Question

Magnet Limited is in publishing business. Business has been quite slow over the past few years but owing to upcoming elections and a host

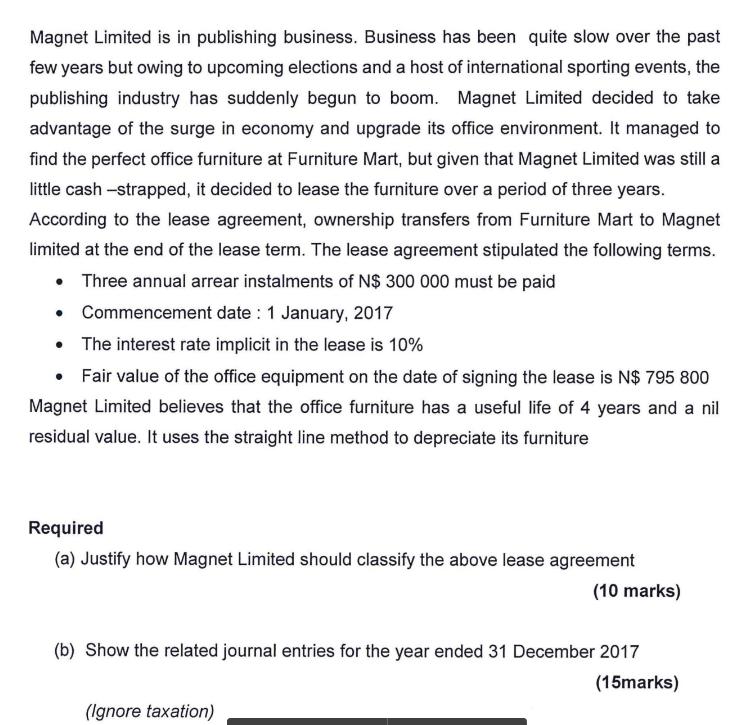

Magnet Limited is in publishing business. Business has been quite slow over the past few years but owing to upcoming elections and a host of international sporting events, the publishing industry has suddenly begun to boom. Magnet Limited decided to take advantage of the surge in economy and upgrade its office environment. It managed to find the perfect office furniture at Furniture Mart, but given that Magnet Limited was still a little cash-strapped, it decided to lease the furniture over a period of three years. According to the lease agreement, ownership transfers from Furniture Mart to Magnet limited at the end of the lease term. The lease agreement stipulated the following terms. Three annual arrear instalments of N$ 300 000 must be paid Commencement date : 1 January, 2017 The interest rate implicit in the lease is 10% Fair value of the office equipment on the date of signing the lease is N$ 795 800 Magnet Limited believes that the office furniture has a useful life of 4 years and a nil residual value. It uses the straight line method to depreciate its furniture Required (a) Justify how Magnet Limited should classify the above lease agreement (10 marks) (b) Show the related journal entries for the year ended 31 December 2017 (15marks) (Ignore taxation)

Step by Step Solution

3.31 Rating (127 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Classification of Lease Agreement In order to determine the classification of the lease agreement we need to assess whether it is a finance lease or an operating lease based on the criteria p...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started