Question: M P N = 4 . 5 K 0 . 5 N 0 . 5 . The labor supply curve i s N S =

The labor supply curve where the real wage rate, the tax rate labor income, and hence the aftertax

real wage rate.

The capital stock

Assume that the tax rate labor income, equals zero.

Which the following equations represents the labor demand curve?

The equilibrium level the real wage your answer two decimal places

The equilibrium level employment your answer one decimal place

Total aftertax wage income workers $ your answer two decimal places With this production function, the marginal product labor

The labor supply curve where the real wage rate, the tax rate labor income, and hence the aftertax real

wage rate.

The capital stock

Assume that the tax rate labor income, equals zero.

Which the following equations represents the labor demand curve?

The equilibrium level the real wage your answer two decimal places

please can you solve for problem a and a and analytical problem thank you

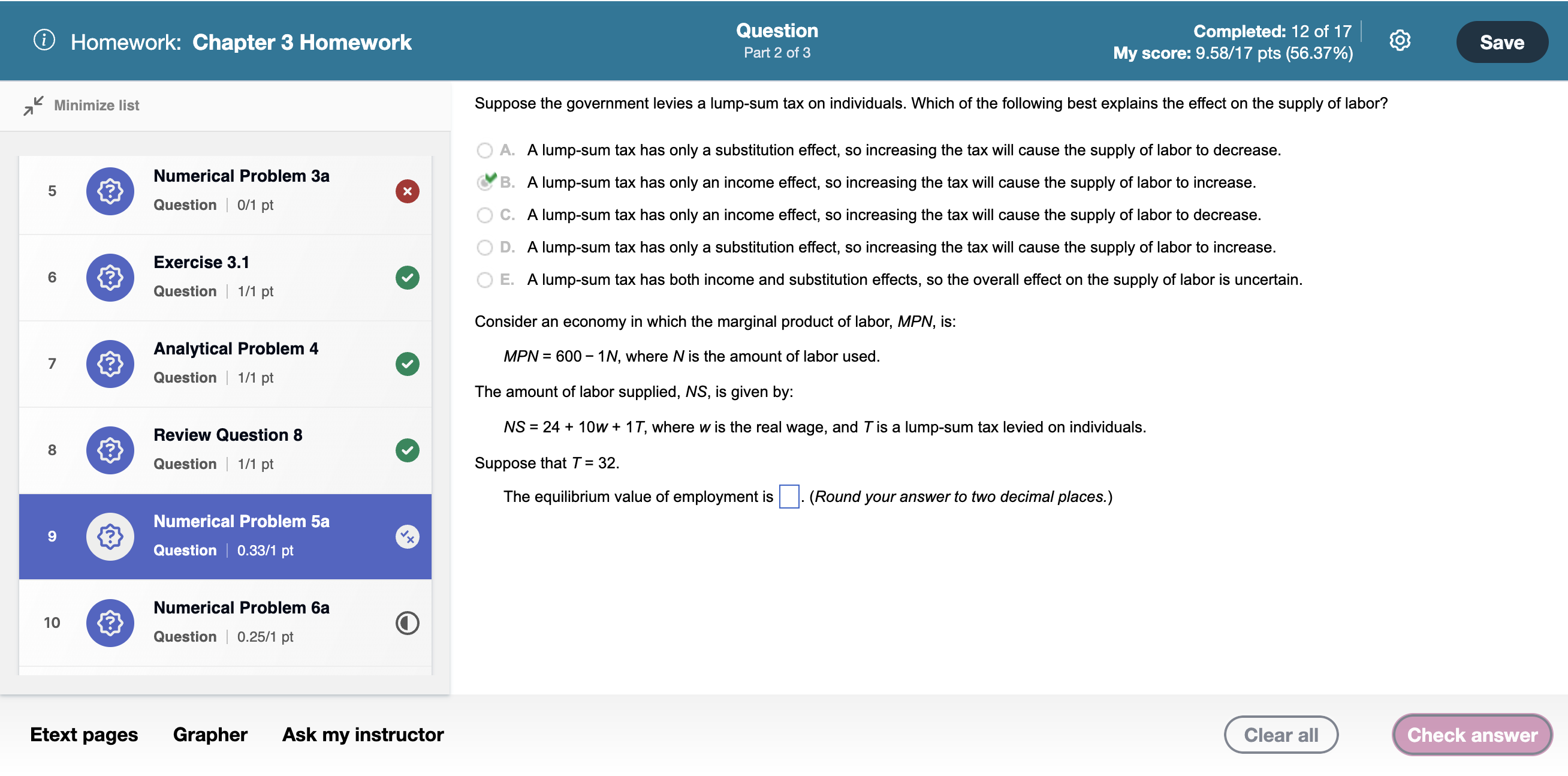

Suppose the government levies a lumpsum tax individuals. Which the following best explains the effect the supply labor?

A lumpsum tax has only a substitution effect, increasing the tax will cause the supply labor increase.

A lumpsum tax has only a substitution effect, increasing the tax will cause the supply labor decrease.

A lumpsum tax has both income and substitution effects, the overall effect the supply labor uncertain.

A lumpsum tax has only income effect, increasing the tax will cause the supply labor decrease.

A lumpsum tax has only income effect, increasing the tax will cause the supply labor increase.

Consider economy which the marginal product labor, :

where the amount labor used.

The amount labor supplied, given :

where the real wage, and a lumpsum tax levied individuals.

Suppose that

The equilibrium value employment your answer two decimal places. that under a new law all businesses must pay a tax equal their

sales revenue. Assume that this tax not passed consumers. Instead,

consumers pay the same prices after the tax imposed they did before.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock