Question: Magic Ltd is a company producing essential components for the mobile phone industry. The company's main product is called Leba which is distributed to

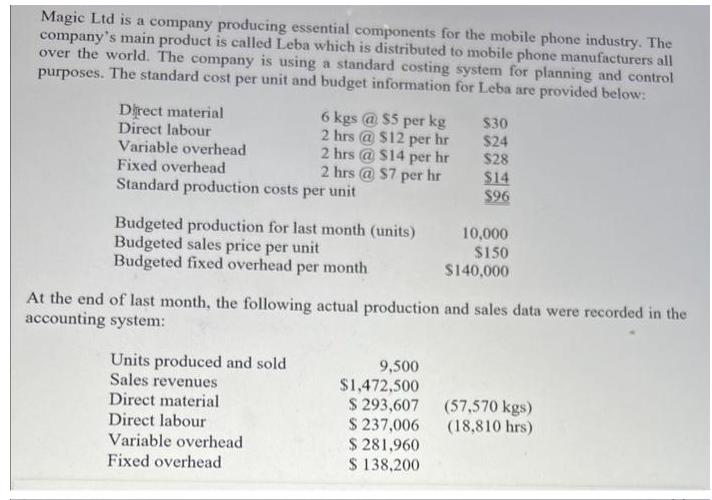

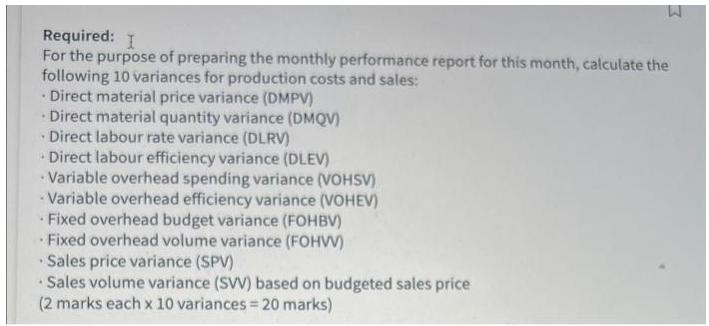

Magic Ltd is a company producing essential components for the mobile phone industry. The company's main product is called Leba which is distributed to mobile phone manufacturers all over the world. The company is using a standard costing system for planning and control purposes. The standard cost per unit and budget information for Leba are provided below: Direct material Direct labour Variable overhead Fixed overhead Standard production costs per unit 6 kgs @ $5 per kg 2 hrs @ $12 per hr 2 hrs @ $14 per hr 2 hrs @ $7 per hr Budgeted production for last month (units) Budgeted sales price per unit Budgeted fixed overhead per month Units produced and sold Sales revenues Direct material Direct labour Variable overhead Fixed overhead $30 $24 9,500 $1,472,500 $ 293,607 $ 237,006 $ 281,960 $ 138,200 $28 $14 $96 At the end of last month, the following actual production and sales data were recorded in the accounting system: 10,000 $150 $140,000 (57,570 kgs) (18,810 hrs) Required: I For the purpose of preparing the monthly performance report for this month, calculate the following 10 variances for production costs and sales: Direct material price variance (DMPV) Direct material quantity variance (DMQV) Direct labour rate variance (DLRV) Direct labour efficiency variance (DLEV) . Y Variable overhead spending variance (VOHSV) Variable overhead efficiency variance (VOHEV) Fixed overhead budget variance (FOHBV) Fixed overhead volume variance (FOHVV) W Sales price variance (SPV) Sales volume variance (SVV) based on budgeted sales price (2 marks each x 10 variances = 20 marks)

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

The detailed ... View full answer

Get step-by-step solutions from verified subject matter experts