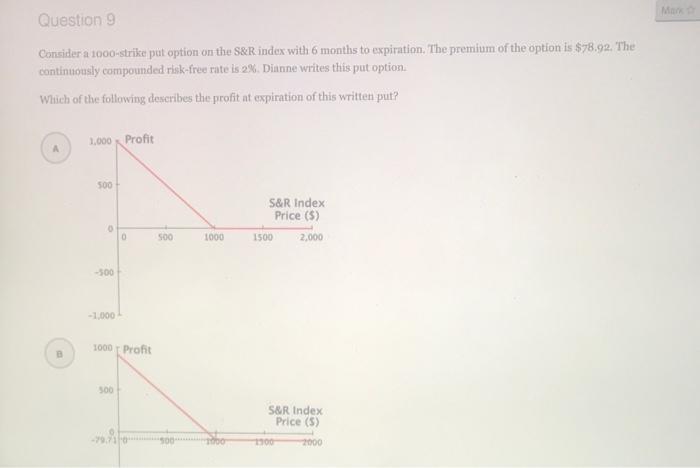

Question: Man Question 9 Consider a 1000-strike put option on the S&Rindex with 6 months to expiration. The premium of the option is $78,92. The continuously

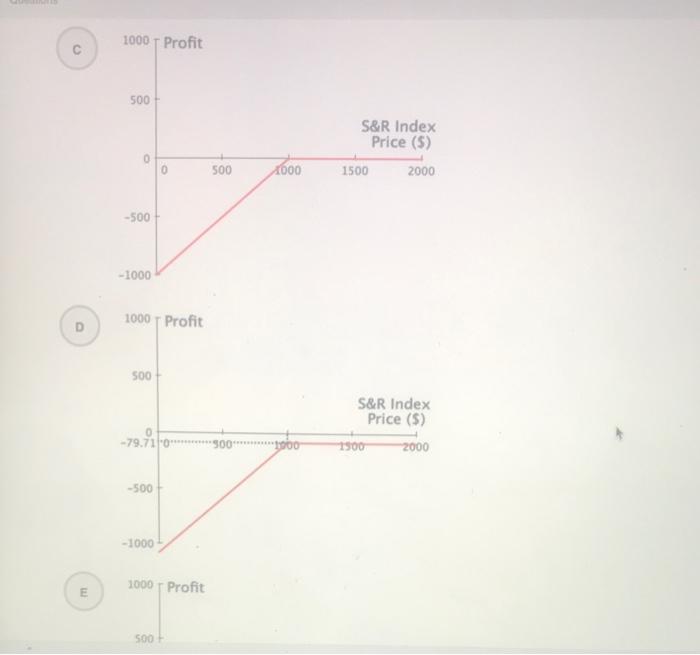

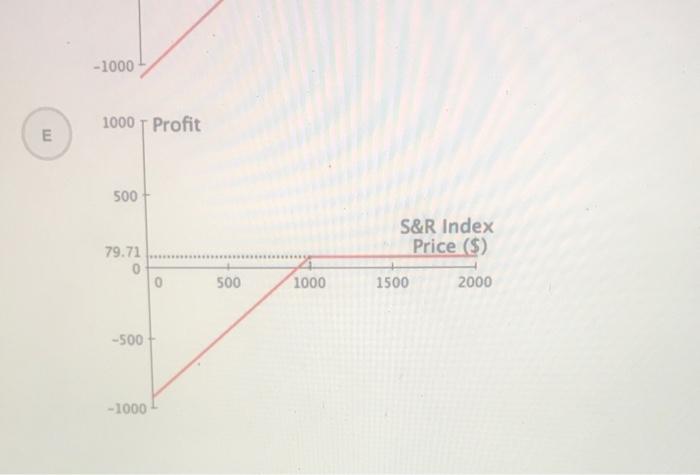

Man Question 9 Consider a 1000-strike put option on the S&Rindex with 6 months to expiration. The premium of the option is $78,92. The continuously compounded risk-free rate is 2%. Dianne writes this put option Which of the following describes the profit at expiration of this written put? 1.000 Profit 500 S&R Index Price (5) 1500 2,000 0 8 1000 -500 -1,000 1000 Profit 500 S&R Index Price (5) 1900 2000 1000 Profit 500 S&R Index Price (5) 1500 2000 O 0 500 2000 -500 -1000 D 1000 Profit 500 S&R Index Price (5) 1900 2000 - 79.710 5004 1900 -500 -1000 1000 Profit m 500 -1000 1000 s Profit E 500 S&R Index Price ($) 79.71 0 0 500 1000 1500 2000 --500 -1000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts