Question: MAKE SURE YOU COMPLETE ALL QUESTIONS WITHIN THIS PROBLEM. THERE ARE 14 DROPDOWN BOXES TO COMPLETE. You will receive partial credit for all correct answers.

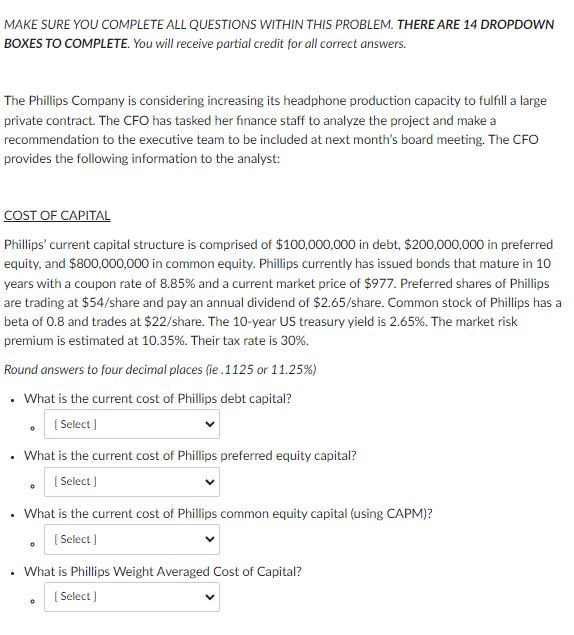

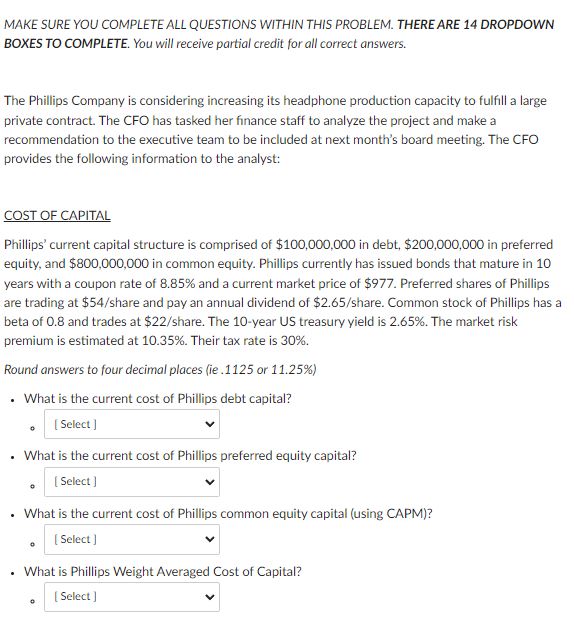

MAKE SURE YOU COMPLETE ALL QUESTIONS WITHIN THIS PROBLEM. THERE ARE 14 DROPDOWN BOXES TO COMPLETE. You will receive partial credit for all correct answers. The Phillips Company is considering increasing its headphone production capacity to fulfill a large private contract. The CFO has tasked her finance staff to analyze the project and make a recommendation to the executive team to be included at next month's board meeting. The CFO provides the following information to the analyst: COST OF CAPITAL Phillips' current capital structure is comprised of $100,000,000 in debt, $200,000,000 in preferred equity, and $800,000,000 in common equity. Phillips currently has issued bonds that mature in 10 years with a coupon rate of 8.85% and a current market price of $977. Preferred shares of Phillips are trading at $54/ share and pay an annual dividend of $2.65/ share. Common stock of Phillips has a beta of 0.8 and trades at $22/ share. The 10 -year US treasury yield is 2.65%. The market risk premium is estimated at 10.35%. Their tax rate is 30%. Round answers to four decimal places (ie.1125 or 11.25% ) - What is the current cost of Phillips debt capital? - What is the current cost of Phillips preferred equity capital? -What is the current cost of Phillips common equity capital (using CAPM)? -What is Phillips Weight Averaged Cost of Capital? MAKE SURE YOU COMPLETE ALL QUESTIONS WITHIN THIS PROBLEM. THERE ARE 14 DROPDOWN BOXES TO COMPLETE. You will receive partial credit for all correct answers. The Phillips Company is considering increasing its headphone production capacity to fulfill a large private contract. The CFO has tasked her finance staff to analyze the project and make a recommendation to the executive team to be included at next month's board meeting. The CFO provides the following information to the analyst: COST OF CAPITAL Phillips' current capital structure is comprised of $100,000,000 in debt, $200,000,000 in preferred equity, and $800,000,000 in common equity. Phillips currently has issued bonds that mature in 10 years with a coupon rate of 8.85% and a current market price of $977. Preferred shares of Phillips are trading at $54/ share and pay an annual dividend of $2.65/ share. Common stock of Phillips has a beta of 0.8 and trades at $22/ share. The 10 -year US treasury yield is 2.65%. The market risk premium is estimated at 10.35%. Their tax rate is 30%. Round answers to four decimal places (ie.1125 or 11.25% ) - What is the current cost of Phillips debt capital? - What is the current cost of Phillips preferred equity capital? -What is the current cost of Phillips common equity capital (using CAPM)? -What is Phillips Weight Averaged Cost of Capital? MAKE SURE YOU COMPLETE ALL QUESTIONS WITHIN THIS PROBLEM. THERE ARE 14 DROPDOWN BOXES TO COMPLETE. You will receive partial credit for all correct answers. The Phillips Company is considering increasing its headphone production capacity to fulfill a large private contract. The CFO has tasked her finance staff to analyze the project and make a recommendation to the executive team to be included at next month's board meeting. The CFO provides the following information to the analyst: COST OF CAPITAL Phillips' current capital structure is comprised of $100,000,000 in debt, $200,000,000 in preferred equity, and $800,000,000 in common equity. Phillips currently has issued bonds that mature in 10 years with a coupon rate of 8.85% and a current market price of $977. Preferred shares of Phillips are trading at $54/ share and pay an annual dividend of $2.65/ share. Common stock of Phillips has a beta of 0.8 and trades at $22/ share. The 10 -year US treasury yield is 2.65%. The market risk premium is estimated at 10.35%. Their tax rate is 30%. Round answers to four decimal places (ie.1125 or 11.25% ) - What is the current cost of Phillips debt capital? - What is the current cost of Phillips preferred equity capital? -What is the current cost of Phillips common equity capital (using CAPM)? -What is Phillips Weight Averaged Cost of Capital? MAKE SURE YOU COMPLETE ALL QUESTIONS WITHIN THIS PROBLEM. THERE ARE 14 DROPDOWN BOXES TO COMPLETE. You will receive partial credit for all correct answers. The Phillips Company is considering increasing its headphone production capacity to fulfill a large private contract. The CFO has tasked her finance staff to analyze the project and make a recommendation to the executive team to be included at next month's board meeting. The CFO provides the following information to the analyst: COST OF CAPITAL Phillips' current capital structure is comprised of $100,000,000 in debt, $200,000,000 in preferred equity, and $800,000,000 in common equity. Phillips currently has issued bonds that mature in 10 years with a coupon rate of 8.85% and a current market price of $977. Preferred shares of Phillips are trading at $54/ share and pay an annual dividend of $2.65/ share. Common stock of Phillips has a beta of 0.8 and trades at $22/ share. The 10 -year US treasury yield is 2.65%. The market risk premium is estimated at 10.35%. Their tax rate is 30%. Round answers to four decimal places (ie.1125 or 11.25% ) - What is the current cost of Phillips debt capital? - What is the current cost of Phillips preferred equity capital? -What is the current cost of Phillips common equity capital (using CAPM)? -What is Phillips Weight Averaged Cost of Capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts