Question: MAKE SURE TO ANSWER THIS WHOLE SECTION. This is 1 question with 2 parts . AKA... 1 QUESTION. Thanks! I DO NOT NEED AN EXPLANATION,

MAKE SURE TO ANSWER THIS WHOLE SECTION. This is 1 question with 2 parts. AKA...1 QUESTION.Thanks!

I DO NOT NEED AN EXPLANATION, JUST THE ANSWER

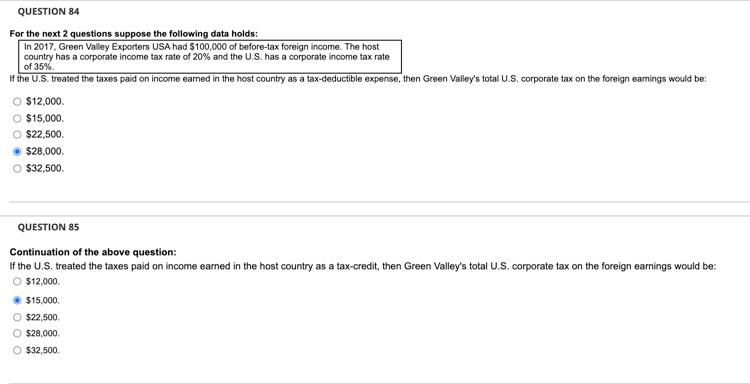

QUESTION 84 For the next 2 questions suppose the following data holds: In 2017. Green Valley Exporters USA had $100,000 of before-tax foreign income. The host country has a corporate income tax rate of 20% and the U.S. has a corporate income tax rate of 35% if the U.S. treated the taxes paid on income earned in the host country as a tax-deductible expense, then Green Valley's total U.S. corporate tax on the foreign earnings would be: O $12.000 $15,000 O $22,500 $28.000 $32,500 QUESTION 85 Continuation of the above question: If the U.S. treated the taxes paid on income earned in the host country as a tax-credit, then Green Valley's total U.S. corporate tax on the foreign earnings would be: $12,000. $15.000 $22,500. $28.000 $32,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts