Question: management? Ryker well, because Galaxy's book value with changes in the market price of the refledt management's efforts to maximize the firm's shares, the firm's

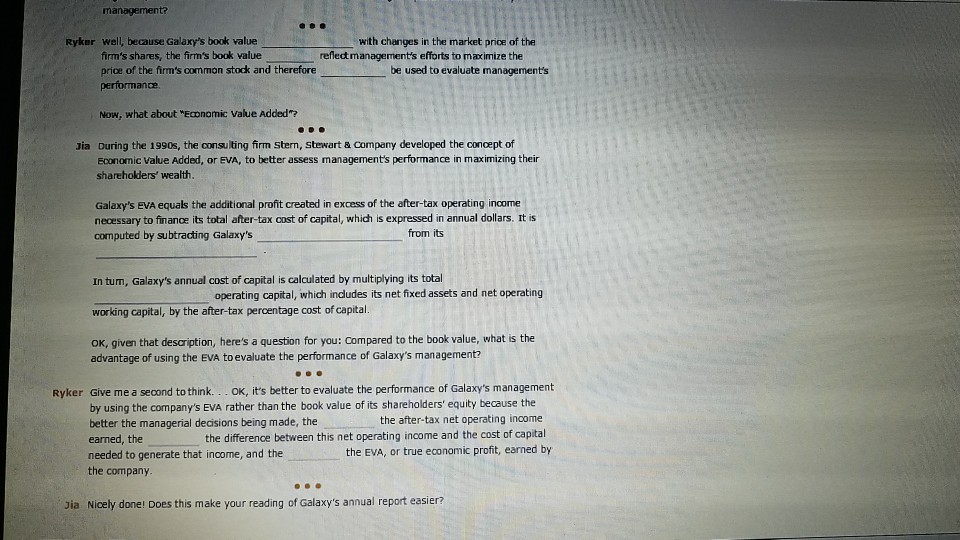

management? Ryker well, because Galaxy's book value with changes in the market price of the refledt management's efforts to maximize the firm's shares, the firm's book value price of the firm's common stock and therefore performance be used to evaluate management's Now, what about "Economic Value Added"? ia During the 1990s, the consulting firm Stern, Stewart & company developed the concept of Economic Value Added, or EVA, to better assess management's performance in maximizing their shareholders' wealth. Galaxy's EVA equals the additional profit created in excess of the after-tax operating income necessary to finanoe its total after-tax cost of capital, which is expressed in annual dollars. It is computed by subtracting Galaxy's from its In tum, Galaxy's annual cost of capital is calculated by multiplying its total working capital, by the after-tax percentage cost of capital. OK, given that desaription, here's a question for you: Compared to the book value, what is the operating capital, which indudes its net fixed assets and net operating advantage of using the EVA to evaluate the performance of Galaxy's management? Ryker Give me a second to think. . . OK, it's better to evaluate the performance of Galaxy's management by using the company's EVA rather than the book value of its shareholders' equity because the better the managerial decisions being made, the earned, the needed to generate that income, and the the company the after-tax net operating income the difference between this net operating income and the cost of capital the EVA, or true economic profit, earned by ia Nicely done! Does this make your reading of Galaxy's annual report easier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts