Question: Malt Ltd is considering a new project that will require equipment costing $2,000,000. The company believes the project will generate after-tax cash flows of

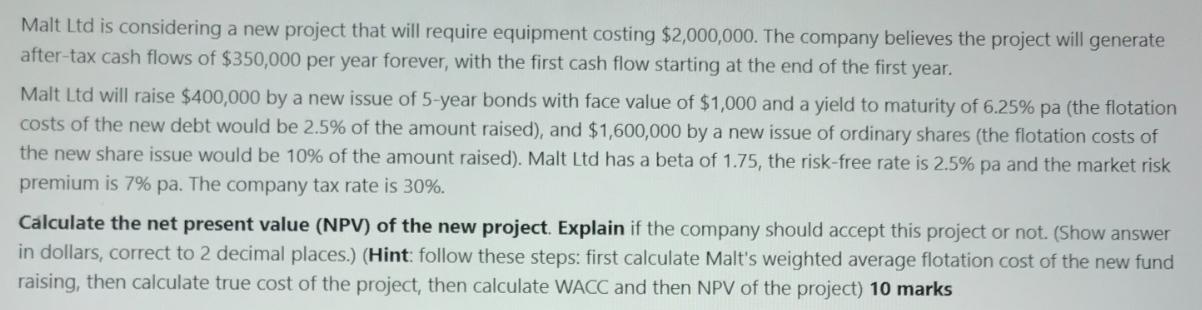

Malt Ltd is considering a new project that will require equipment costing $2,000,000. The company believes the project will generate after-tax cash flows of $350,000 per year forever, with the first cash flow starting at the end of the first year. Malt Ltd will raise $400,000 by a new issue of 5-year bonds with face value of $1,000 and a yield to maturity of 6.25% pa (the flotation costs of the new debt would be 2.5% of the amount raised), and $1,600,000 by a new issue of ordinary shares (the flotation costs of the new share issue would be 10% of the amount raised). Malt Ltd has a beta of 1.75, the risk-free rate is 2.5% pa and the market risk premium is 7% pa. The company tax rate is 30%. Calculate the net present value (NPV) of the new project. Explain if the company should accept this project or not. (Show answer in dollars, correct to 2 decimal places.) (Hint: follow these steps: first calculate Malt's weighted average flotation cost of the new fund raising, then calculate true cost of the project, then calculate WACC and then NPV of the project) 10 marks

Step by Step Solution

There are 3 Steps involved in it

To calculate the net present value NPV of the new project we need to follow these steps 1 Calculate ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

663e3b3e2ce0c_959428.pdf

180 KBs PDF File

663e3b3e2ce0c_959428.docx

120 KBs Word File