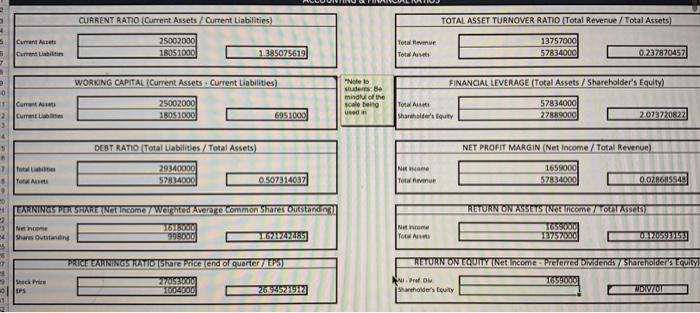

Question: could i please get help with the quetions below. CURRENT RATIO (Current Assets Current Liabilities) TOTAL ASSET TURNOVER RATIO Total Revenue / Total Assets) 5

CURRENT RATIO (Current Assets Current Liabilities) TOTAL ASSET TURNOVER RATIO Total Revenue / Total Assets) 5 Current A 25002000 18051000 Total Rem Totises 13757000 57834000 Curabiti 1.385075619 0.237870457 WORKING CAPITAL (Current Assets Current Liabilities) FINANCIAL LEVERAGE Total Assets / Shareholder's Equity 0 1 cm Current "Note des B mind of the scaletto undin 25002000 IROS 1000 Tot i Shareholder's quity 57834000 27889000 6951000 2 073720822 DEBT RATIO Total abilities/Total Assets) NET PROFIT MARGIN (Net Income / Total Revenue) Tot Yok 29340000 52A4DOG Nane Total Reve 1659000 57834000 0.507314037 0.02R6ASSAR RETURNON ASSETS TNet Income tal Assets LARNINGS PER SHARE TREE Income weighted Average Common Shares Outstandine Neto 15150 Share Outstanding 999000 Nem To 165RC 12757000 4 PRICE EARNINGSTATIOTShare Price end of quarters RETURN ON EQUITY TNet Income - Preferred Dividends Shareholders Equity shack PS 1659 270350 100400C NAIDW Sancholder's 269452092 UVO mail YouTube Maps PG Campus Mdl B. Working Capital Management: Explain the impact of working capital management on the business's operations. Provide examples to support your claims. C. Bond Investment: Analyze the risks and benefits of the business choosing to invest in a corporate bond, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. D. Capital Equipment: Analyze the risks and benefits of the business choosing to invest in capital equipment, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. E. Capital Lease: Analyze the risks and benefits of the business choosing to purchase a capital lease, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. 2. Financial Evaluation: In this section of the report, you will now determine if the three available financial options in the Project Two Financial Assumptions document are appropriate for the business, considering the analysis you did in the first section. You will also explain financing and describe the business's likely future performance. A. Financing: Explain how a business finances its operations and expansion B. Bond Investment: Assess the appropriateness of a bond investment as a financing option for the business's financial health, using your financial analysis and other financial information to your support claims. C. Capital Equipment: Assess the appropriateness of a capital equipment investment as a financing option for the business's financial health, using your financial analysis and other financial information to support your claims. D. Capital Lease: Assess the appropriateness of a capital lease purchase as a financing option for the business's financial health, using your financial analysis and other financial information to support your claims. E. Short-Term Financing: Explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the business's current financial information. F. Future Financial Considerations: Describe the business's likely future financial performance based on its current financial well-being and risk levels. Use financial information to support your claims. 3. Financial Recommendations: In this section of the report, you will recommend which financing option(s) are the best for the business to choose depending on its financial health. A. Financial Recommendation(s): Recommend the most appropriate financing option(s) based on the business's financial health, including a rationale for why the option(s) are best. CURRENT RATIO (Current Assets Current Liabilities) TOTAL ASSET TURNOVER RATIO Total Revenue / Total Assets) 5 Current A 25002000 18051000 Total Rem Totises 13757000 57834000 Curabiti 1.385075619 0.237870457 WORKING CAPITAL (Current Assets Current Liabilities) FINANCIAL LEVERAGE Total Assets / Shareholder's Equity 0 1 cm Current "Note des B mind of the scaletto undin 25002000 IROS 1000 Tot i Shareholder's quity 57834000 27889000 6951000 2 073720822 DEBT RATIO Total abilities/Total Assets) NET PROFIT MARGIN (Net Income / Total Revenue) Tot Yok 29340000 52A4DOG Nane Total Reve 1659000 57834000 0.507314037 0.02R6ASSAR RETURNON ASSETS TNet Income tal Assets LARNINGS PER SHARE TREE Income weighted Average Common Shares Outstandine Neto 15150 Share Outstanding 999000 Nem To 165RC 12757000 4 PRICE EARNINGSTATIOTShare Price end of quarters RETURN ON EQUITY TNet Income - Preferred Dividends Shareholders Equity shack PS 1659 270350 100400C NAIDW Sancholder's 269452092 UVO mail YouTube Maps PG Campus Mdl B. Working Capital Management: Explain the impact of working capital management on the business's operations. Provide examples to support your claims. C. Bond Investment: Analyze the risks and benefits of the business choosing to invest in a corporate bond, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. D. Capital Equipment: Analyze the risks and benefits of the business choosing to invest in capital equipment, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. E. Capital Lease: Analyze the risks and benefits of the business choosing to purchase a capital lease, including the necessary ethical considerations, appropriate calculations, and examples to support your analysis. 2. Financial Evaluation: In this section of the report, you will now determine if the three available financial options in the Project Two Financial Assumptions document are appropriate for the business, considering the analysis you did in the first section. You will also explain financing and describe the business's likely future performance. A. Financing: Explain how a business finances its operations and expansion B. Bond Investment: Assess the appropriateness of a bond investment as a financing option for the business's financial health, using your financial analysis and other financial information to your support claims. C. Capital Equipment: Assess the appropriateness of a capital equipment investment as a financing option for the business's financial health, using your financial analysis and other financial information to support your claims. D. Capital Lease: Assess the appropriateness of a capital lease purchase as a financing option for the business's financial health, using your financial analysis and other financial information to support your claims. E. Short-Term Financing: Explain how potential short-term financing sources could help the business raise needed funds for improving its financial health. Base your response on the business's current financial information. F. Future Financial Considerations: Describe the business's likely future financial performance based on its current financial well-being and risk levels. Use financial information to support your claims. 3. Financial Recommendations: In this section of the report, you will recommend which financing option(s) are the best for the business to choose depending on its financial health. A. Financial Recommendation(s): Recommend the most appropriate financing option(s) based on the business's financial health, including a rationale for why the option(s) are best

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts