Question: make project report on all CVP Analysis and Deco Components 12 and 14 are decorporated into other products manufactured and sold by the Company but

make project report on all

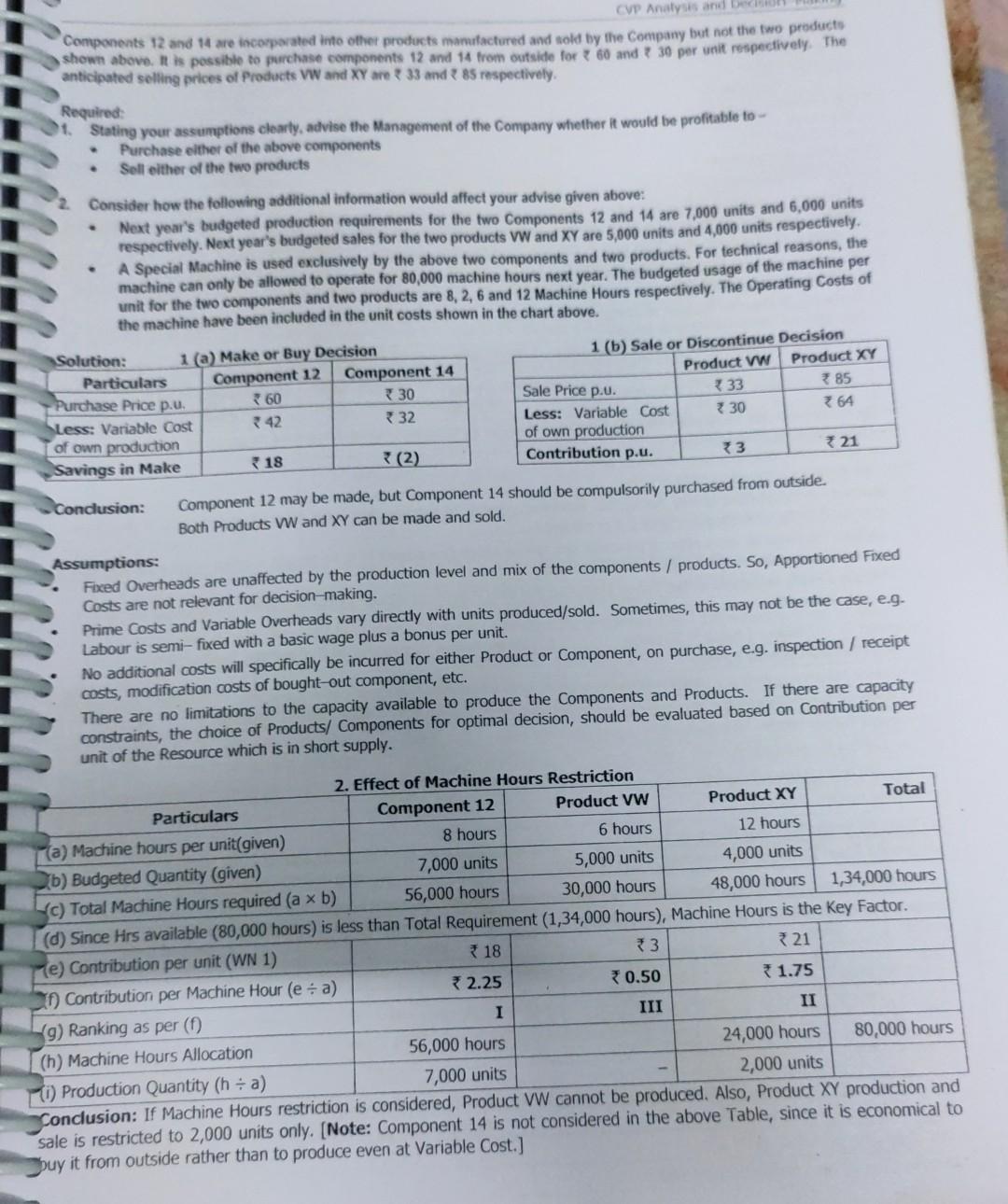

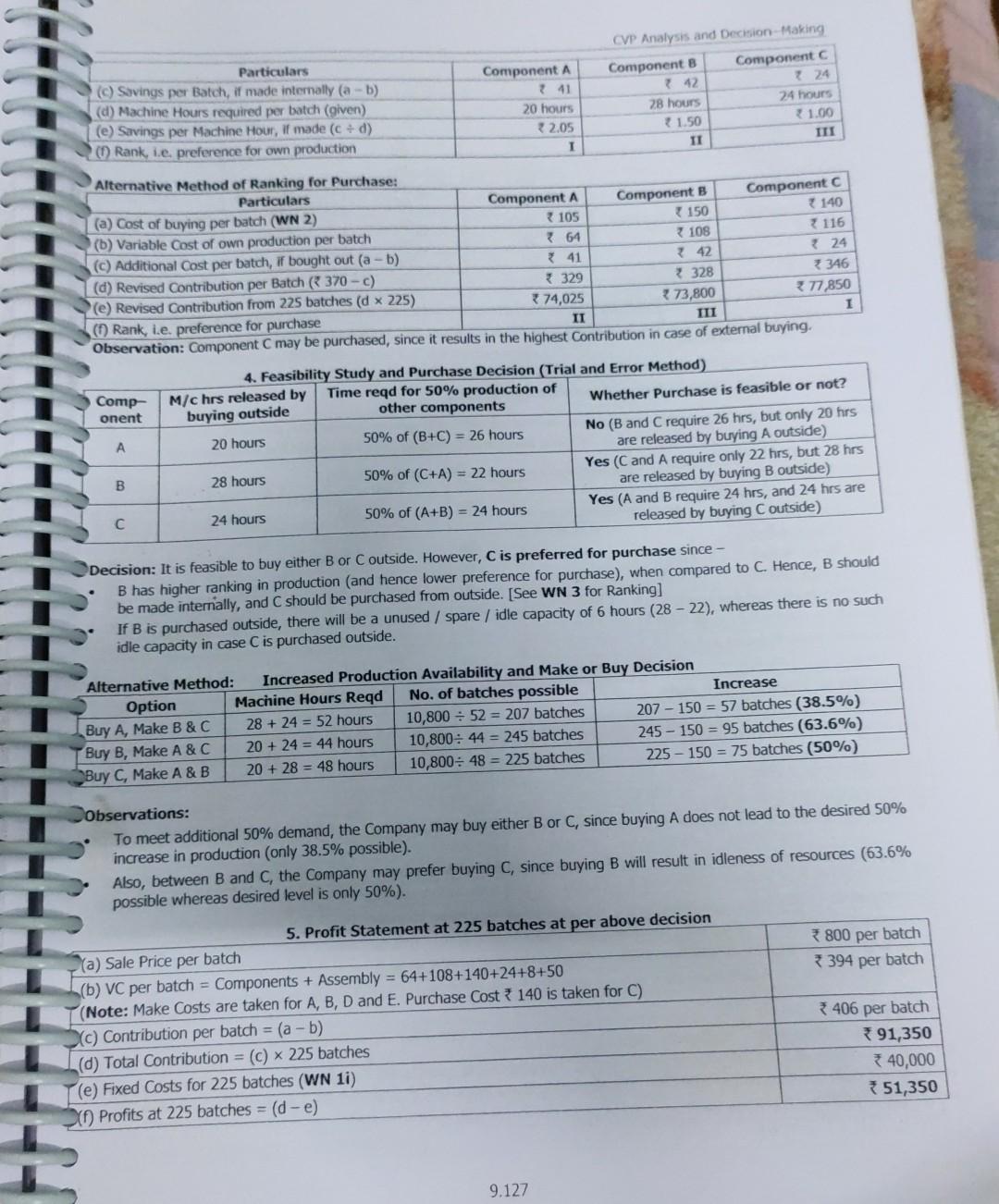

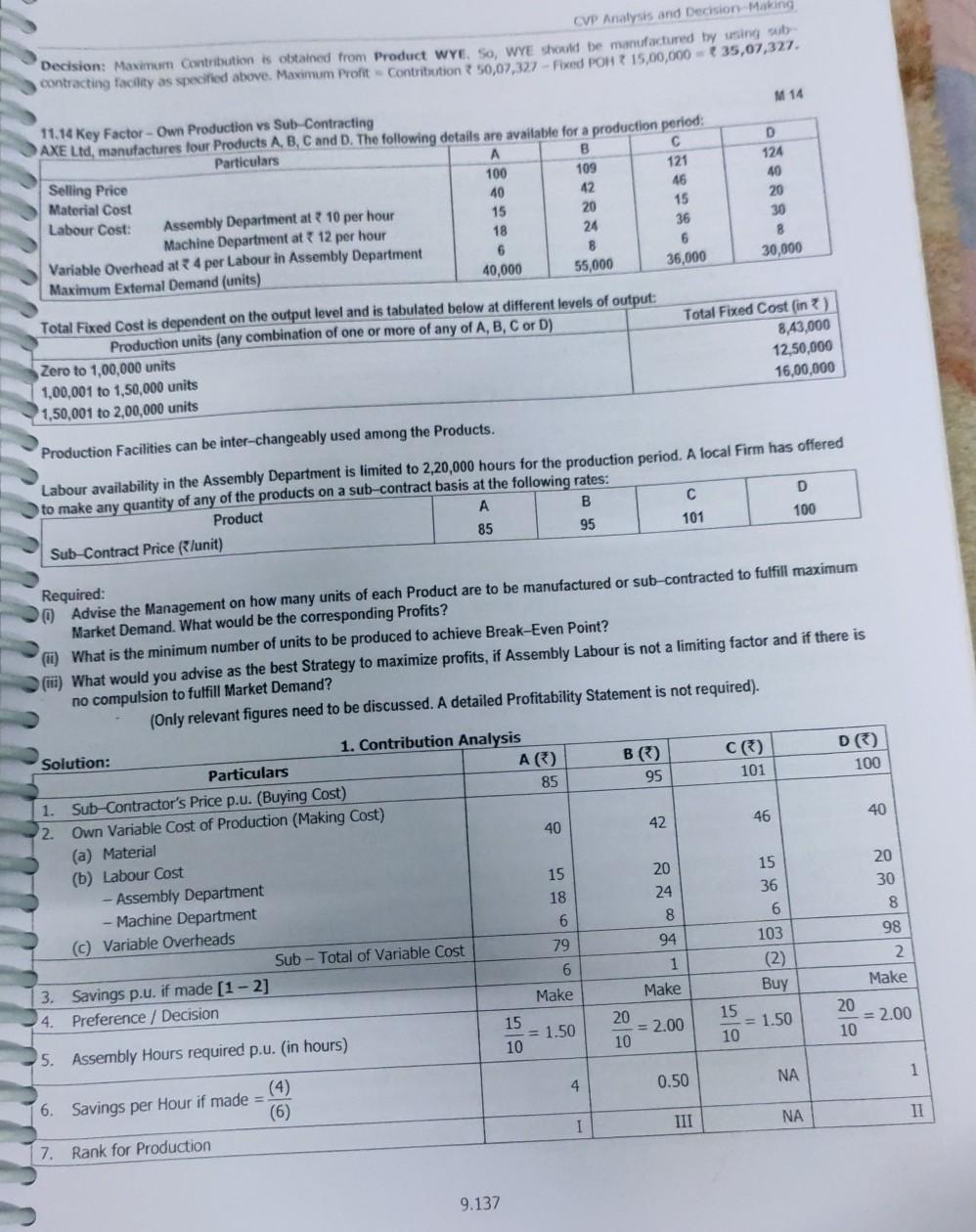

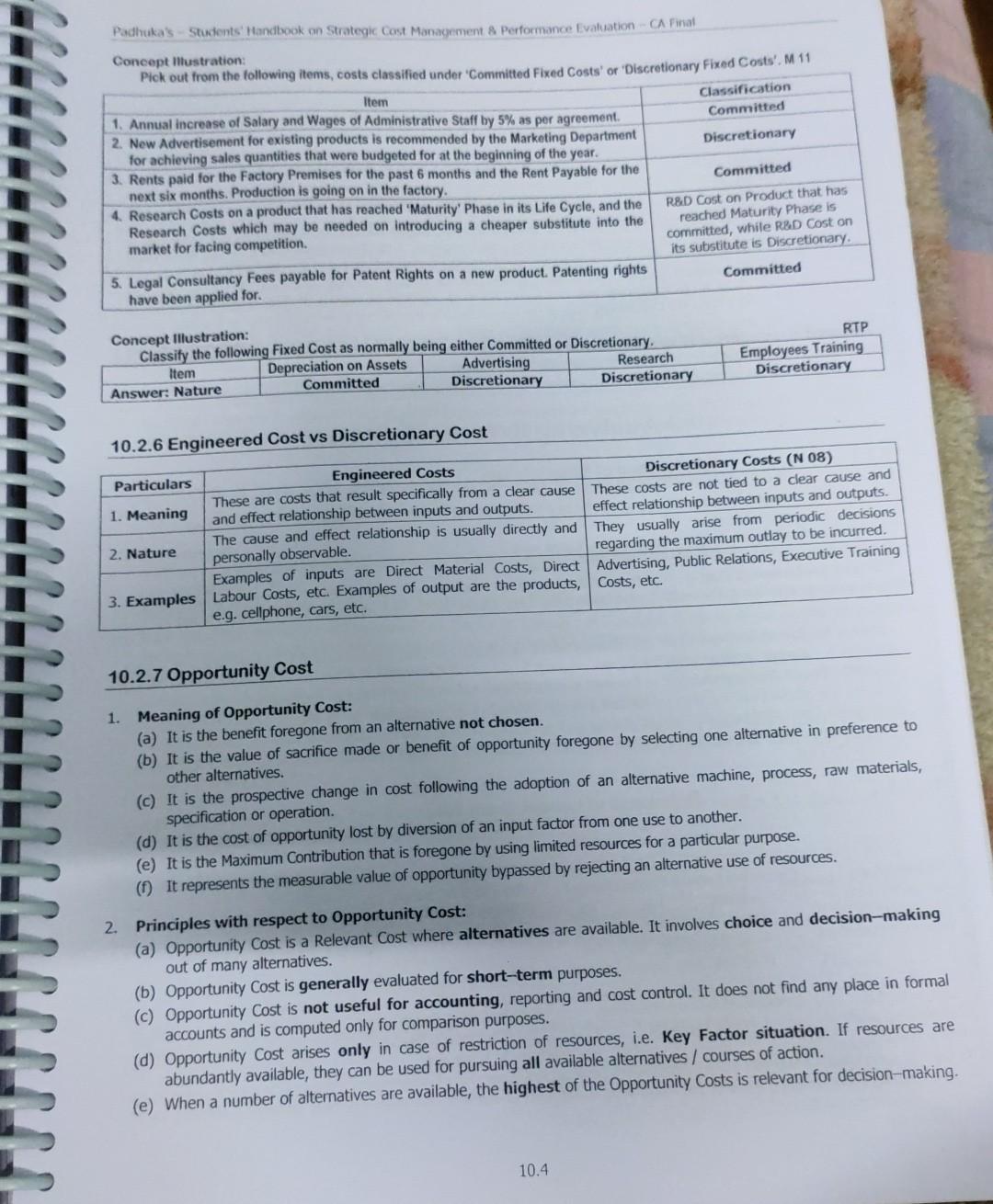

CVP Analysis and Deco Components 12 and 14 are decorporated into other products manufactured and sold by the Company but not the two producto shown above. It is possible to purchase components 12 and 14 from outside for a 60 and 30 por unit respectively. The anticipated selling prices of Products VW and XY are 33 and 85 respectively Required: 1. Stating your assumptions clearly, advise the Management of the Company whether it would be profitable to Purchase either of the above components Sell either of the two products Consider how the following additional information would affect your advise given above: Next year's budgeted production requirements for the two Components 12 and 14 are 7,000 units and 6,000 units respectively. Next year's budgeted sales for the two products VW and XY are 5,000 units and 4,000 units respectively. A Special Machine is used exclusively by the above two components and two products. For technical reasons, the machine can only be allowed to operate for 80,000 machine hours next year. The budgeted usage of the machine per unit for the two components and two products are 8, 2, 6 and 12 Machine Hours respectively. The Operating costs of the machine have been included in the unit costs shown in the chart above. Sale Price p.u. Solution: 1 (a) Make or Buy Decision Particulars Component 12 Component 14 Purchase Price p.u. 60 * 30 Less: Variable Cost 42 32 of own production Savings in Make 18 (2) 1 (b) Sale or Discontinue Decision Product Ww Product XY 33 85 Less: Variable Cost 30 364 of own production Contribution p.u. 73 21 Condusion: Component 12 may be made, but Component 14 should be compulsorily purchased from outside. Both Products VW and XY can be made and sold. Assumptions: Fixed Overheads are unaffected by the production level and mix of the components/products. So, Apportioned Fixed Costs are not relevant for decision-making. Prime Costs and Variable Overheads vary directly with units produced/sold. Sometimes, this may not be the case, e.g. Labour is semi-fixed with a basic wage plus a bonus per unit. No additional costs will specifically be incurred for either Product or Component, on purchase, e.g. inspection / receipt costs, modification costs of bought-out component, etc. There are no limitations to the capacity available to produce the Components and Products. If there are capacity constraints, the choice of Products/ Components for optimal decision, should be evaluated based on Contribution per unit of the Resource which is in short supply. 2. Effect of Machine Hours Restriction Particulars Component 12 Product VW Product XY Total (a) Machine hours per unit(given) 8 hours 6 hours 12 hours b) Budgeted Quantity (given) 7,000 units 5,000 units 4,000 units (c) Total Machine Hours required (a x b) 56,000 hours 30,000 hours 48,000 hours 1,34,000 hours (d) Since Hrs available (80,000 hours) is less than Total Requirement (1,34,000 hours), Machine Hours is the Key Factor. (e) Contribution per unit (WN 1) 18 3 21 Contribution per Machine Hour (e : a) 2.25 0.50 1.75 (9) Ranking as per (0) I III II (h) Machine Hours Allocation 56,000 hours 24,000 hours 80,000 hours 0) Production Quantity (h + a) 7,000 units 2,000 units Conclusion: If Machine Hours restriction is considered, Product WW cannot be produced. Also, Product XY production and sale is restricted to 2,000 units only. (Note: Component 14 is not considered in the above Table, since it is economical to buy it from outside rather than to produce even at Variable Cost.] Particulars ( Savings per Batch, if made internally (a - b) (d) Machine Hours required per batch (given) (e) Savings per Machine Hour, if made (c + d) Rank, i.e. preference for own production Component A 741 20 hours 22.05 1 CVP Analysis and Decision-making Component B Component 142 224 28 hours 24 hours 1.50 1.00 II ITT Alternative Method of Ranking for Purchase: Particulars Component A Component B Component (a) Cost of buying per batch (WN 2) 105 150 140 (b) Variable Cost of own production per batch 3 64 108 116 (c) Additional Cost per batch, if bought out (a - b) 41 42 24 (d) Revised Contribution per Batch ( 370 - c) 329 2328 346 (e) Revised Contribution from 225 batches (d x 225) 74,025 273,800 377,850 Rank, i.e. preference for purchase II III 1 Observation: Component C may be purchased, since it results in the highest Contribution in case of external buying. 4. Feasibility Study and Purchase Decision (Trial and Error Method) Comp- M/c hrs released by Time reqd for 50% production of onent buying outside other components Whether Purchase is feasible or not? 20 hours 50% of (B+C) = 26 hours No (B and C require 26 hrs, but only 20 firs are released by buying A outside) B 28 hours 50% of (C+A) = 22 hours Yes (C and A require only 22 hrs, but 28 hrs are released by buying B outside) Yes (A and B require 24 hrs, and 24 hrs are C 24 hours 50% of (A+B) = 24 hours released by buying Coutside) Decision: It is feasible to buy either B or Coutside. However, C is preferred for purchase since - B has higher ranking in production (and hence lower preference for purchase), when compared to C. Hence, B should be made internally, and C should be purchased from outside. [See WN 3 for Ranking] If B is purchased outside, there will be a unused / spare / idle capacity of 6 hours (28-22), whereas there is no such idle capacity in case C is purchased outside. Alternative Method: Increased Production Availability and Make or Buy Decision Option Machine Hours Reqd No. of batches possible Increase Buy A, Make B & C 28 + 24 = 52 hours 10,800 = 52 = 207 batches 207 - 150 = 57 batches (38.5%) Buy B, Make A &C 20 + 24 = 44 hours 10,800: 44 = 245 batches 245 - 150 = 95 batches (63.6%) Buy C, Make A&B 20 + 28 = 48 hours 10,800: 48 = 225 batches 225 - 150 = 75 batches (50%) Dobservations: To meet additional 50% demand, the Company may buy either B or C, since buying A does not lead to the desired 50% increase in production (only 38.5% possible). Also, between B and C, the Company may prefer buying C, since buying B will result in idleness of resources (63.6% possible whereas desired level is only 50%). 800 per batch 394 per batch 5. Profit Statement at 225 batches at per above decision (a) Sale Price per batch (b) VC per batch = Components + Assembly = 64+108+140+24+8+50 (Note: Make Costs are taken for A, B, D and E. Purchase Cost140 is taken for C) (c) Contribution per batch = (a - b) (d) Total Contribution = (c) * 225 batches (e) Fixed Costs for 225 batches (WN 11) X Profits at 225 batches = (de) 406 per batch 91,350 40,000 51,350 9.127 CVP Analysis and Decision Making Decision: Maximum Contribution is obtained from Product Wye. So, WYE should be manufactured by using wb contracting facility as specified above. Maximum Profit Contribution 50,07,322 - Fixed POH ? 15,00,000 - 35,07,327. M 14 121 11.14 Key Factor-Own Production vs Subs Contracting AXE Ltd, manufactures four Products A, B, C and D. The following details are available for a production period: Particulars A B Selling Price 100 109 Material Cost 40 42 46 Labour Cost: Assembly Department at 10 per hour 15 20 15 Machine Department at 12 per hour 18 24 36 Variable Overhead at 4 per Labour in Assembly Department 6 B 6 Maximum External Demand (units) 40,000 55,000 36,000 D 124 40 20 30 8 30,000 Total Fixed Cost is dependent on the output level and is tabulated below at different levels of output: Production units (any combination of one or more of any of A, B, C or D) Zero to 1,00,000 units 1,00,001 to 1,50,000 units 1,50,001 to 2,00,000 units Total Fixed Cost (in) 8,43,000 12,50,000 16,00,000 Production Facilities can be inter-changeably used among the Products. B Labour availability in the Assembly Department is limited to 2,20,000 hours for the production period. A local Firm has offered to make any quantity of any of the products on a sub-contract basis at the following rates: Product A D Sub-Contract Price R/unit) 85 95 101 100 Required: O Advise the Management on how many units of each Product are to be manufactured or sub-contracted to fulfill maximum Market Demand. What would be the corresponding Profits? () What is the minimum number of units to be produced to achieve Break-Even Point? (11) What would you advise as the best Strategy to maximize profits, if Assembly Labour is not a limiting factor and if there is no compulsion to fulfill Market Demand? (Only relevant figures need to be discussed. A detailed profitability Statement is not required). B) 95 C) 101 D) 100 46 40 42 20 24 8 94 15 36 6 Solution: 1. Contribution Analysis Particulars A) 85 1. Sub-Contractor's Price p.u. (Buying Cost) 2. Own Variable Cost of Production (Making Cost) 40 (a) Material (b) Labour Cost 15 - Assembly Department Machine Department 18 6 (c) Variable Overheads Sub - Total of Variable Cost 79 6 3. Savings p.u. if made (1 -2] 4. Preference / Decision Make 15 5. Assembly Hours required p.u. (in hours) = 1.50 10 (4) 6. Savings per Hour if made = 4 (6) 7. Rank for Production 1 20 30 8 98 2 1 103 (2) Buy Make 20 = 2.00 10 15 = 1.50 10 Make 20 = 2.00 10 1 NA 0.50 II NA III 9.137 Padhuka's Students Handbook on Strategic Cost Management & Performance Evaluation Carral Concept Illustration: Pick out from the following items, costs classified under "Committed Fixed Costs' or Discretionary Fixed Costs'. M 11 Item Classification 1. Annual increase of Salary and Wages of Administrative Staff by 5% as per agreement. Committed 2. New Advertisement for existing products is recommended by the Marketing Department for achieving sales quantities that were budgeted for at the beginning of the year. Discretionary 3. Rents paid for the Factory Premises for the past 6 months and the Rent Payable for the next six months. Production is going on in the factory Committed 4. Research Costs on a product that has reached Maturity' Phase in its Life Cycle, and the R&D Cost on Product that has Research Costs which may be needed on introducing a cheaper substitute into the reached Maturity Phase is market for facing competition. committed, while R&D Cost on its substitute is Discretionary. 5. Legal Consultancy Fees payable for Patent Rights on a new product. Patenting rights Committed have been applied for. Concept Illustration: Classify the following Fixed Cost as normally being either Committed or Discretionary. Item Depreciation on Assets Advertising Research Answer: Nature Committed Discretionary Discretionary RTP Employees Training Discretionary 10.2.6 Engineered Cost vs Discretionary Cost Particulars Engineered Costs Discretionary Costs (N 08) These are costs that result specifically from a clear cause 1. Meaning These costs are not tied to a clear cause and and effect relationship between inputs and outputs. effect relationship between inputs and outputs. The cause and effect relationship is usually directly and They usually arise from periodic decisions 2. Nature personally observable. regarding the maximum outlay to be incurred. Examples of inputs are Direct Material Costs, Direct Advertising, Public Relations, Executive Training 3. Examples Labour Costs, etc. Examples of output are the products, Costs, etc. e.g. cellphone, cars, etc. 10.2.7 Opportunity Cost 1. Meaning of Opportunity Cost: (a) It is the benefit foregone from an alternative not chosen. (b) It is the value of sacrifice made or benefit of opportunity foregone by selecting one alternative in preference to other alternatives. (C) It is the prospective change in cost following the adoption of an alternative machine, process, raw materials, specification or operation. (d) It is the cost of opportunity lost by diversion of an input factor from one use to another. (e) It is the Maximum Contribution that is foregone by using limited resources for a particular purpose. (1). It represents the measurable value of opportunity bypassed by rejecting an alternative use of resources. 2. Principles with respect to Opportunity Cost: (a) Opportunity cost is a Relevant Cost where alternatives are available. It involves choice and decision-making out of many alternatives. (b) Opportunity Cost is generally evaluated for short-term purposes. (c) Opportunity Cost is not useful for accounting, reporting and cost control. It does not find any place in formal accounts and is computed only for comparison purposes. (d) Opportunity Cost arises only in case of restriction of resources, i.e. Key Factor situation. If resources are abundantly available, they can be used for pursuing all available alternatives / courses of action. (e) When a number of alternatives are available, the highest of the Opportunity Costs is relevant for decision-making. 10.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts