Question: Make a journal Entry worksheet for each, 1 Record the entry for insurance expired during the year, $5. 2 Record the entry for depreciation expense

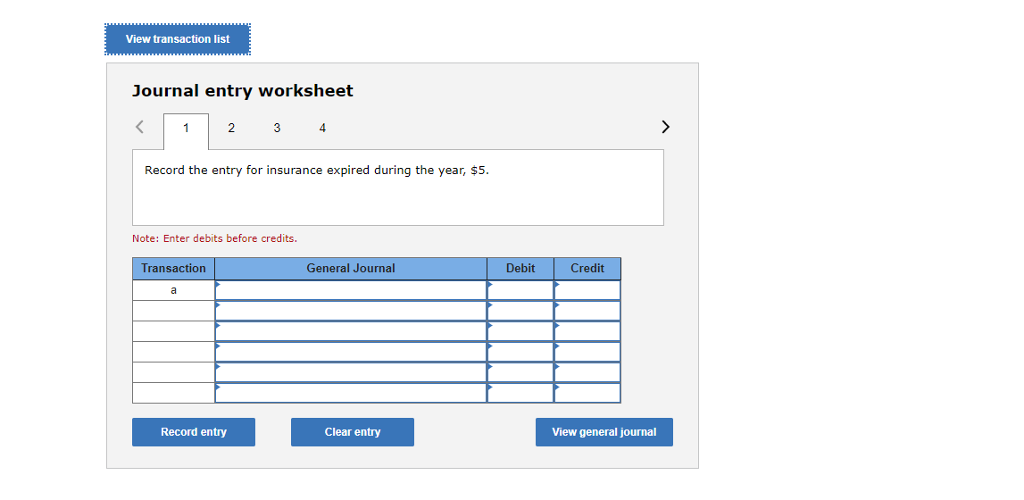

Make a journal Entry worksheet for each,

1

Record the entry for insurance expired during the year, $5.

2

Record the entry for depreciation expense for the year, $4.

3

Record the entry for wages payable of $7.

4

Record the entry for income tax payable of $9.

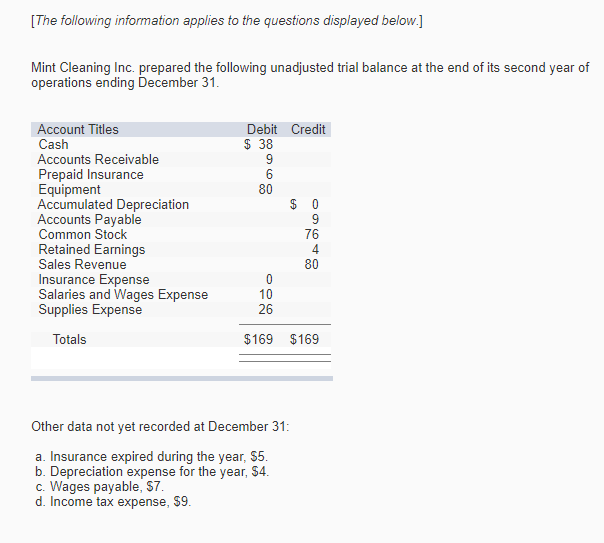

The following information applies to the questions displayed below.] Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations ending December 31 Account Titles Cash Accounts Receivable Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Common Stock Retained Earnings Sales Revenue Insurance Expense Salaries and Wages Expense Supplies Expense Debit Credit $ 38 80 76 4 80 10 26 Totals $169 $169 Other data not yet recorded at December 31 a. Insurance expired during the year, $5 b. Depreciation expense for the year, $4 c. Wages payable, S7 d. Income tax expense, $9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts