Question: make income statement and balance sheet. please reply as soon as possible its urgent There are no results for Commission.: There are 4 salespersons. 3

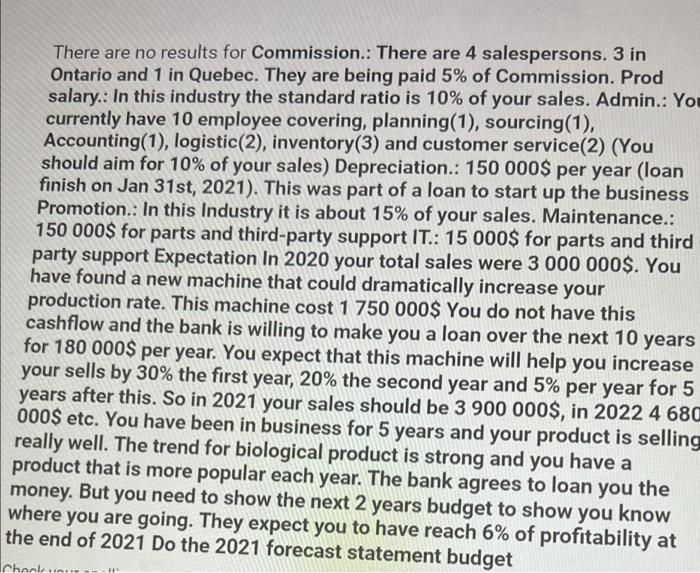

There are no results for Commission.: There are 4 salespersons. 3 in Ontario and 1 in Quebec. They are being paid 5% of Commission. Prod salary.: In this industry the standard ratio is 10% of your sales. Admin.: You currently have 10 employee covering, planning(1), sourcing (1), Accounting(1), logistic(2), inventory(3) and customer service (2) (You should aim for 10% of your sales) Depreciation.: 150 000$ per year (loan finish on Jan 31st, 2021). This was part of a loan to start up the business Promotion.: In this Industry it is about 15% of your sales. Maintenance.: 150 000$ for parts and third-party support IT.: 15 000$ for parts and third party support Expectation In 2020 your total sales were 3 000 000$. You have found a new machine that could dramatically increase your production rate. This machine cost 1 750 000$ You do not have this cashflow and the bank is willing to make you a loan over the next 10 years for 180 000$ per year. You expect that this machine will help you increase your sells by 30% the first year, 20% the second year and 5% per year for 5 years after this. So in 2021 your sales should be 3 900 000$, in 2022 4 680 000$ etc. You have been in business for 5 years and your product is selling really well. The trend for biological product is strong and you have a product that is more popular each year. The bank agrees to loan you the money. But you need to show the next 2 years budget to show you know where you are going. They expect you to have reach 6% of profitability at the end of 2021 Do the 2021 forecast statement budget Check your H There are no results for Commission.: There are 4 salespersons. 3 in Ontario and 1 in Quebec. They are being paid 5% of Commission. Prod salary.: In this industry the standard ratio is 10% of your sales. Admin.: You currently have 10 employee covering, planning(1), sourcing (1), Accounting(1), logistic(2), inventory(3) and customer service (2) (You should aim for 10% of your sales) Depreciation.: 150 000$ per year (loan finish on Jan 31st, 2021). This was part of a loan to start up the business Promotion.: In this Industry it is about 15% of your sales. Maintenance.: 150 000$ for parts and third-party support IT.: 15 000$ for parts and third party support Expectation In 2020 your total sales were 3 000 000$. You have found a new machine that could dramatically increase your production rate. This machine cost 1 750 000$ You do not have this cashflow and the bank is willing to make you a loan over the next 10 years for 180 000$ per year. You expect that this machine will help you increase your sells by 30% the first year, 20% the second year and 5% per year for 5 years after this. So in 2021 your sales should be 3 900 000$, in 2022 4 680 000$ etc. You have been in business for 5 years and your product is selling really well. The trend for biological product is strong and you have a product that is more popular each year. The bank agrees to loan you the money. But you need to show the next 2 years budget to show you know where you are going. They expect you to have reach 6% of profitability at the end of 2021 Do the 2021 forecast statement budget Check your H

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts