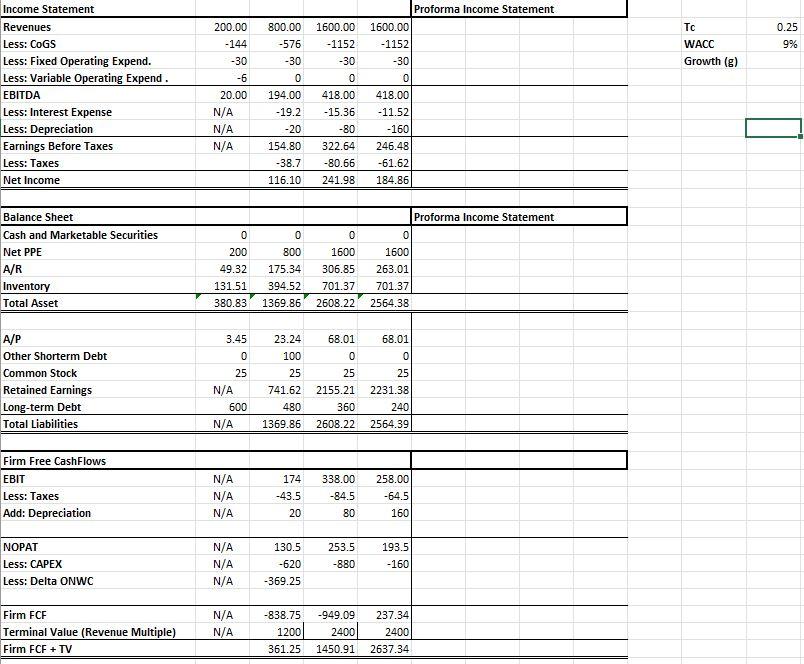

Question: Make predictions on the proforma income statement below with the given information on excel. Income Statement Proforma Income Statement Revenues Less: CoGS begin{tabular}{|r|r|} hline Tc

Make predictions on the proforma income statement below with the given information on excel.

Income Statement Proforma Income Statement Revenues Less: CoGS \begin{tabular}{|r|r|} \hline Tc & 0.25 \\ \hline WACC & 9% \\ \hline \end{tabular} Less: Fixed Operating Expend. Growth (g) Less: Variable Operating Expend. \begin{tabular}{|r|r|r|r|} \hline 200.00 & 800.00 & 1600.00 & 1600.00 \\ \hline-144 & -576 & -1152 & -1152 \\ \hline-30 & -30 & -30 & -30 \\ -6 & 0 & 0 & 0 \\ \hline \end{tabular} EBITDA Less: Interest Expense Less: Depreciation Earnings Before Taxes Les5: Taxes Net Income \begin{tabular}{|r|r|r|r|} \hline 20.00 & 194.00 & 418.00 & 418.00 \\ \hline N/A & -19.2 & -15.36 & -11.52 \\ \hline N/A & -20 & -80 & -160 \\ \hline N/A & 154.80 & 322.64 & 246.48 \\ & -38.7 & -80.66 & -61.62 \\ \hline & 116.10 & 241.98 & 184.86 \\ \hline \end{tabular} Balance Sheet Proforma Income Statement Cash and Marketable Securities Net PPE \begin{tabular}{l} A/R \\ Inventory \\ \hline \hline \\ \hline \hline \end{tabular} A/P Other Shorterm Debt Common Stock Retained Earnings Long-term Debt Total Liabilities N/A1369.862608.222564.39 Firm Free CashFlows EBIT Less: Taxes Add: Depreciation \begin{tabular}{|l|r|r|r|} \hline N/A & 174 & 338.00 & 258.00 \\ \hline N/A & -43.5 & -84.5 & -64.5 \\ \hline N/A & 20 & 80 & 160 \\ \hline \end{tabular} NOPAT Les5: CAPEX Less: Delta ONWC \begin{tabular}{|r|r|r|r|} \hline N/A & 130.5 & 253.5 & 193.5 \\ \hline N/A & -620 & -880 & -160 \\ \hline N/A & -369.25 & & \\ \hline \end{tabular} N/A 369.25 Firm FCF Terminal Value (Revenue Multiple) \begin{tabular}{|rrr|r|} \hline N/A & -838.75 & -949.09 & 237.34 \\ \hline N/A & 1200 & 2400 & 2400 \\ \hline & 361.25 & 1450.91 & 2637.34 \\ \hline \end{tabular} Income Statement Proforma Income Statement Revenues Less: CoGS \begin{tabular}{|r|r|} \hline Tc & 0.25 \\ \hline WACC & 9% \\ \hline \end{tabular} Less: Fixed Operating Expend. Growth (g) Less: Variable Operating Expend. \begin{tabular}{|r|r|r|r|} \hline 200.00 & 800.00 & 1600.00 & 1600.00 \\ \hline-144 & -576 & -1152 & -1152 \\ \hline-30 & -30 & -30 & -30 \\ -6 & 0 & 0 & 0 \\ \hline \end{tabular} EBITDA Less: Interest Expense Less: Depreciation Earnings Before Taxes Les5: Taxes Net Income \begin{tabular}{|r|r|r|r|} \hline 20.00 & 194.00 & 418.00 & 418.00 \\ \hline N/A & -19.2 & -15.36 & -11.52 \\ \hline N/A & -20 & -80 & -160 \\ \hline N/A & 154.80 & 322.64 & 246.48 \\ & -38.7 & -80.66 & -61.62 \\ \hline & 116.10 & 241.98 & 184.86 \\ \hline \end{tabular} Balance Sheet Proforma Income Statement Cash and Marketable Securities Net PPE \begin{tabular}{l} A/R \\ Inventory \\ \hline \hline \\ \hline \hline \end{tabular} A/P Other Shorterm Debt Common Stock Retained Earnings Long-term Debt Total Liabilities N/A1369.862608.222564.39 Firm Free CashFlows EBIT Less: Taxes Add: Depreciation \begin{tabular}{|l|r|r|r|} \hline N/A & 174 & 338.00 & 258.00 \\ \hline N/A & -43.5 & -84.5 & -64.5 \\ \hline N/A & 20 & 80 & 160 \\ \hline \end{tabular} NOPAT Les5: CAPEX Less: Delta ONWC \begin{tabular}{|r|r|r|r|} \hline N/A & 130.5 & 253.5 & 193.5 \\ \hline N/A & -620 & -880 & -160 \\ \hline N/A & -369.25 & & \\ \hline \end{tabular} N/A 369.25 Firm FCF Terminal Value (Revenue Multiple) \begin{tabular}{|rrr|r|} \hline N/A & -838.75 & -949.09 & 237.34 \\ \hline N/A & 1200 & 2400 & 2400 \\ \hline & 361.25 & 1450.91 & 2637.34 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts