Question: M11-12 (Static) Using NPV to Evaluate Mutually Exclusive Projects (LO 11-5) Tremaine Company is considering two mutually exclusive long-term investment projects Project ABC would require

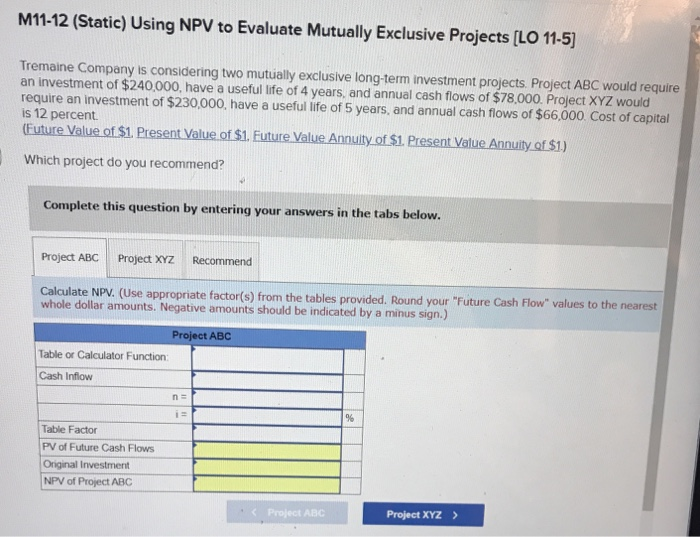

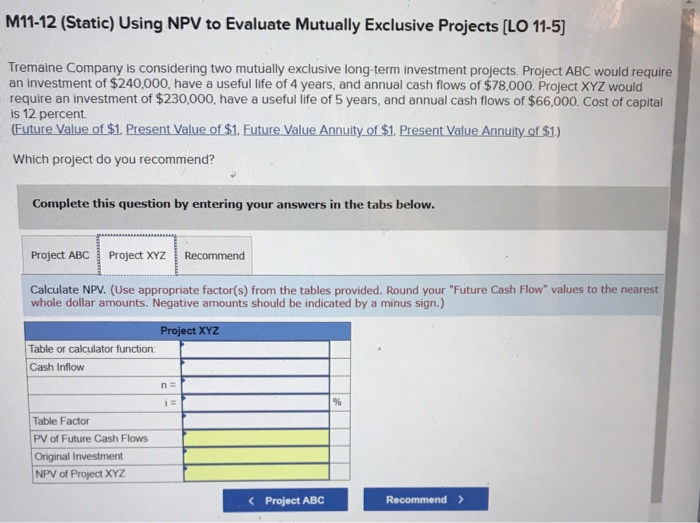

M11-12 (Static) Using NPV to Evaluate Mutually Exclusive Projects (LO 11-5) Tremaine Company is considering two mutually exclusive long-term investment projects Project ABC would require an investment of $240,000, have a useful life of 4 years, and annual cash flows of $78,000. Project XYZ would require an investment of $230,000, have a useful life of 5 years, and annual cash flows of $66,000. Cost of capital is 12 percent (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) Which project do you recommend? Complete this question by entering your answers in the tabs below. Project ABC Project XYZ Recommend Calculate NPV. (Use appropriate factor(s) from the tables provided. Round your "Future Cash Flow" values to the nearest whole dollar amounts. Negative amounts should be indicated by a minus sign.) Project ABC Table or Calculator Function Cash Inflow Table Factor PV of Future Cash Flows Original Investment NPV of Project ABC ProABC Project XYZ ) M11-12 (Static) Using NPV to Evaluate Mutually Exclusive Projects [LO 11-5) Tremaine Company is considering two mutually exclusive long-term investment projects. Project ABC would require an investment of $240,000, have a useful life of 4 years, and annual cash flows of $78,000. Project XYZ would an investment of $230,000, have a useful life of 5 years, and annual cash flows of $66,000. Cost of capital is 12 percent (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) Which project do you recommend? Complete this question by entering your answers in the tabs below. Project ABC Project XYZ Recommend Calculate NPV. (Use appropriate factor(s) from the tables provided. Round your "Future Cash Flow" values to the nearest whole dollar amounts. Negative amounts should be indicated by a minus sign.) Project XYZ Table or calculator function: Cash Inflow % Table Factor PV of Future Cash Flows Original Investment NPV of Project XYZ Tremaine Company is considering two mutually exclusive long-term investment projects. Project ABC would require an investment of $240,000, have a useful life of 4 years, and annual cash flows of $78,000. Project XYZ would require an investment of $230,000, have a useful life of 5 years, and annual cash flows of $66,000. Cost of capital is 12 percent. (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1.) Which project do you recommend? Complete this question by entering your answers in the tabs below. Project ABC Project XYZ Recommend Which project do you recommend? Which project do you recommend?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts