Question: maar dit with this and the word ative Problem de ses expected 2010 to 15 2018 in roor rojecte el. A 2019. uren 720,000 g

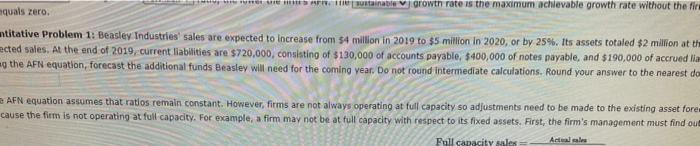

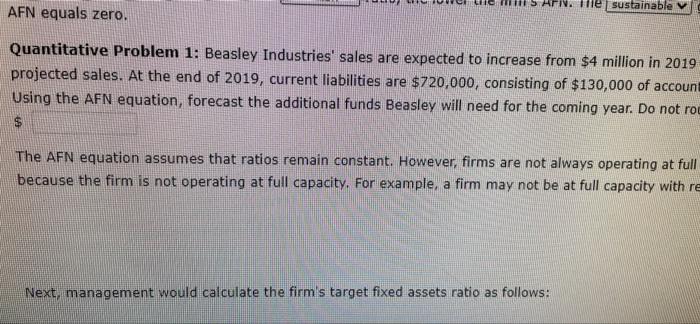

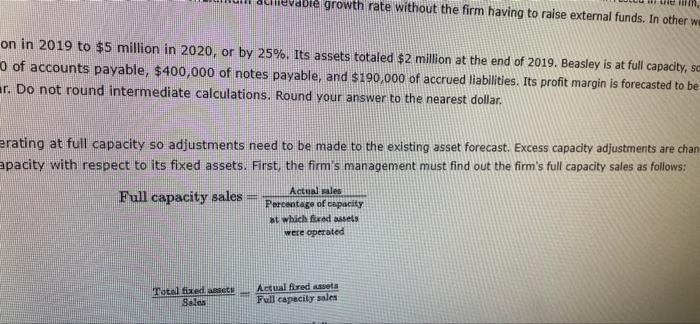

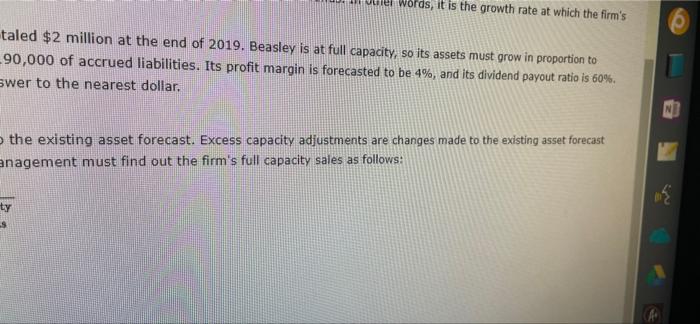

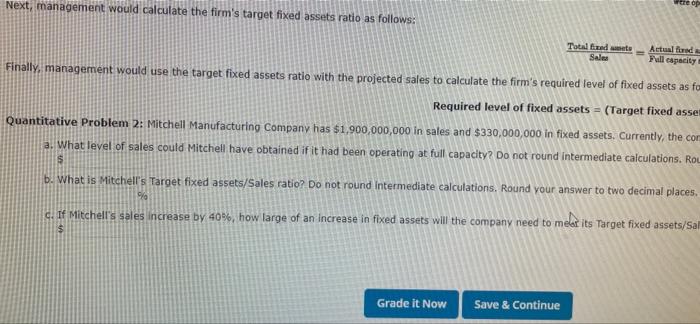

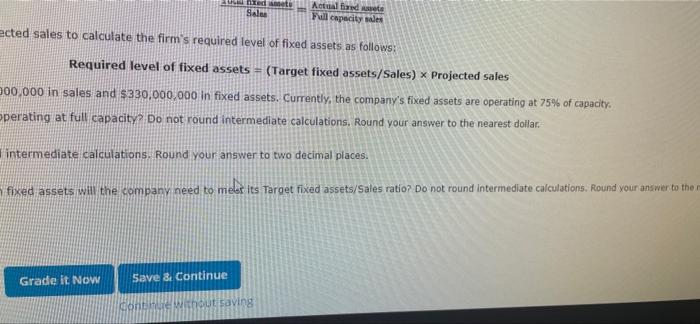

maar dit with this and the word ative Problem de ses expected 2010 to 15 2018 in roor rojecte el. A 2019. uren 720,000 g 000 100.000 10.000 program ving the Nation, forecast then und will need for the Rower The won that comes the worfollow operated codi con Full ww tanse would the wow Ast easer Ried of food (Targetdated sales mitative Problem than 100.000 000,00 Wate 1 wicht tes owner wie went would calculate the art follows management would use the total with the projecte the free Required level of the targeted sales lected nie Problema: el aufacturing Cow 11.900.000.000 in de and 130,00.000 und Gewind? which were the best contended to b.wmtches Targeted at rand Write and your time to his the low. www.bone in to the core testere in commerce Grade tow Save & Co MESA:stainable growth rate is the maximum achievable growth rate without the fire aquals zero. antitative Problem 1: Beasley Industries' sales are expected to increase from $4 million in 2019 to $5 million in 2020, or by 25%. Its assets totaled $2 million at the ected sales. At the end of 2019, current liabilities are $720,000, consisting of $130,000 of accounts payable, $400,000 of notes payable, and $190,000 of accrued liam ay the AFN equation, forecast the additional funds Beasley will need for the coming year. Do not round intermediate calculations. Round your answer to the nearest do AFN equation assumes that ratios remain constant. However, firms are not always operating at full capacity so adjustments need to be made to the existing asset fore cause the firm is not operating at full capacity. For example, a firm may not be at full capacity with respect to its fixed assets. First, the firm's management must find out Full capacity wler Actual is the proportion of net income that is reinvested in the firm, and it is calculated as 1 minus the rate is the maximum achievable growth rate without the firm having to raise external funds. In other words, it is the growth rate at which the firm's higher the profit million in 2020, or by 25%. Its assets totaled $2 million at the end of 2019. Beasley is at full capacity, so its assets must grow in proportion yable, $400,000 of notes payable, and $190,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 60%. intermediate calculations. Round your answer to the nearest dollar. pacity so adjustments need to be made to the existing asset forecast. Excess capacity adjustments are changes made to the existing asset forecast pect to its fixed assets. First, the firm's management must find out the firm's full capacity sales as follows: He sustainable v AFN equals zero. Quantitative Problem 1: Beasley Industries' sales are expected to increase from $4 million in 2019 projected sales. At the end of 2019, current liabilities are $720,000, consisting of $130,000 of account Using the AFN equation, forecast the additional funds Beasley will need for the coming year. Do not row $ The AFN equation assumes that ratios remain constant. However, firms are not always operating at full because the firm is not operating at full capacity. For example, a firm may not be at full capacity with re Next, management would calculate the firm's target fixed assets ratio as follows: vable growth rate without the firm having to raise external funds. In other w e 1 on in 2019 to $5 million in 2020, or by 25%. Its assets totaled $2 million at the end of 2019. Beasley is at full capacity, sc of accounts payable, $400,000 of notes payable, and $190,000 of accrued liabilities. Its profit margin is forecasted to be ar. Do not round intermediate calculations. Round your answer to the nearest dollar. erating at full capacity so adjustments need to be made to the existing asset forecast. Excess capacity adjustments are chan apacity with respect to its fixed assets. First, the firm's management must find out the firm's full capacity sales as follows: Full capacity sales Percentage of capacity Actual sales at which fixed assets were operated Total fixed asset Sales Actual fired sets Full capacity sales Words, it is the growth rate at which the firm's taled $2 million at the end of 2019. Beasley is at full capacity, so its assets must grow in proportion to _90,000 of accrued liabilities. Its profit margin is forecasted to be 4%, and its dividend payout ratio is 60%. swer to the nearest dollar. the existing asset forecast. Excess capacity adjustments are changes made to the existing asset forecast anagement must find out the firm's full capacity sales as follows: image ty Next, management would calculate the firm's target fixed assets ratio as follows: tie op Total Bundes Sales Actual Pull capacity Finally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required level of fixed assets as for Required level of fixed assets = (Target fixed asset Quantitative Problem 2: Mitchell Manufacturing Company has $1,900,000,000 in sales and $330,000,000 in fixed assets. Currently, the com a. What level of sales could Mitchell have obtained if it had been operating at full capacity? Do not round Intermediate calculations. Rou S b. What is Mitchell's Target fixed assets/Sales ratio? Do not round Intermediate calculations. Round your answer to two decimal places. % a. If Mitchell's sales increase by 40%, how large of an increase in fixed assets will the company need to meet its Target fixed assets/Salt $ Grade it Now Save & Continue IDEA Sale Actual and il capacity ades ected sales to calculate the firm's required level of fixed assets as follows: Required level of fixed assets = (Target fixed assets/Sales) x Projected sales 000,000 in sales and $330,000,000 in fixed assets. Currently, the company's fixed assets are operating at 75% of capacity operating at full capacity? Do not round intermediate calculations. Round your answer to the nearest dollar. intermediate calculations. Round your answer to two decimal places. fixed assets will the company need to meet its Target fixed assets/Sales ratio? Do not round Intermediate calculations. Round your answer to the melar Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts