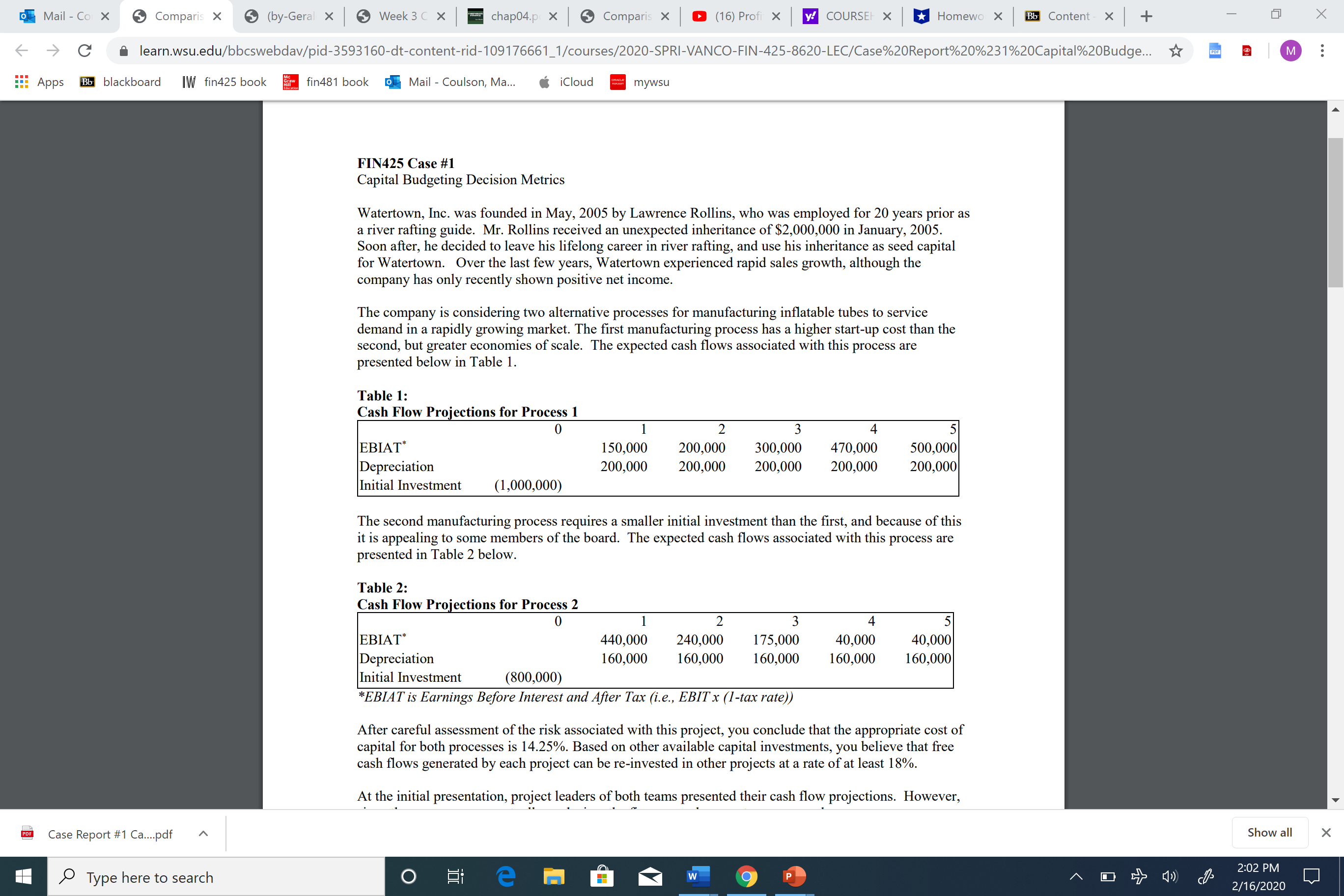

Mail - Co X Comparis X (by-Geral X Week 3 C X chap04.p X Comparis X (16) Profi X y! COURSEI X Homewo X Bb Content X + X C learn.wsu.edu/bbcswebdav/pid-3593160-dt-content-rid-109176661_1/courses/2020-SPRI-VANCO-FIN-425-8620-LEC/Case%20Report%20%231%20Capital%20Budge... M Apps Bb blackboard IW fin425 book fin481 book . Mail - Coulson, Ma... iCloud mywsu FIN425 Case #1 Capital Budgeting Decision Metrics Watertown, Inc. was founded in May, 2005 by Lawrence Rollins, who was employed for 20 years prior as a river rafting guide. Mr. Rollins received an unexpected inheritance of $2,000,000 in January, 2005. Soon after, he decided to leave his lifelong career in river rafting, and use his inheritance as seed capital for Watertown. Over the last few years, Watertown experienced rapid sales growth, although the company has only recently shown positive net income. The company is considering two alternative processes for manufacturing inflatable tubes to service demand in a rapidly growing market. The first manufacturing process has a higher start-up cost than the second, but greater economies of scale. The expected cash flows associated with this process are presented below in Table 1. Table 1: Cash Flow Projections for Process 1 EBIAT* 2 150,000 200,000 300,000 470,000 500,000 Depreciation 200,000 200,000 200,000 200,000 200,000 Initial Investment (1,000,000) The second manufacturing process requires a smaller initial investment than the first, and because of this it is appealing to some members of the board. The expected cash flows associated with this process are presented in Table 2 below. Table 2: Cash Flow Projections for Process 2 0 EBIAT* 440,000 240,000 175,000 40,000 40,000 Depreciation 160,000 160,000 160,000 160,000 160,000 Initial Investment (800,000) *EBIAT is Earnings Before Interest and After Tax (i.e., EBIT x (1-tax rate)) After careful assessment of the risk associated with this project, you conclude that the appropriate cost of capital for both processes is 14.25%. Based on other available capital investments, you believe that free cash flows generated by each project can be re-invested in other projects at a rate of at least 18%. At the initial presentation, project leaders of both teams presented their cash flow projections. However, Case Report #1 Ca....pdf Show all X Type here to search O W 9 P O 2:02 PM 2/16/2020