Question: Problem 5-86A (Algorithmic) Accounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yamell engaged in the following activities involving notes receivable a.

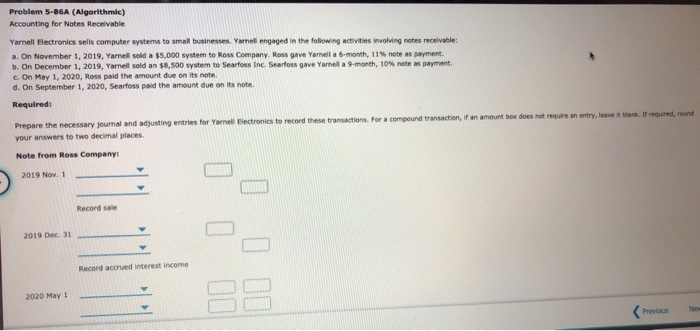

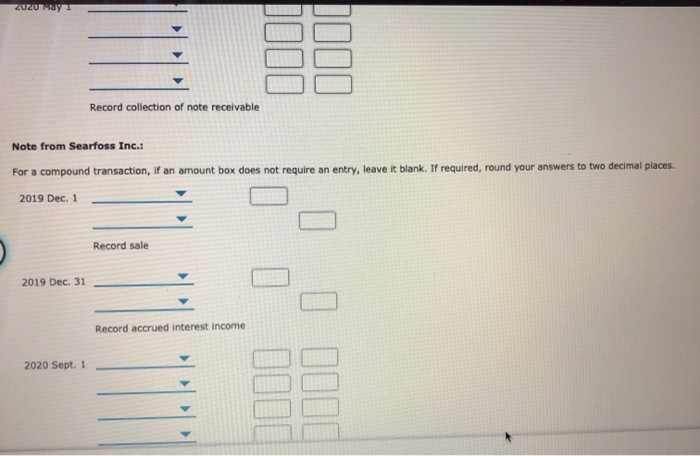

Problem 5-86A (Algorithmic) Accounting for Notes Receivable Yarnell Electronics sells computer systems to small businesses. Yamell engaged in the following activities involving notes receivable a. On November 1, 2019, Yamell sold a $5,000 system to Ross Company. Ross gave Yamella 6-month, 11% note as payment b. On December 1, 2019, Yarnell sold an $8,500 system to Searfoss Inc. Starfoss gave Yarella 9- month, 10% note as payment c. On May 1, 2020, Ross paid the amount due on its note. d. On September 1, 2020, Searfoss paid the amount due on its note Required: Prepare the necessary Journal and adjusting entries for Yarnell Electronies to record these transactions. For a compound transaction, if an amount box does not require an entry, leavet blank. It required, round your answers to two decimal places Note from Ross Company 2019 Nov. 1 - Record sale 2019 Dec. 31 Record accrued interest Income 2020 May 1 Previous ZUZU Tray Record collection of note receivable Note from Searfoss Inc.: For a compound transaction, if an amount box does not require an entry, leave it blank. If required, round your answers to two decimal places. 2019 Dec. 1 Record sale 2019 Dec. 31 o Record accrued interest income 2020 Sept. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts