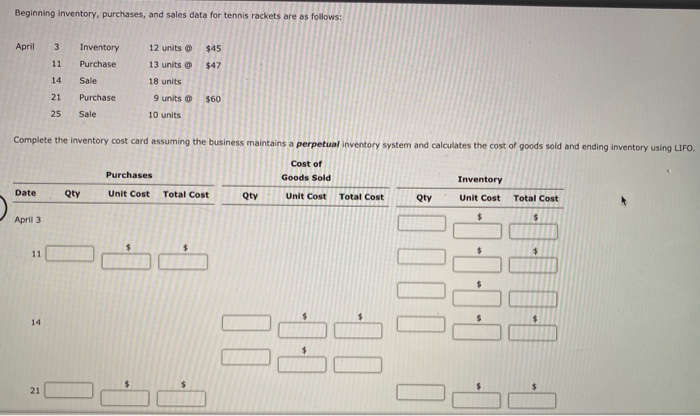

Question: PLEASE HELP ASAP!!! Beginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 12 units $45 Inventory Purchase 11 $47 13

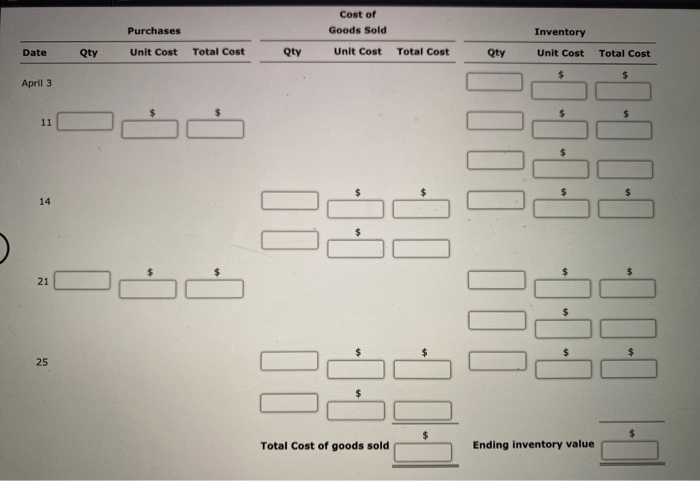

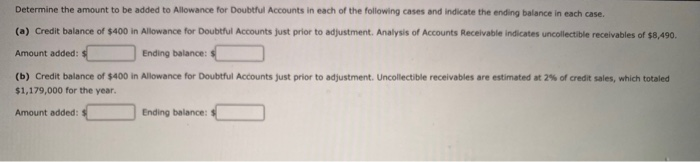

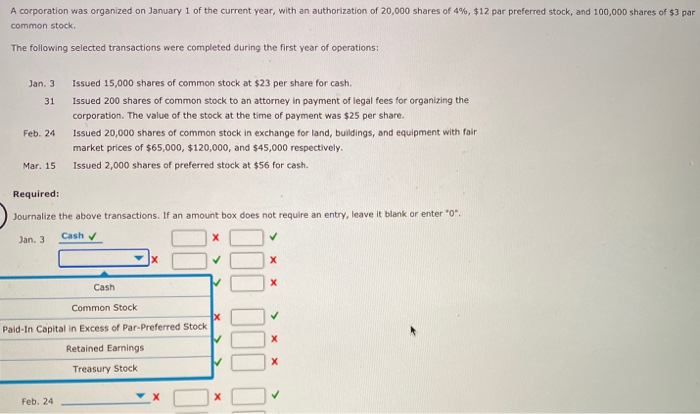

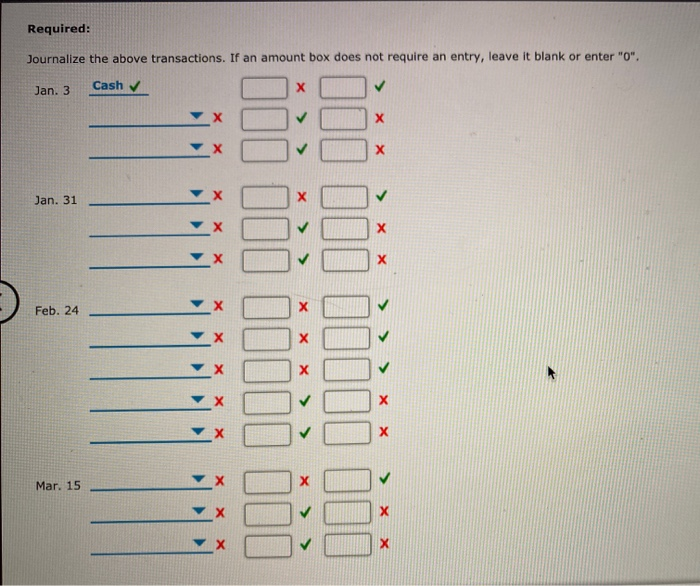

Beginning inventory, purchases, and sales data for tennis rackets are as follows: April 3 12 units $45 Inventory Purchase 11 $47 13 units @ 18 units 14 Sale 21 Purchase 9 units $60 25 Sale 10 units Complete the inventory cost card assuming the business maintains a perpetual inventory system and calculates the cost of goods sold and ending inventory using LIFO. Purchases Cost of Goods Sold Inventory Date Qty Unit Cost Total Cost Qty Unit Cost Total Cost Qty Unit Cost Total Cost April 3 $ $ 11 1-1-1-1-1 14 21 Cost of Goods Sold Purchases Date Qty Unit Cost Total Cost Qty Unit Cost Total Cost April 3 11 14 00 -- 01- 000 0000 --- ---- LCD LOL 0 0 LD- D. 21 25 Ending inventory value Amount added: Determine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. (a) Credit balance of $400 in Allowance for Doubtful Accounts just prior to adjustment. Analysis of Accounts Receivable indicates uncollectible receivables of $8,490. Ending balance (b) Credit balance of $400 in Allowance for Doubtful Accounts just prior to adjustment. Uncollectible receivables are estimated at 2% of credit sales, which totaled $1,179,000 for the year. Amount added: Ending balance: A corporation was organized on January 1 of the current year, with an authorization of 20,000 shares of 4%, $12 par preferred stock, and 100,000 shares of $3 par common stock The following selected transactions were completed during the first year of operations: Jan. 3 31 Issued 15,000 shares of common stock at $23 per share for cash. Issued 200 shares of common stock to an attorney in payment of legal fees for organizing the corporation. The value of the stock at the time of payment was $25 per share. Issued 20,000 shares of common stock in exchange for land, buildings, and equipment with fair market prices of $65,000, $120,000, and $45,000 respectively. Issued 2,000 shares of preferred stock at $56 for cash. Feb. 24 Mar. 15 Required: Journalize the above transactions. If an amount box does not require an entry, leave it blank or enter "o" Jan. 3 Cash X Cash Common Stock Pald-In Capital in Excess of Par-Preferred Stock Retained Earnings Treasury Stock Feb. 24 Required: Journalize the above transactions. If an amount box does not require an entry, leave it blank or enter "O". Jan. 3 Cash Jan. 31 88 Feb. 24 Mar. 15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts