Question: What would the correct answers be? Sayed Help Sav. C3 Champion Contractors completed the following transactions involving equipment. Year 1 January 1 Paid $290,000 cash

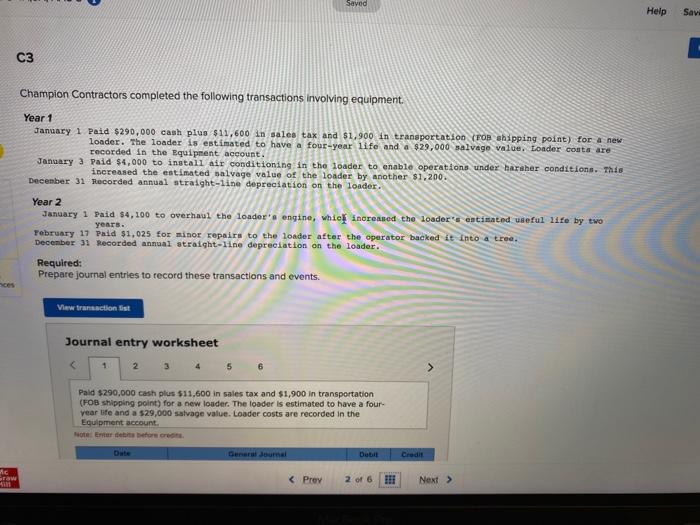

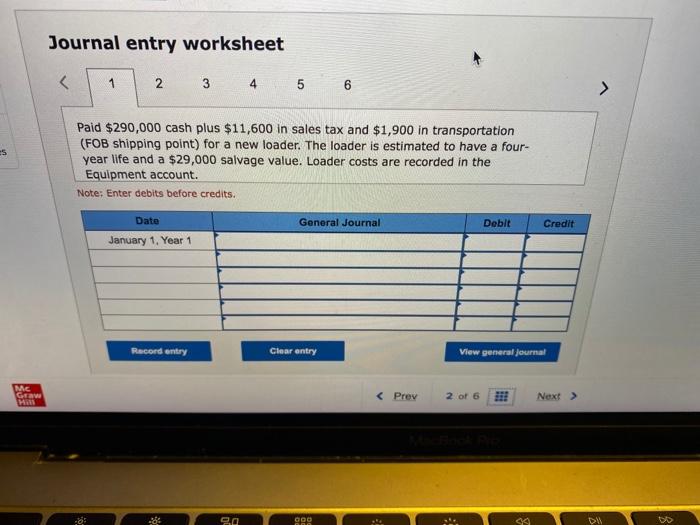

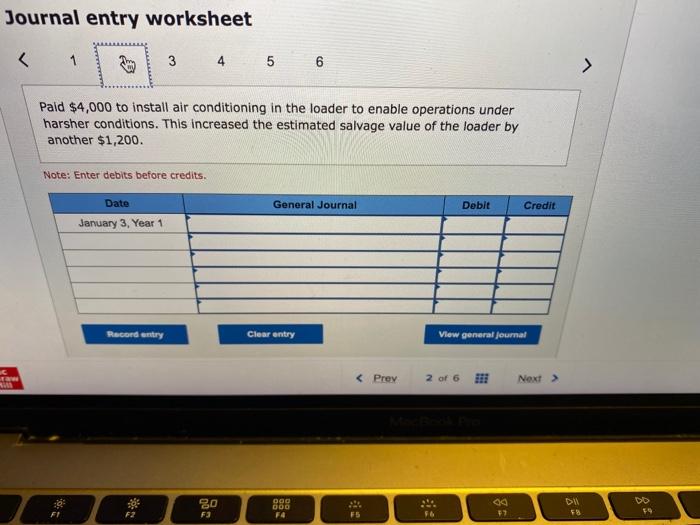

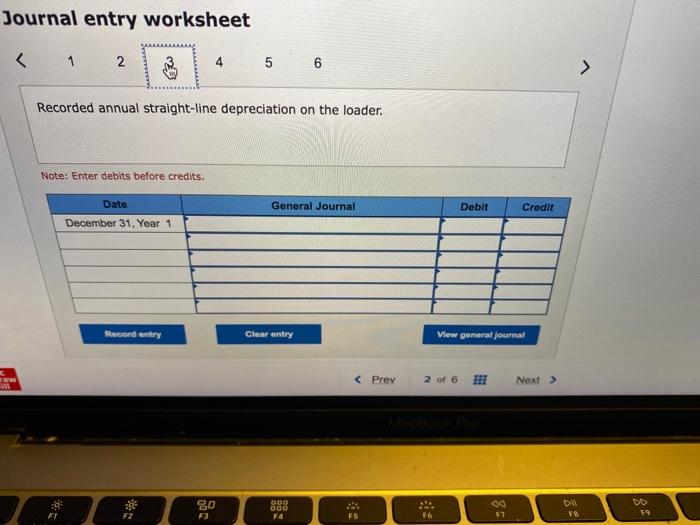

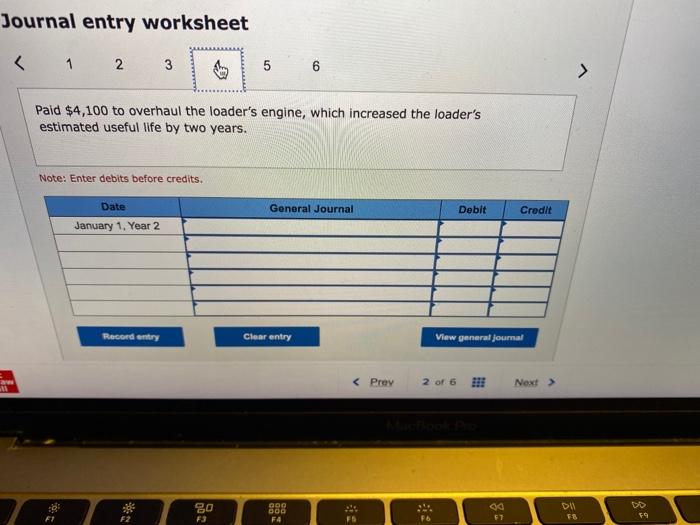

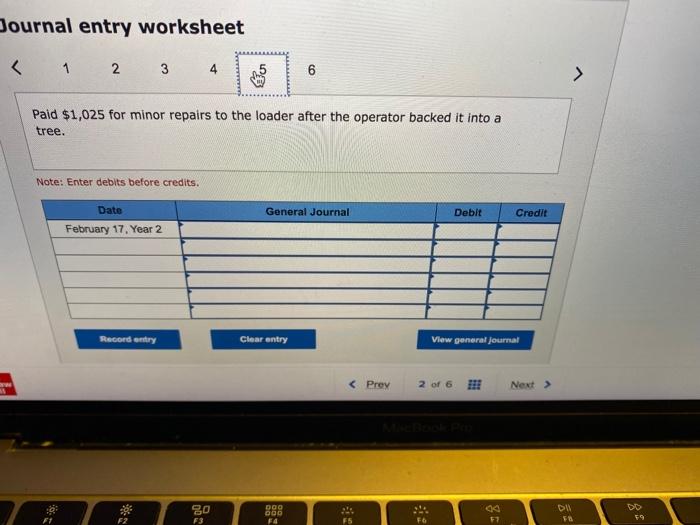

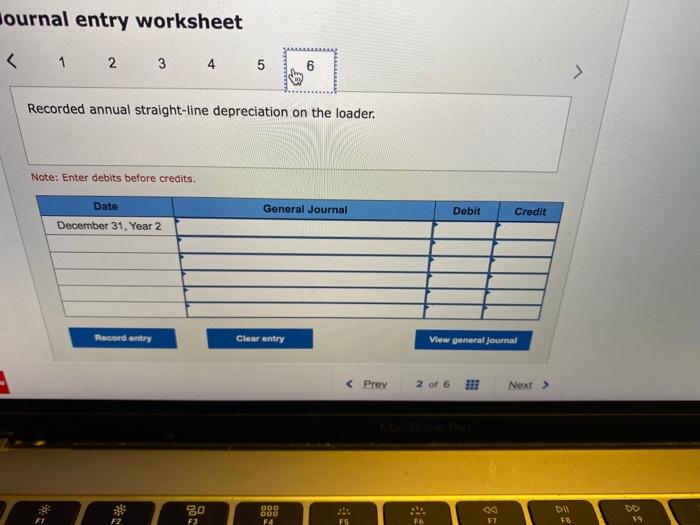

Sayed Help Sav. C3 Champion Contractors completed the following transactions involving equipment. Year 1 January 1 Paid $290,000 cash plus $11,600 in sales tax and $1,900 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $29,000 salvage value. Londer coats are recorded in the Equipment account. January 3 Paid $4,000 to install air conditioning in the loader to enable operations under barsher conditions. This increased the estimated salvage value of the loader by another $1,200. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $4,100 to overhaul the loader's engine, which increased the loader's estimated useful 111e by two years. February 17 Paid $1,025 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events. ces View transaction ist Journal entry worksheet 1 Paid $290,000 cash plus $11,600 in sales tax and $1,900 in transportation (FOB shipping point) for a new louder. The loader is estimated to have a four- year life and a $29,000 salvage value. Loader costs are recorded in the Equipment account Noter before con Dute General Journal Debit Credit c raw Journal entry worksheet 1 2 3 45 6 Paid $290,000 cash plus $11,600 in sales tax and $1,900 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four- year life and a $29,000 salvage value. Loader costs are recorded in the Equipment account. Note: Enter debits before credits. Date General Journal Debit January 1, Year 1 Credit Record entry Clear entry View general Journal Me w O 990 DU Do Journal entry worksheet 80 F3 000 000 F4 Di 58 FI F2 59 45 6 77 Journal entry worksheet 38 2008 00 GOO 000 FC DK FB F2 F5 F3 F6 77 59 Journal entry worksheet 11 DU 80 F3 009 DOO F4 og FT DO 9 FT F2 Journal entry worksheet 1 2 3 4 och 6 > Paid $1,025 for minor repairs to the loader after the operator backed it into a tree. Note: Enter debits before credits. General Journal Debit Credit Date February 17. Year 2 Record entry Clear entry View general journal 999 DU 20 F3 000 F4 325 FS 90 F7 59 Journal entry worksheet o 80 F3 000 DOO 14 DK F8 F2 FS 57 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts