Question: Make an Income Statement using this information. Current Attempt in Progress Sheridan Ltd. is a private corporation reporting under ASPE. It has recorded all necessary

Make an Income Statement using this information.

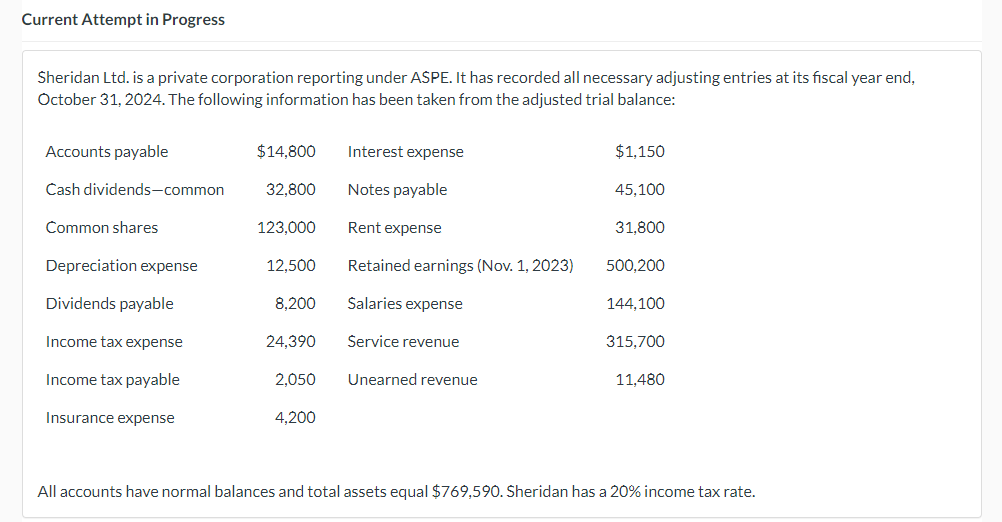

Current Attempt in Progress Sheridan Ltd. is a private corporation reporting under ASPE. It has recorded all necessary adjusting entries at its fiscal year end, October 31, 2024. The following information has been taken from the adjusted trial balance: Accounts payable $14,800 Interest expense $1,150 Cash dividends-common 32,800 Notes payable 45,100 Common shares 123,000 Rent expense 31,800 Depreciation expense 12,500 Retained earnings (Nov. 1, 2023) 500,200 Dividends payable 8,200 Salaries expense 144,100 Income tax expense 24,390 Service revenue 315,700 Income tax payable 2,050 Unearned revenue 11,480 Insurance expense 4,200 All accounts have normal balances and total assets equal $769,590. Sheridan has a 20% income tax rate.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts