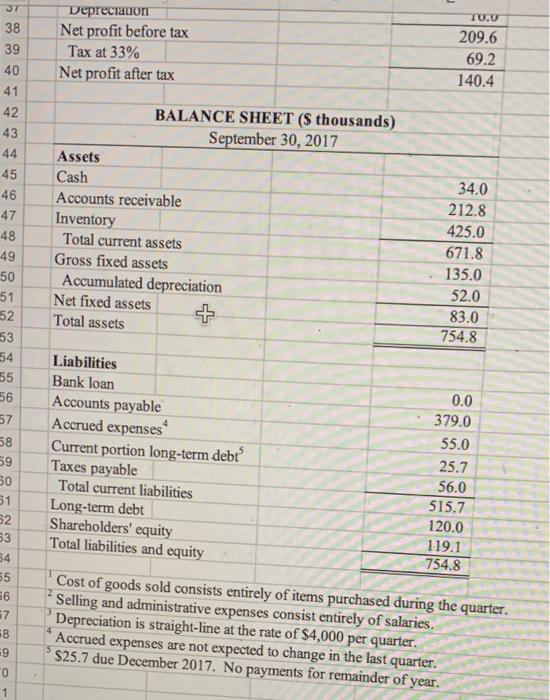

M a. Using the information provided, construct a monthly cash budget for October through December 2017. Based on your analysis, will Noble enjoy a surplus of cash, or require external financing? b. Construct a pro forma income statement for the first fiscal quarter of 2018 (Oct. through Dec. 2017) and a pro forma balance sheet as of December 31, 2017. What is your estimated external funding required for December 312 c. Does the December 31, 2017 estimated external financing equal your cash surplus (deficit) for this date from your cash budget? Based on your answers above, construct a cash flow forecast for Noble for the period October through December 2017 4 5 d 6 7 8 9 10 11 NOBLE EQUIPMENT CORP. Facts and assumptions Sales (20 percent for cash, the rest on 30-day credit terms): 2015 actual 2017 Projected July August September October November 76,000 88,000 266,000 125,000 51,000 December 53,000 Purchases (all on 60-day terms): 2017 Actual July August 116,000 122.000 September 257,000 October 62,000 2017 Projected November 27,000 December 26,000 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Salaries payable monthly Principal payment on debt due in December Interest due in December Dividend payable in December Taxes payable in November Addition to accumulated depreciation in December Cash balance on October 1, 2017 Minimum desired cash balance 20,000 25,700 9,000 15,000 19.000 4,000 34,000 15,000 NOBLE EQUIPMENT CORP. INCOME STATEMENT (Sthousands) Fiscal year ended September 30, 2017 Net sales Cost of goods sold Gross profits Selling and administrative expenses? Interest expense Depreciation Net profit before tax Tax at 33% 1,5816 1.098.0 483.6 240.0 18.0 16.0 209.6 69.2 3.16 37 38 39 40 41 Depreciation Net profit before tax Tax at 33% Net profit after tax TU. 209.6 69.2 140.4 42 BALANCE SHEET (S thousands) September 30, 2017 Assets Cash Accounts receivable Inventory Total current assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 50 51 52 53 34.0 212.8 425.0 671.8 135.0 52.0 83.0 754.8 Liabilities Bank loan Accounts payable Accrued expenses Current portion long-term debt Taxes payable Total current liabilities Long-term debt Shareholders' equity Total liabilities and equity 0.0 379.0 55.0 25.7 56.0 515.7 120.0 119.1 754.8 34 35 1 2 O 000 Oo Cost of goods sold consists entirely of items purchased during the quarter. Selling and administrative expenses consist entirely of salaries. Depreciation is straight-line at the rate of $4,000 per quarter. Accrued expenses are not expected to change in the last quarter. $25.7 due December 2017. No payments for remainder of year. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts