Question: mainly need part ( b ) I am not sure in ( a ) I should use mac dur or convexity to estimate, can you

mainly need part b

I am not sure in a I should use mac dur or convexity to estimate, can you tell me which formula I should use?

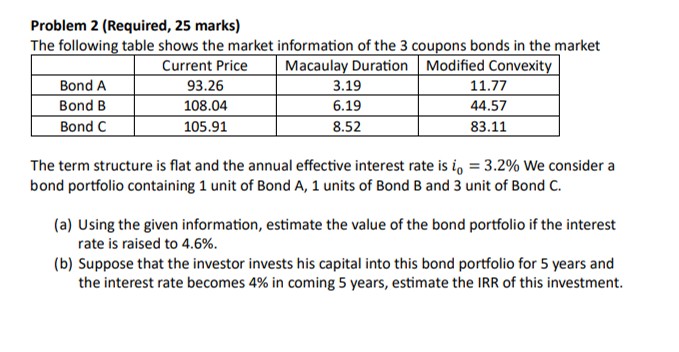

Problem Required marks

The following table shows the market information of the coupons bonds in the market

The term structure is flat and the annual effective interest rate is We consider a

bond portfolio containing unit of Bond A units of Bond B and unit of Bond C

a Using the given information, estimate the value of the bond portfolio if the interest

rate is raised to

b Suppose that the investor invests his capital into this bond portfolio for years and

the interest rate becomes in coming years, estimate the IRR of this investment.The following table shows the market information of the coupons bonds in the market

Current Price Macaulay Duration Modified Convexity

Bond A

Bond B

Bond C

The term structure is flat and the annual effective interest rate is We consider a

bond portfolio containing unit of Bond A units of Bond B and unit of Bond C

a Using the given information, estimate the value of the bond portfolio if the interest

rate is raised to

b Suppose that the investor invests his capital into this bond portfolio for years and

the interest rate becomes in coming years, estimate the IRR of this investment.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock