Question: Make the answers very obvious please, the work doesn't matter to much to me. I just need to easily be able to input the correct

Make the answers very obvious please, the work doesn't matter to much to me. I just need to easily be able to input the correct answers! thank u!

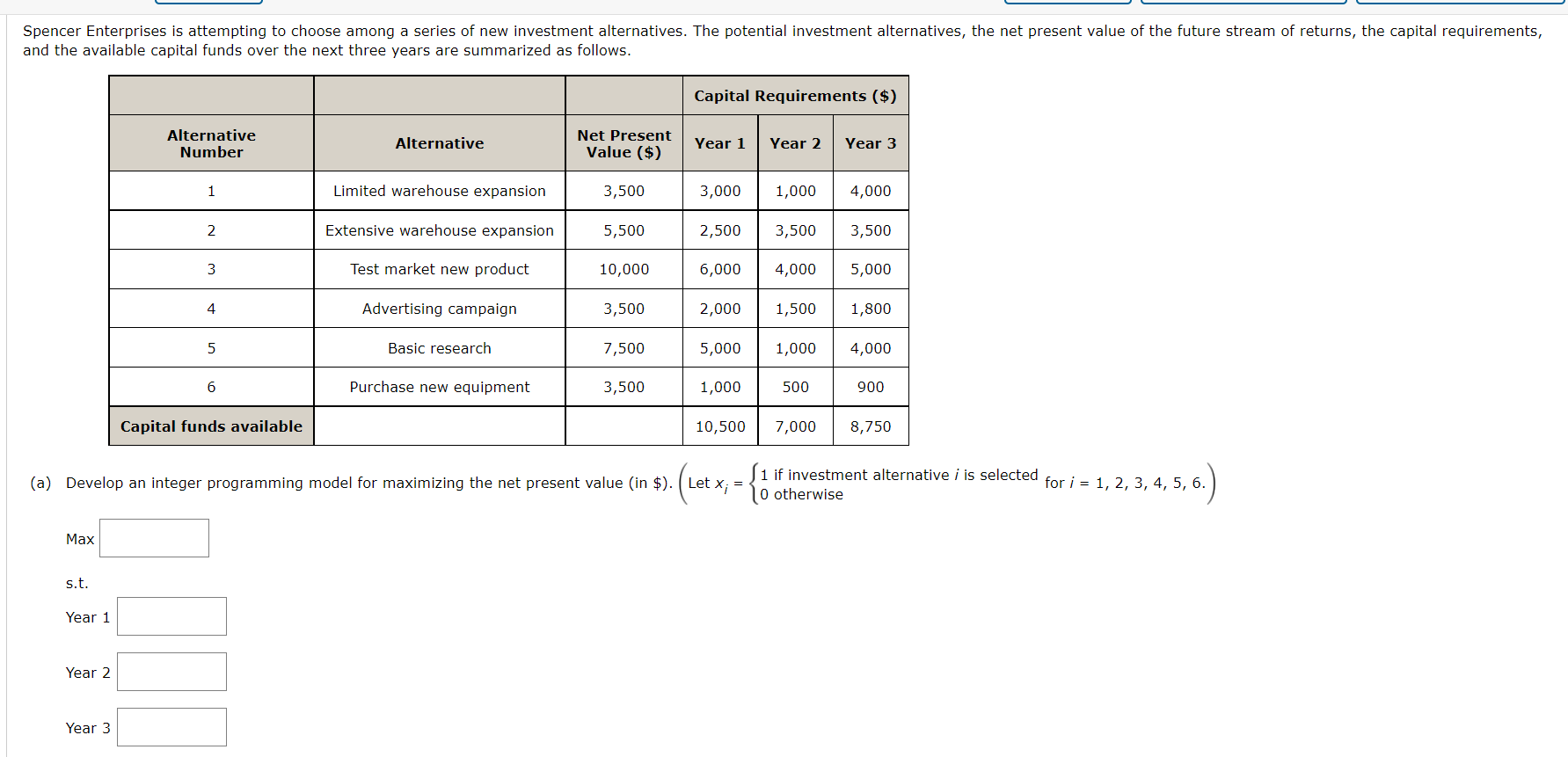

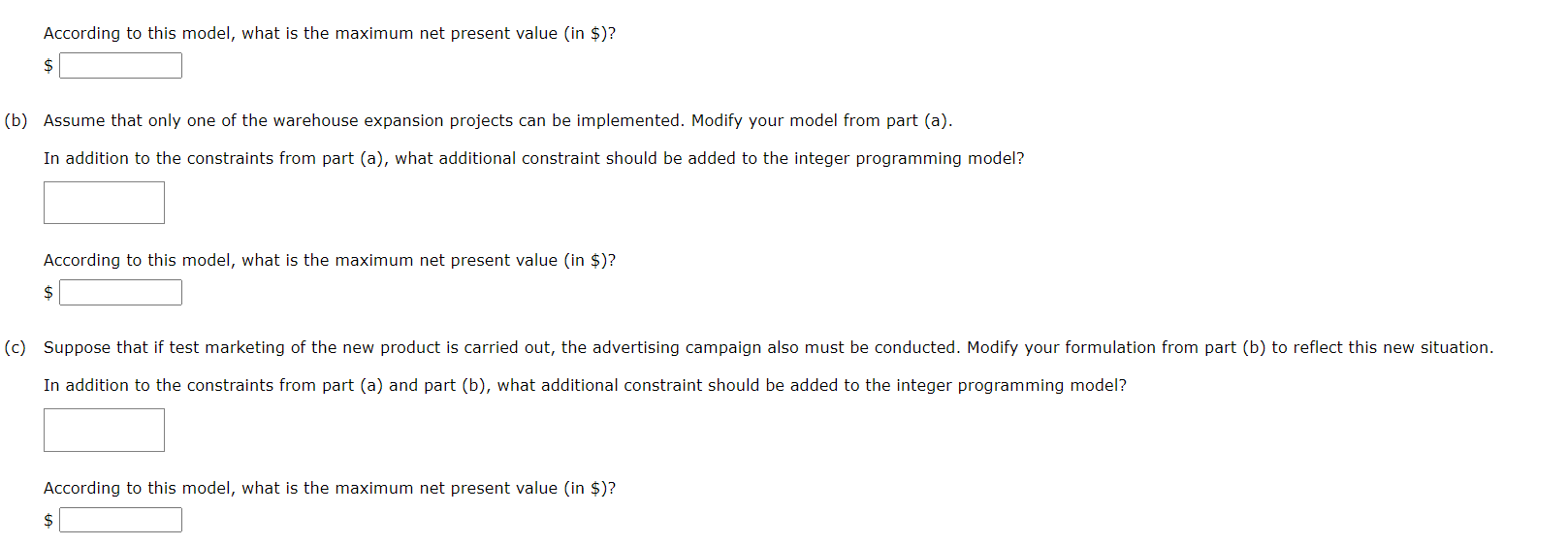

(a) Develop an integer programming model for maximizing the net present value (in $ ). (Let xi={1ifinvestmentalternativeiisselected0otherwisei=1,2,3,4,5,6.) Max s.t. Year 1 Year 2 Year 3 According to this model, what is the maximum net present value (in \$)? $ (b) Assume that only one of the warehouse expansion projects can be implemented. Modify your model from part (a). In addition to the constraints from part (a), what additional constraint should be added to the integer programming model? According to this model, what is the maximum net present value (in \$)? $ In addition to the constraints from part (a) and part (b), what additional constraint should be added to the integer programming model? According to this model, what is the maximum net present value (in $ )? $ (a) Develop an integer programming model for maximizing the net present value (in $ ). (Let xi={1ifinvestmentalternativeiisselected0otherwisei=1,2,3,4,5,6.) Max s.t. Year 1 Year 2 Year 3 According to this model, what is the maximum net present value (in \$)? $ (b) Assume that only one of the warehouse expansion projects can be implemented. Modify your model from part (a). In addition to the constraints from part (a), what additional constraint should be added to the integer programming model? According to this model, what is the maximum net present value (in \$)? $ In addition to the constraints from part (a) and part (b), what additional constraint should be added to the integer programming model? According to this model, what is the maximum net present value (in $ )? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts