Question: M9.4 Computing Book Value (Straight-Line Depreciation) LO9.3 A machine that cost $400,000 has an estimated residual value of $40,000 and an estimated useful life of

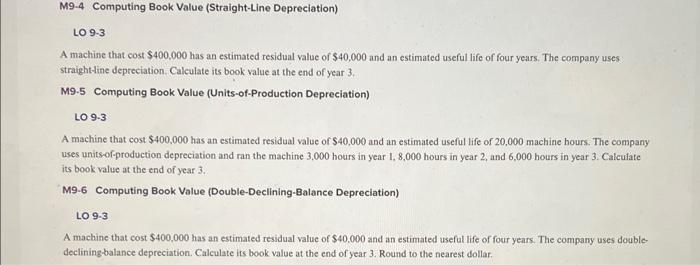

M9.4 Computing Book Value (Straight-Line Depreciation) LO9.3 A machine that cost $400,000 has an estimated residual value of $40,000 and an estimated useful life of four years. The company uses straight tine depreciation. Calculate its book value at the end of year 3 . M9.5 Computing Book Value (Units-of-Production Depreciation) LO9-3 A machine that cost $400,000 has an estimated residual value of $40,000 and an estimated useful life of 20,000 machine hours. The company uses units-of-production depreciation and ran the machine 3,000 hours in year 1,8,000 hours in year 2, and 6,000 hours in year 3 . Calculate its book value at the end of year 3 . M9-6 Computing Book Value (Double-Declining-Balance Depreciation) LO9.3 A machine that cost $400,000 has an estimated residual value of $40.000 and an estimated useful life of four years. The company uses doubledeclining-balance depreciation. Calculate its book value at the end of year 3 . Round to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts