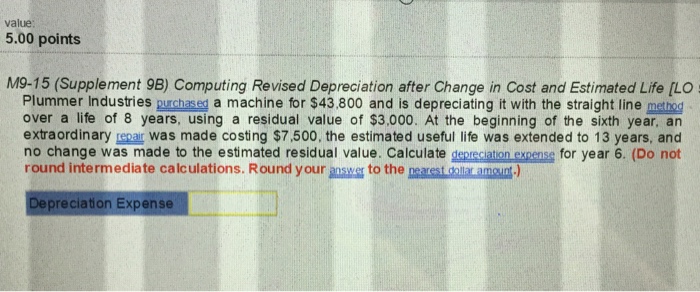

Question: M9-15 (Supplement 9B) Computing Revised Depreciation after Change in Cost and Estimated Life [LO Plummer Industries purchased a machine for $43,800 and is depreciating it

M9-15 (Supplement 9B) Computing Revised Depreciation after Change in Cost and Estimated Life [LO Plummer Industries purchased a machine for $43,800 and is depreciating it with the straight line method over a life of 8 years,. using a residual value of $3,000. At the beginning of the sixth year, an extraordinary repair was made costing $7,500, the estimated useful life was extended to 13 years, and no change was made to the estimated residual value. Calculate depreciation expense for year 6. (Do not round intermediate calculation-. Round your answer to the nearest dollar amount.) Depreciation Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts