Question: MacroTough (MT), a software company, sells WebPredator, a program for browsing the World Wide Web. MT sells this program to two types of customers, corporations

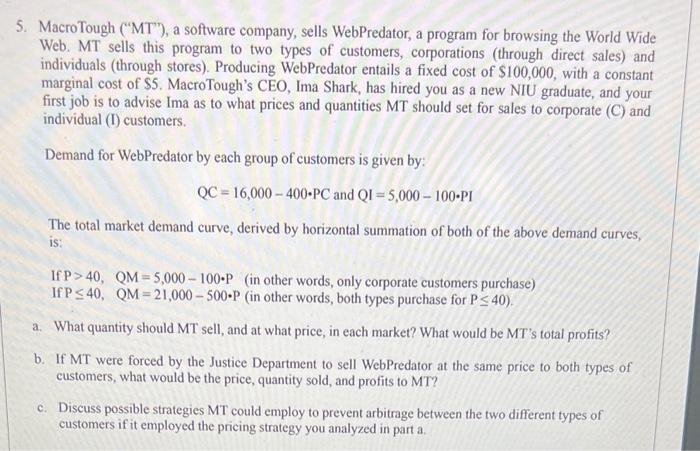

MacroTough ("MT"), a software company, sells WebPredator, a program for browsing the World Wide Web. MT sells this program to two types of customers, corporations (through direct sales) and individuals (through stores). Producing WebPredator entails a fixed cost of $100,000, with a constant marginal cost of \$5. MacroTough's CEO, Ima Shark, has hired you as a new NIU graduate, and your first job is to advise Ima as to what prices and quantities MT should set for sales to corporate (C) and individual (I) customers. Demand for WebPredator by each group of customers is given by: QC=16,000400PCandQI=5,000100PI The total market demand curve, derived by horizontal summation of both of the above demand curves, is: If P>40,QM=5,000100P (in other words, only corporate customers purchase) If P40,QM=21,000500P (in other words, both types purchase for P40 ). a. What quantity should MT sell, and at what price, in each market? What would be MT's total profits? b. If MT were forced by the Justice Department to sell WebPredator at the same price to both types of customers, what would be the price, quantity sold, and profits to MT? c. Discuss possible strategies MT could employ to prevent arbitrage between the two different types of customers if it employed the pricing strategy you analyzed in part a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts