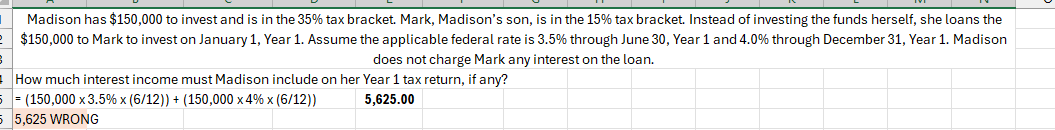

Question: Madison has $ 1 5 0 , 0 0 0 to invest and is in the 3 5 % tax bracket. Mark, Madison's son, is

Madison has $ to invest and is in the tax bracket. Mark, Madison's son, is in the tax bracket. Instead of investing the funds herself, she loans the $ to Mark to invest on January Year Assume the applicable federal rate is through June Year and through December Year Madison does not charge Mark any interest on the loan. How much interest income must Madison include on her Year tax return, if any? times times times times WRONG

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock