Question: Short Question 3:Binomial Tree (12 marks) Currently, the HS index is 24,200. The annualized volatility is 13%. The continuously compounded risk-free rate is 0.21% p.a..

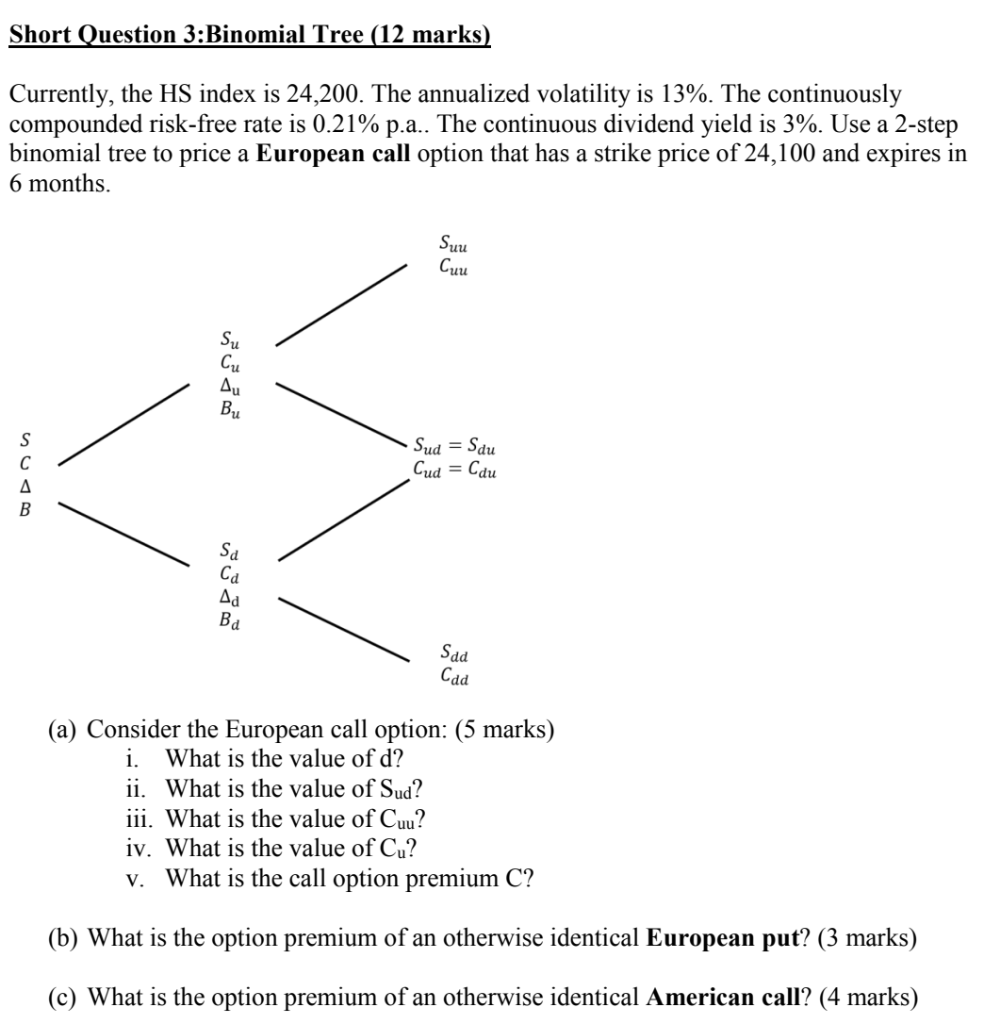

Short Question 3:Binomial Tree (12 marks) Currently, the HS index is 24,200. The annualized volatility is 13%. The continuously compounded risk-free rate is 0.21% p.a.. The continuous dividend yield is 3%. Use a 2-step binomial tree to price a European call option that has a strike price of 24,100 and expires in 6 months. Suu Cuu Su Cu Au BUL S Sud = Sdu Cud = Cdu Sa Cd Bd Sad Cad (a) Consider the European call option: (5 marks) i. What is the value of d? ii. What is the value of Sud? iii. What is the value of Cuu? iv. What is the value of Cu? V. What is the call option premium C? (b) What is the option premium of an otherwise identical European put? (3 marks) (c) What is the option premium of an otherwise identical American call? (4 marks) Short Question 3:Binomial Tree (12 marks) Currently, the HS index is 24,200. The annualized volatility is 13%. The continuously compounded risk-free rate is 0.21% p.a.. The continuous dividend yield is 3%. Use a 2-step binomial tree to price a European call option that has a strike price of 24,100 and expires in 6 months. Suu Cuu Su Cu Au BUL S Sud = Sdu Cud = Cdu Sa Cd Bd Sad Cad (a) Consider the European call option: (5 marks) i. What is the value of d? ii. What is the value of Sud? iii. What is the value of Cuu? iv. What is the value of Cu? V. What is the call option premium C? (b) What is the option premium of an otherwise identical European put? (3 marks) (c) What is the option premium of an otherwise identical American call? (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts