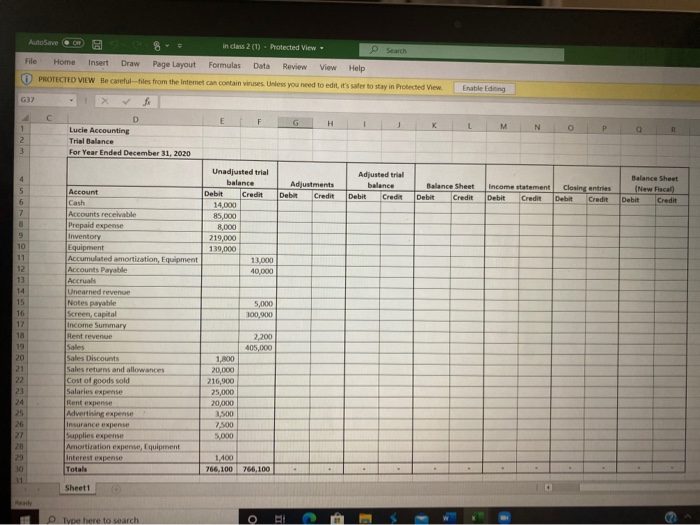

Question: ma AutoSave On in class 2 (1) Protected View Search File Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files

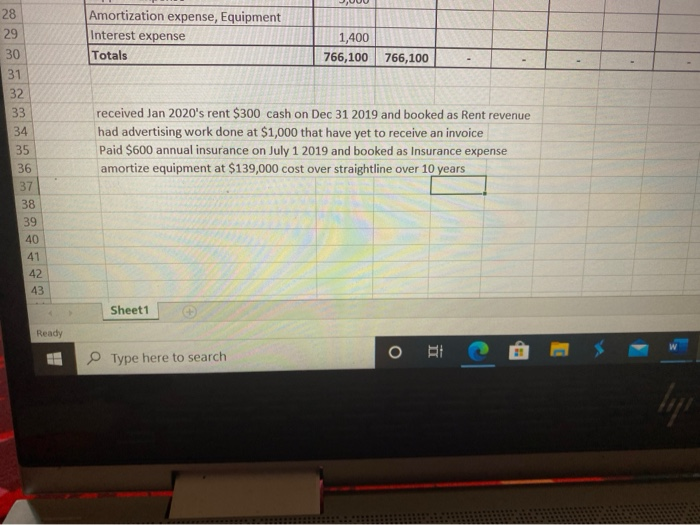

ma AutoSave On in class 2 (1) Protected View Search File Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing 32 f C E F H L M N 1 2 D Lucie Accounting Trial Balance For Year Ended December 31, 2020 3 4 Adjusted trial balance Credit Adjustments Debit Credit 5 Balance Sheet Debit Credit Debit Income statement Debit Credit Balance Sheet (New Fiscal Debit Credit Closing entries Debit Credit 6 Unadjusted trial balance Debit Credit 14,000 85,000 8,000 219,000 139,000 13.000 40.000 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 Account Cash Accounts receivable Prepaid expense Inventory Equipment Accumulated amortization Equipment Accounts Payable Accruals Unearned revenue Notes payable Screen, capital Income Summary Rent revenue Sales Sales Discounts Sales returns and allowances Cost of goods sold Salaries expense Rent expense Advertising expense Insurance expense Supplies expense Amortization expense, Equipment 5,000 300,900 2,200 405,000 1,800 20,000 216,900 25,000 20,000 3.500 2.500 5.000 1,400 766,100 766,100 Totals Sheet1 DI here to search o 28 29 30 31 32 Amortization expense, Equipment Interest expense Totals 1,400 766,100 766,100 33 received Jan 2020's rent $300 cash on Dec 31 2019 and booked as Rent revenue had advertising work done at $1,000 that have yet to receive an invoice Paid $600 annual insurance on July 1 2019 and booked as Insurance expense amortize equipment at $139,000 cost over straightline over 10 years 34 35 36 37 38 39 40 41 42 43 Sheet1 Ready o BE Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts