Question: Make sure that you show all your computations. Results without support will be ignored. At the same time support for your results will earn partial

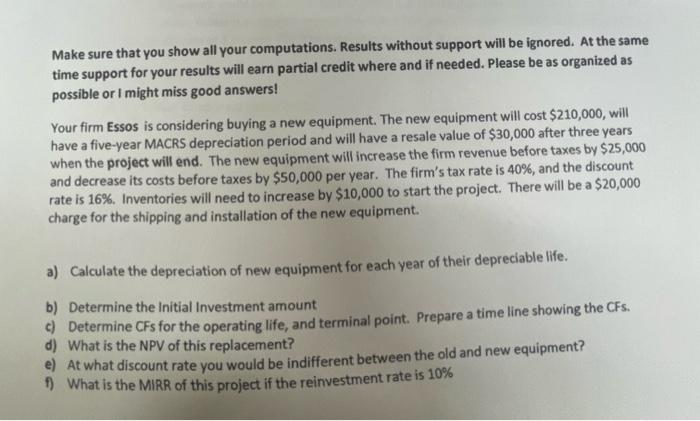

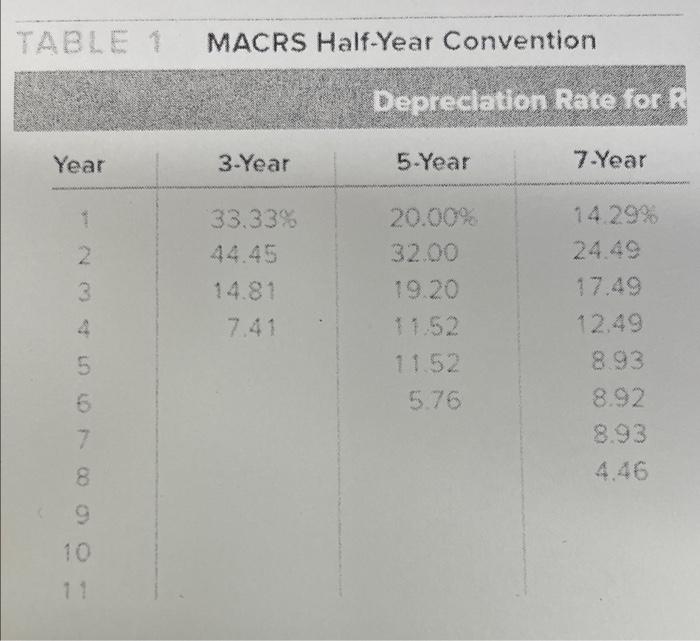

Make sure that you show all your computations. Results without support will be ignored. At the same time support for your results will earn partial credit where and if needed. Please be as organized as possible or I might miss good answers! Your firm Essos is considering buying a new equipment. The new equipment will cost $210,000, will have a five-year MACRS depreciation period and will have a resale value of $30,000 after three years when the project will end. The new equipment will increase the firm revenue before taxes by $25,000 and decrease its costs before taxes by $50,000 per year. The firm's tax rate is 40%, and the discount rate is 16%. Inventories will need to increase by $10,000 to start the project. There will be a $20,000 charge for the shipping and installation of the new equipment. a a) Calculate the depreciation of new equipment for each year of their depreciable life. b) Determine the initial Investment amount Determine CFs for the operating life, and terminal point. Prepare a time line showing the CFs. d) What is the NPV of this replacement? e) At what discount rate you would be indifferent between the old and new equipment? What is the MIRR of this project if the reinvestment rate is 10% MACRS Half-Year Convention Depreciation Rate for R Year 3-Year 5-Year 7-Year 33.33% 44.45 20.00% 32.00 14.29% 24.49 3 4 5 00017 N 11.52 11.52 5.76 6 8.93 8.92 8.93 8 9 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts